Some trademark applications for registration for use of brand names in the virtual world make a lot more sense at first glance than others. It is not difficult to imagine Nike using its trademark-protected name and swoosh logo on virtual goods in the metaverse – and in fact, imagination is not required since Nike launched Nikeland on Roblox around this time last year, and more recently revealed a larger venture, .Swoosh, which will see it offer up “interactive digital objects, such as virtual shoes or jerseys.” The same is true for Gucci, for example, and virtual uses of its various source-indicating marks, including its “GG” print, as the Italian fashion brand maintains a virtual presence on Roblox, as well. Against this background, the actual use – and the potential for use – of brands’ marks on virtual goods falls somewhat neatly in line with a trajectory that includes expansion from the “real” world into the virtual world – gaming skins and platform-specific assets, included.

Potentially less immediately obvious are filings for marks like peanut butter brand Jif’s red, blue, and green-striped logo, banana producer Chiquita Brands’s lady with a fruit hat logo, or the “CHUCK E. CHEESE” word mark for use on virtual goods/services, the latter of which prompted at least one Twitter user, trademark attorney Deborah Mortimer, to ponder, “Do we really need a virtual Chuck E Cheese’s in the metaverse? Who craves virtual pizza?”

More than FOMO

The sheer number of companies that have lodged trademark applications for use of their often-well-known marks on goods/services that have no actual “purpose” in a virtual environment has “confused many people into thinking that the metaverse will be stupid – just a big billboard,” Scharf Banks Marmor LLC’s Advertising and Intellectual Property Practice head Darren Cahr stated earlier this year. But “many of these brands know exactly what is up,” he says. In fact, “What a lot of brands realize is that the future health of their companies may depend on bridging the gap between ‘real’ product consumption and virtual product consumption by tying them together as soon as possible.”

Some of the “trademark applications [may have been filed] out of fear or FOMO,” including uncertainty about if/how their “real world” rights will translate to the relatively new medium that is the metaverse (and web3 more broadly), but there is likely more to it than that. The clever companies, Cahr says, understand that while the dystopian reality depicted in Ready Player One is still “years away, something else is coming much sooner.”

As for what exactly that “something else” might entail between now and when the relevant tech catches up to the point that the metaverse is a sophisticated and enticing experience (as distinct from silly Meta avatars and glitchy Metaverse Fashion Weeks), Cahr suspects that the “metaverse” will function as “a gaming environment and/or a place where highly motivated early adopters hang out,” and a place where virtual goods have a role. “Your avatar is not eating a taco in Decentraland,” he states, but … virtual goods “become a promotional opportunity, meaning that you buy a taco” – in the “real world” – and the restaurant provides you tokens via a metaverse-centric reward program that “enable you to ‘do’ exclusive [brand-related] things online with those tokens.”

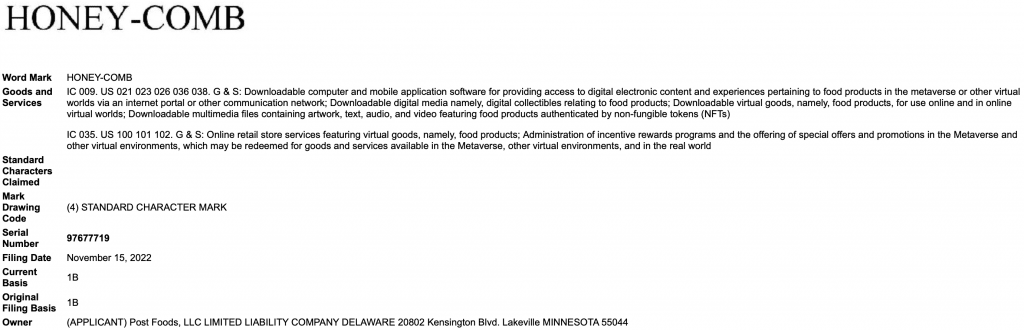

Cahr’s theory – which is, of course, not limited to tacos, and in fact, may be even more easily applied to things like fashion, particularly as brands prove to be eager to connect with consumers in the virtual world – appears to being playing out in a handful of new applications, such as those from cereal manufacturer Post Foods. Among the goods/services listed in the web3-focused filings for its Honey-Comb, Grape-Nuts, Great Grains, and Honey Bunches of Oats brands: The “administration of incentive rewards programs and the offering of special offers and promotions in the metaverse and other virtual environments, which may be redeemed for goods and services available in the metaverse, other virtual environments, and in the real world” (in Class 35).

Are Consumers Interested?

For these endeavors to take off, the metaverse – which currently exists in the form of gaming platforms – will need to continue to draw consumers in, and at the same time, the success of such ventures will rely on consumers wanting to engage with brands in the virtual world. There is not exactly a firm consensus on the latter front: Some early-ish survey figures are not exactly promising from a consumer interest perspective. This spring, Zipline surveyed 600 people across the U.S. between ages 13-50 to better understand how generational differences influence consumer perception of and participation in virtual retail experiences. One of the most striking takeaways from the retail tech company’s study was that 85 percent of Gen Z respondents reported feeling “indifferent about brands developing a presence in the metaverse.” That follows from a Piper Sandler report early this year, which found that almost half (48 percent) of the 7,100 U.S. teens surveyed said they are either “unsure” or “not interested” in the metaverse.

On the other hand, if the previously-mentioned ventures by the likes of Nike and Gucci are any indication, consumers are, in fact, very interested in engaging with brands in the virtual world. More than 20 million people reportedly visited the Gucci Garden pop-up on Roblox during the two-week-long virtual event during the spring of 2021. Meanwhile, Nike’s CEO John revealed in March that “a total of 6.7 million players from 224 countries have visited NIKELAND,” the experience that Nike launched with Roblox in mid-November 2021. Since then, the number of NIKELAND “visits” has surpassed 27.2 million, according to Roblox data.

Given that it is not yet clear how exactly the metaverse will evolve and what brands’ endeavors in it will look like, one of the most telling takeaways from Zipline’s survey is that 85 percent of Gen Z consumers said that they “would be interested in hybrid in-store experiences that use mixed reality technologies to incorporate a virtual element to shopping.” This seems to fit in neatly with the larger narrative that in a post-pandemic world companies need to provide consumers with “an exponentially deeper level of engagement [both] online and offline,” per McKinsey, which requires companies to “put digitally driven commerce at the center of their organizations so they can orchestrate experiences that meet customers’ ever-rising expectations.” These range from “live commerce to the nascent metaverse.”

THE BOTTOM LINE: If nothing else, the virtual world will likely be part of brands’ efforts to cater to consumers in a more dynamic way, namely, by adopting an omnichannel model, in which the metaverse may be one critical component. And at least some early-moving brands are making inroads in that direction now.