The RealReal is all about trends – but not necessarily the ones on the runway. Instead, the 7-year old luxury consignment website, which is at the forefront of a surge in consumer spending on luxury re-sale sites, is interested in gauging trends from both real-time and existing data, and events, not unlike how stock market traders do it. “We’re pulling data all the time,” Rati Levesque, The RealReal’s chief merchant, told Quartz this month. Levesque, who has been with the San Francisco-based The RealReal from the outset, approaches its inventory of luxury and high fashion garments, accessories, and homewares more from a supply-and-demand perspective than a full-fledged fashion one; economics is her background, after all.

This approach sees The RealReal collecting data – in real time – about what items and brands are “trending up and trending down” amongst searching-consumers and ultimately, buyers. It uses this data to stock its heavily-trafficked website (which has sold more than 8 million items to date to some 9 million active users) and its two brick-and-mortar spaces in New York and Los Angeles. It also takes these numbers into account when it “adjusts prices [for the products on its site], based on the supply and demand.”

Basing prices on event-driven consumer-search data and the resulting demand for – versus actual supply of – specific brands and products is not a far cry from how shifts in the financial markets are impacted by an array of factors, including, of course, events and anticipated events. Stock prices for Michael Kors Holdings (now trading as Capri Holdings), for instance, dropped 8 percent on Monday in connection with news that it was in talks to potentially purchase Italian design house Versace. That deal was confirmed on Tuesday.

In much the same way, supply and demand on The RealReal is not immune to – and in many cases, actually dependent upon – external industry events.

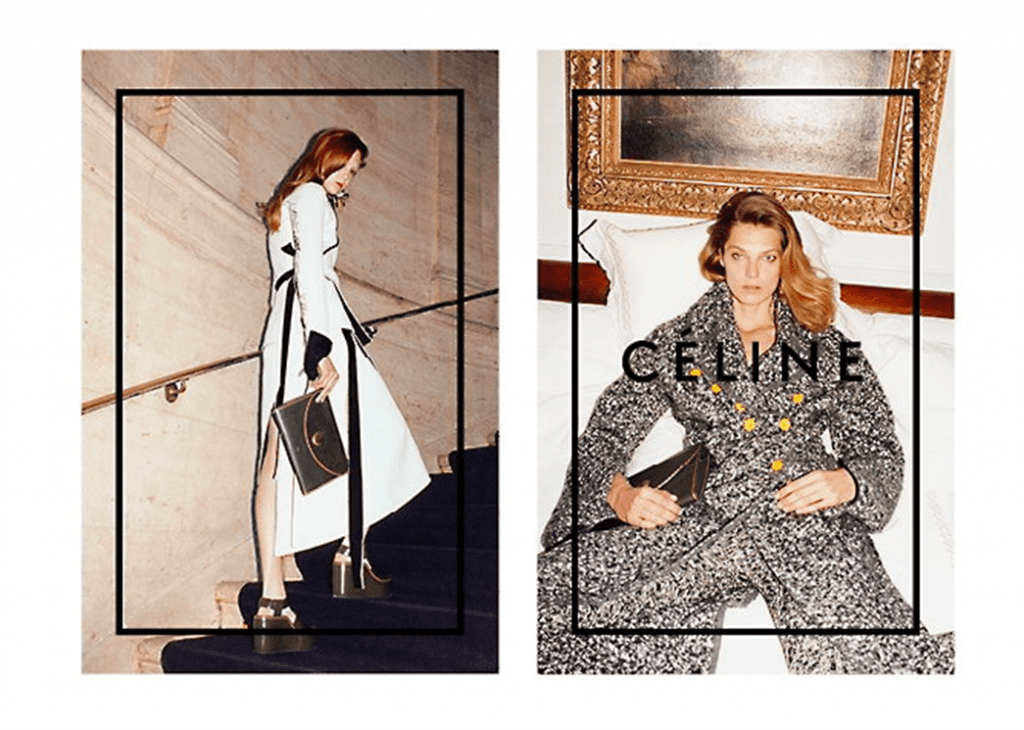

An example cited by Ms. Levesque? Phoebe Philo for Céline. “When the announcement came out [in December 2017] that she was leaving [the Paris-based brand], that changed the pricing for Céline products. In real-time, we saw search results go up 30 percent. And then, all of a sudden you see the sell-through increase.”

As a result, she says, “We knew we could start increasing prices, because there [was] a bigger demand for it. And so we raised prices up to 20 percent on some items, knowing that now it’s a collectible, and you can’t get that anymore.”

Over at Stock X, the similarly heavily-funded start up, the model is inherently based on the leveraging of real-time data to set prices. The site, itself – which was founded three years ago by former IBM consultant Josh Luber and Quicken Loans head Dan Gilbert and joins the larger $25 billion-and-growing resale market – has made its name as “the NASDAQ of sneakers,” thanks to its practice of enabling third parties to sell sneakers (and streetwear) on its platform based on the current market price for those sneakers.

In short, the pricing for the $2 million-plus in daily transactions that Stock X boasts is controlled almost exclusively by the rise and fall of demand and supply on its site just like the stock market. For instance, while Air Jordans typically carry a retail price tag of $160 to $220, on Stock X, where the supply and demand dictate the shoe’s value, some pairs sell for more than 10 times their retail price.

“Everything is based on the way the stock market connects buyers and sellers. That’s the key to it,” Mr. Luber told Detroit News this May, which is precisely what makes the platform different from the many other marketplace sites on the web. “That generally doesn’t exist in any other consumer marketplace, the leveraging of the stock market’s mechanics. There’s a lot of nuance and a lot of details in that.”

“At the highest level,” Luber says, “it’s all around the data. It is built around having a market price for an item.”

With such supply and demand metrics in mind, the prices of Versace products are likely going to surge based on news that Michael Kors Holdings has set to buy out the brand, marking the end – in some ways – for the family-owned fashion company, which was operating as one of the last independently-held powerhouses in the fashion industry. As of now, no shortage of Versace goods on The RealReal are “On Hold,” meaning that they are in consumers’ e-carts, and chances are, prices will soon be on the rise.