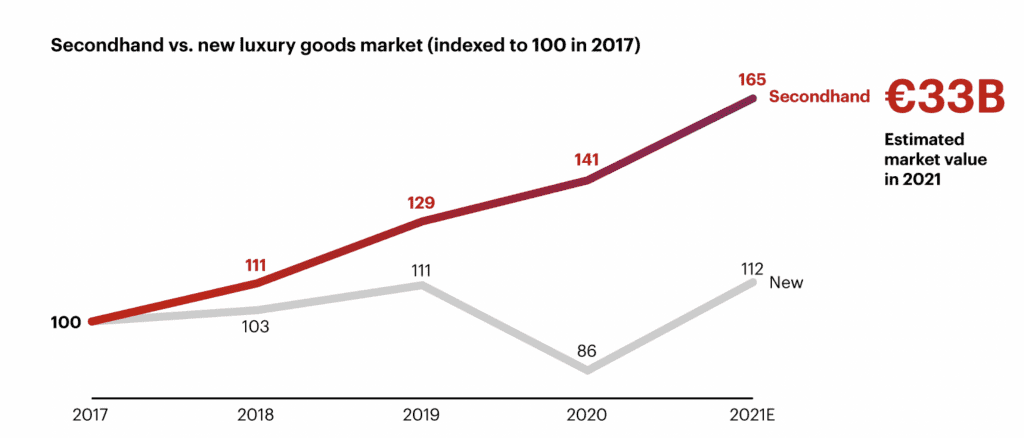

Soaring demand for secondhand luxury goods was one of the key trends that Bain & Co. analysts highlighted in 2021, with the management consulting firm valuing the luxury resale segment at €33 billion ($37.45 billion) as of the close of the year. On the heels of luxury resale site The RealReal focusing heavily on the impact of enduring supply chain disruptions on demand for pre-owned products in its 2021 Consignment Report, Bain analysts stated that growth in the value of the secondary luxury market also had to do with a rise in supply in the space, reflecting “an increased supply of [pre-owned goods] from an expanding arena of players in the segment.”

In a secondary market-focused report this week, Bain’s Claudia D’Arpizio and Federica Levato stated that not only is the resale market proving to be a “powerful way for brands, fashion platforms, and investors to extend the lifetime of luxury products and show their commitment to sustainability,” secondhand sales are offering brands with “an additional distribution channel that is gaining share within the larger luxury ecosystem.” (As TFL previously reported, resale is a way for brands to “gain an additional point of access to entry-level luxury spenders in much the same way as more accessible, lower-priced, and oftentimes licensed products do.”)

Beyond that, D’Arpizio and Levato note that the “network-based nature of secondhand luxury retail (and its capacity to give brands a richer, data-led understanding of young consumers’ behavior) is another plus” for the increasing number of luxury participants in the space. Efforts in the resale segment range from those of Alexander McQueen, for instance, which partnered with secondhand luxury marketplace Vestiaire Collective as part of its “Brand Approved” program, to Gucci, which launched an in-house venture to curate and offer up a selection of pre-owned items by way of its Vault initiative.

Despite the rising adoption of pre-owned endeavors by luxury brands, “there are still a few points to solve,” the Bain analysts assert. Among them are “creating a compelling value proposition, cracking operational complexity (e.g., authentication, start-up stock, and margins), defining a winning branding (or rebranding) strategy, maximizing customer outreach, and ensuring that the resold items are valued and priced properly.” Many of these concerns are likely a large part of what is driving brands to take a more active role in the space, by way of partnerships with – and/or investments in – existing pre-owned players (Kering and its controlling shareholder Groupe Artemis have invested in resale entities, including Vestiaire, Grailed, and GOAT, while Chanel has a stake in Farfetch, which boasts a resale arm) and ventures of their own.

Currently worth more than €30 billion, which is a rise of 65 percent from 2017, Bain projects that the preowned luxury market “can keep surging,” and continue to outpace the market for new products if brands address these issues.