In times of severe economic downturn, certain companies routinely fare better than others. While luxury brands tend to suffer significantly, off-price retailers often thrive during recessionary times, as consumers look to cut costs. In the same vein, some types of goods and services remain popular during fiscal slumps, and hair and other beauty-centric services are among them. History shows that even during the Great Depression, when GDP fell by 30 percent in the U.S., and unemployment spiked to more than 20 percent, “people continued to pay for salon visits, opting to forgo other essentials” in order to keep up appearances.

“The length of time between salon visits appears to grow during times of downturn, thereby, giving rise to an alternative metric to gauge consumer confidence in the market (what has been coined the ‘haircut index’),” according to Hannah McCann, a lecturer in Cultural Studies at the University of Melbourne. As John Paul Dejoria, the founder of hair care company Paul Mitchell, asserted on the heels of the Great Recession of the late 2000s, “Beauty salons are the best economic indicator. Typically, customers will visit every six weeks; in downturns, that drops to every eight weeks. When it goes up again, things are on the mend.”

On the flip side, McCann says that “some argue that consumers tend to buy more small luxury beauty items, such as lipstick during recessions,” thereby giving rise to an another alternative market indicator: the so-called “lipstick index,” a term that Leonard Lauder – then-chairman of Estee Lauder – came up with during the 2001 recession in response to lipstick sales, which indicated, in his mind, “that women facing an uncertain environment turn to beauty products as an affordable indulgence while they cut back on more-expensive items.”

“We have long observed the concept of small luxuries, things that can get you through hard times and good ones. And they become more important during harder times,” he revealed, explaining why sales of lipstick, nail polish, and other beauty products were up despite a falling market.

Fast forward from the 2001 recession to the outbreak of COVID-19 and the ensuing market decline, and demand for salon services has not dimmed. In fact, such demand prompted local regulators and law enforcement to act, with the Governor of New York, for instance, ordering all hair and nail salons to close as of March. Similar provisions have been put in place across the U.S. and beyond. Just this past week, after all, Beaumont, Texas Mayor Becky Ames broke her own city-wide lockdown order when she visited a nail salon, subsequently making national headlines.

The takeaway, according to McCann, “Even in difficult economic periods and even as social distancing complicates the situation for the beauty industry, people still care about keeping up appearances.” Or, as Eric Delapenha, the founder and CEO of Strands Hair Care, a direct-to-consumer custom shampoo and conditioner brand, told Entrepreneur this month, “Customers still want to look and feel good.”

With such enduring demand in mind, and given that many beauty-related business are closed, at least from a brick-and-mortar perspective, companies – from hair and nail salons and spas to experience-driven beauty stores – are shifting to online services, finding creative ways to maintain connections with existing clients and to reach new ones.

Many salons, for instance, “have begun selling ‘lockdown’ product packs online, producing short ‘home maintenance’ videos, and some are even offering one-on-one live digital consultations,” McCann says. WWD echoed this recently, stating that “aestheticians and dermatologists are pivoting to Instagram and virtual consultations.” While “revenue from digital consultations doesn’t offset the cost of staying in business, but it does help,” Joanna Vargas, celebrity facialist and founder of Joanna Vargas Salons and her eponymous skin-care line, told the trade publication. “Vargas is offering virtual consultations for $70, gifting each client $100 in credit for future treatments, purchases or gifts,” per WWD. “She has also opened a text line for clients seeking skin advice.”

Meanwhile, beauty brands and retailers are looking online, as well, with YSL Beauty “has boosted its beauty tutorial content in the face of COVID-19,” according to Jing Daily, “working with the Dutch makeup artist Celine Bernaerts [to] offer short tutorials, beauty tips, and make-up practice skills using YSL Beauty products.” LVMH-owned Sephora has similarly increased its social media content, relying on Q&A’s and tutorials, and prompting consumers make use of its instant-chat customer service system.

Not to be outdone, millennial beauty unicorn Glossier launched a new product amid the COVID-19 crisis: a hand cream. The consumer-facing launch coincided with the announcement that the New York-based brand would donate the first 10,000 units available to healthcare professionals in the U.S., noting that over the past month, it had been “donating thousands of Glossier balms, face mists, and moisturizers to support these teams.”

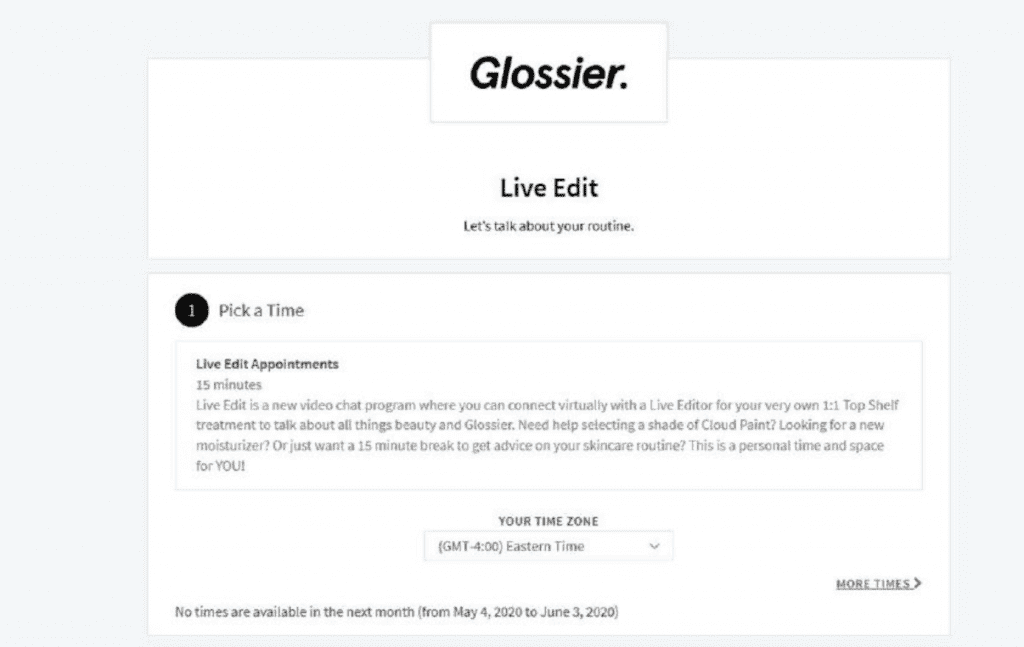

And still yet, a newly-filed trademark application sheds light on something else that the 5-year old beauty startup is doing. Looking to add a new registration to its arsenal of trademarks, counsel for Glossier asserts in an application for registration filed on April 10 that Glossier has recently (i.e., as of April 7, 2020) begun offering “online makeup consultation services beauty consultancy services; beauty consultation services in the selection, use, and application and use of cosmetics, fragrances, beauty aids, personal care products, and bath, body, and beauty products” in connection with the “Live Edit” trademark.

Given that its brick-and-mortar outposts – which largely serve as tools for the brand to further facilitate the Instagram photo-sharing and community-focused model that has been central to its success – are closed, Glossier is seemingly looking to connect with consumers online in the wake of the health pandemic.

As a whole, sales for beauty and personal care brands and retailers were up for the week ending April 2, compared with the 5-week period from January 3 to February 6, according to online retail and marketplace consultancy Forter. And citing a report from Nielsen, CNN recently reported that hair products and tools “are flying off shelves,” as well, as sales of hair clippers increased 166 percent and hair coloring products rose 23 percent, from the same period a year earlier.

As McCann notes, “while it may seem ludicrous to care about makeup and hair products during a public health crisis, there are multiple reasons why this may be the case,” including the fact that “many entrenched beauty norms will persist.” Beyond that, traditional forms of work and socializing may be down, but Zoom calls still come with expectations as to grooming and etiquette, and no small number of consumers with more time on their hands, are looking to self-care by way of skincare.

“There is also an important ritual element to maintaining one’s appearance. In Western culture, one’s outer presentation is seen as intimately connected to one’s sense of identity and well-being,” McCann asserts. And “maintaining a daily routine, including skin care, putting on makeup and styling one’s hair, might give some people a sense they are looking after themselves – especially when other things around them are much harder to control.”