In 2017, Louis Vuitton caused a stir in the luxury industry by partnering with New York-based skatewear/streetwear brand Supreme. This collaboration became something of a milestone in the luxury segment, showcasing the potential of unexpected partnerships between luxury brands and unconventional partners situated outside of the obvious realm of possible partners, such as a streetwear brand. Not to be outdone, the French luxury goods giant raised interest (and eyebrows) again when, in 2019, it partnered with the Riot Games-owned video game franchise League of Legends for in-game offerings and for its annual World Championship, for which Louis Vuitton made a custom case to house the Summoner’s Cup.

It may appear odd for Louis Vuitton, a now-almost 170-year-old luxury design house to team up with a video game developer in order bring their well-known branding (and other intellectual property) together for a joint release. After all, their audiences appear (at first glance, at least) to be quite different. Whereas anyone with an internet connection can jump into a “free-to-play” game, fewer can afford the offerings of a luxury brand.

So, why are luxury brands collaborating with street brands, putting cartoon characters on their garments and accessories, and teaming up with the owners of video games? Part of the reason is their success with young Asian consumers, who are driving demand for luxury consumer goods. Given the established (and enduring) importance of such partnerships for the luxury industry, we conducted a study of unconventional luxury brand collabs. We investigated why this strategy appeals to Chinese luxury consumers of the post-1990s generation, and the results of the study reveal potential opportunities for brand through partnerships with esteemed luxury brands.

The luxury strategy

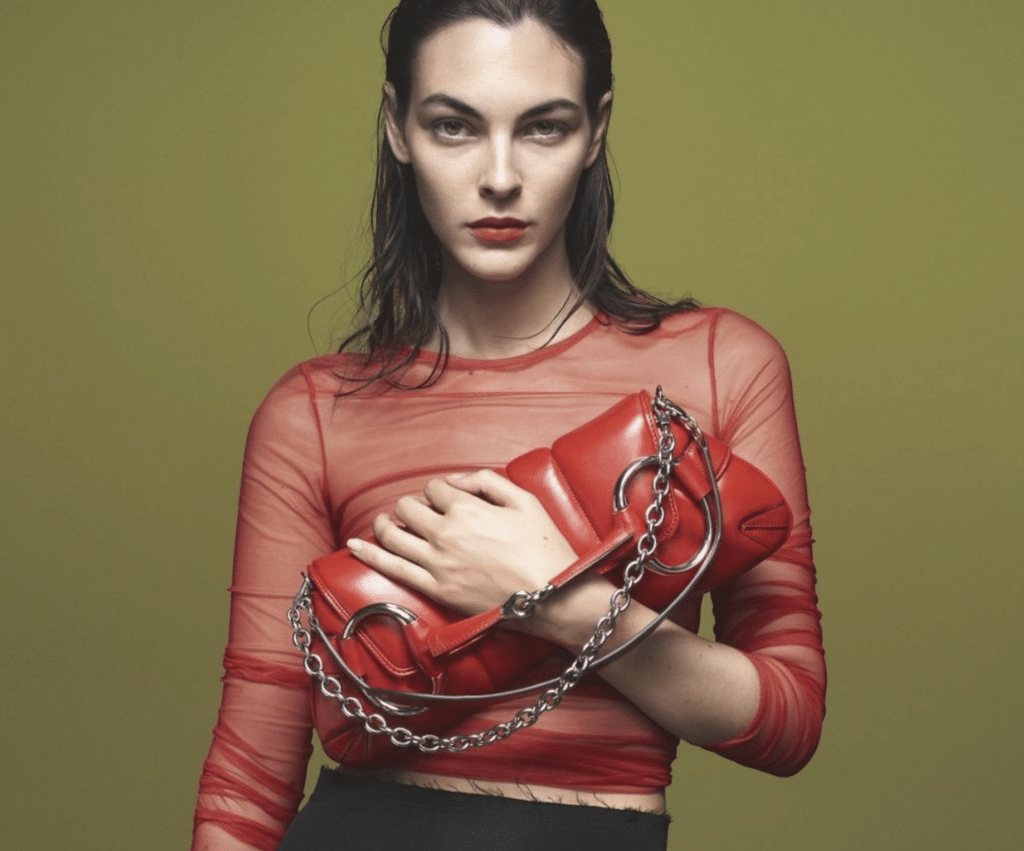

Luxury typically brings to mind images of ultra-expensive products, such as yachts, private jets, couture apparel, and uber-expensive handbags, i.e., things that are not within the reach of the average individual. However, there is another kind of luxury in which products that are not inherently expensive – like cosmetics, perfume, or even chocolate – can be luxurious as a result of the prestige of the brand that is bringing them to maker. Business managers call this approach the luxury strategy. It has specific rules that luxury managers tend to follow, from carefully balancing supply and demand, and engaging in carefully-crafted advertising campaigns to setting prices (so that the “imagined price is higher than the actual price”) and resisting the urge to communicating exclusivity and prestige through strategic arts sponsorships.

While such a strategy has enabled companies like Louis Vuitton and co. to position themselves in the upper echelon of the luxury market, new ways to convey exclusivity and uniqueness in digital and experiential contexts are emerging. For example, consumption experiences can feel like “a moment of luxury” if they convey a pleasurable escape from day-to-day routines. As a result, new forms of luxury consumption, like second-hand luxury markets, are popping up. At the same time, luxury brands are known to collaborate with artists, but they have also been pushing the boundaries of the luxury strategy by teaming up with unexpected non-luxury partners. One early example was between the Swedish fast-fashion retail outlet H&M and designer Karl Lagerfeld in 2004.A partnership between a designer house and a fast-fashion retailer builds upon each other’s strengths, brand prestige and mass distribution. However, luxury brands are growing more creative with their partnerships.

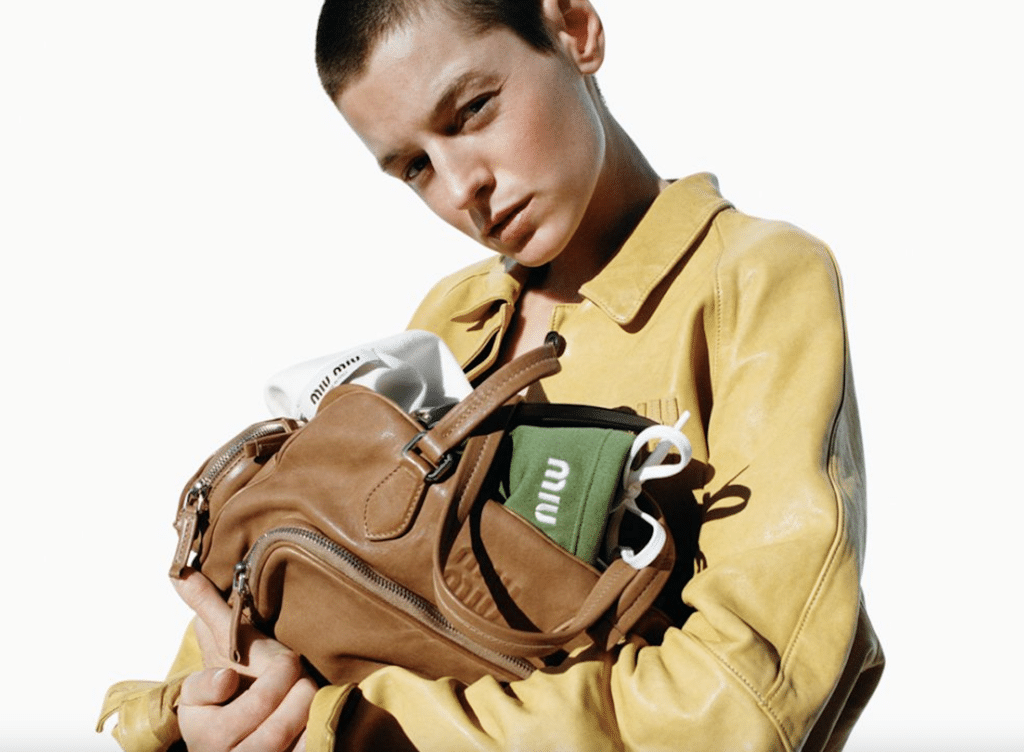

There are renowned luxury pairings between non-affiliated brands, such as LVMH-owned Fendi and Versace, the latter of which falls under the umbrella of rival group Capri Holdings, as well as pairings with sportswear/streetwear brands, including Gucci’s tie-up with adidas or Dior’s collaboration with Nike; celebrities (Kanye and Louis Vuitton come to mind); anime characters like Doraemon x Gucci; and now video game franchises, such as Fortnite x Balenciaga. These collabs are becoming increasingly popular, especially with Chinese consumers.

Chinese consumers & luxury collabs

Designers and producers of high-end goods must keep young adult Chinese consumers top of mind given the growing importance of Asian consumers in the luxury industry. Reports by consulting agencies Bain & Company and McKinsey predicted that, by 2025, East Asia can become the world’s largest personal luxury goods market. China, alone, will consume about half the global market value of luxury goods. In 2019, McKinsey reported that “Chinese consumers are now the engine of worldwide growth in luxury spending,” driven in part by consumers “born between 1980 and 2015 [who] are reshaping global luxury”.

Our study focused on the generational divide that is a uniquely Chinese phenomenon. The 1990s economic reforms and China’s one-child policy shaped the generation. In 1979, a government program restricted (most) Chinese families to having one child each. The policy was updated to two children per family in 2016 and three in 2021. During the 1990s, the media called lone children “little emperors” because they became the sole recipient of the family’s attention and financial support.

Analysts often subdivide the cohort into an affluent post-1980s generation consolidating their careers and a post-1990s generation characterized by urban lifestyle and social media savviness. The post-1990s cohort of Chinese young adults, now in their 20s or early 30s, is characterized by their economic prowess, always-online presence, international mobility, and taste for luxury brands.

We find that Chinese luxury consumers of the post-1990s generation appreciate when luxury brands collaborate with non-luxury partners seemingly at the opposite spectrum of design, image, and values. These collaborations are exciting when they are ephemeral, trendy, and playful. Ephemeral collaborations are transitory, existing only for a limited time, and will not reappear. These types of trend-specific collaborations help consumers navigate the ebbs and flows of social media to capture novelty and hype. Playful collaborations appeal to a youthful audience by mocking traditions and not being too serious. In the words of one of our respondents, “Most of my friends in China like these collaborations … Sometimes they are like: ‘Oh! Wow, your limited edition! Where? How did you get this? Oh my gosh! You must have connections.”

At the same time, collaborations are often instantly recognizable in social media. When asked why they would purchase wares from a collaboration, one respondent told us: “Selfies (giggles). I mean, I am going to take a selfie with it. You must post it! [And then] others will see it and ask me how I got it.”

The popularity of unconventional luxury brand collaborations among young adult Chinese consumers opens timely strategic opportunities for designers and producers of high-end goods. The young adult Chinese segment remains important in many market because of its purchasing power and influence in redefining luxury. By seeking collaborations that are ephemeral, trendy, and playful, brands can meet this segment’s preferences and adapt to the changing rules of luxury.

Carlos Diaz Ruiz is an Assistant Professor at Hanken School of Economics.

Angela Cruz is a Senior Lecturer in Marketing at Monash University. (This article was initially published by The Conversation.)