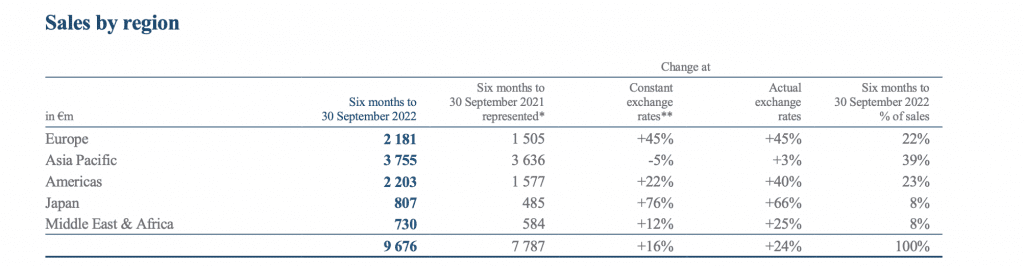

Revenue for Richemont rose by 24 percent on an actual exchange rate basis (and 16 percent on a constant basis) to 9.7 billion euros ($9.88 billion) for the first six months of the fiscal year, while operating profit rose by 26 percent to 2.7 billion euros. In an H1 report on Friday, the Swiss luxury goods group said revenue was driven by “strong” demand for jewelry from Cartier and Van Cleef & Arpels, with sales in the jewelry division up by 24 percent for the first half (ending on September 30) and watch sales up by 22 percent. “This points to mega-brands at the top of their categories continuing to extend their lead against competitors,” Bernstein analysts said in a note on Friday.

The regional breakdown: Compared to H1 2021, Richemont revealed that it saw double-digit sales increases “across all business areas, channels and regions, excluding Asia Pacific, where sales grew by 3 percent” as a result of “temporary boutique closures in mainland China and Macau due to the continued enforcement of the zero-Covid policy.” The European market delivered a 45 percent YoY revenue increase for Richemont, “fueled by strong local demand and resumed inbound tourism from the U.S. and the Middle East following the easing of most restrictions on international travel.”

In N. America, reported sales grew by 22 percent, “continuing trends seen in the first quarter of the financial year, notwithstanding many Americans purchasing abroad.” Growth momentum in the U.S. was the highest for the watch division, per Richemont. As for Japan, which posted the “strongest regional sales growth rate” of 76 percent, sales came by way of “strong domestic demand, a nascent return of tourists and lower comparatives due to boutique closures in the prior-year period.” And finally, in the Middle East & Africa, sales rose by 12 percent thanks to “solid domestic and tourist spending, notably in Dubai.”

According to Bernstein’s note, Richemont “sees strong underlying demand from consumers, first from Chinese nationals and in more recent times from customers in the USA, Europe and Asian countries outside of China, across age groups,” with younger consumer cohort proving to be particularly strong, “partially because of the marketing efforts carried out in the past few years.”

In terms of the physical retail vs. online breakdown: Richemont revealed that the retail sales channel grew in all regions, “most notably in the Americas, Europe and Japan,” reaching a 21 percent increase, while online sales rose by 9 percent YoY “as the Group’s Maisons continued to expand their digital presence.” The largest progression in the period came from the Specialist Watchmakers where online retail sales reached 3 percent of sales. “Overall, online retail sales contributed 6 percent to Group sales, broadly in line with the prior-year period,” the group reported.

Richemont noted that “following the reclassification of YNAP sales to discontinued operations, ‘Online retail’ now comprises online retail sales directly generated by the Group’s Maisons and Watchfinder.”

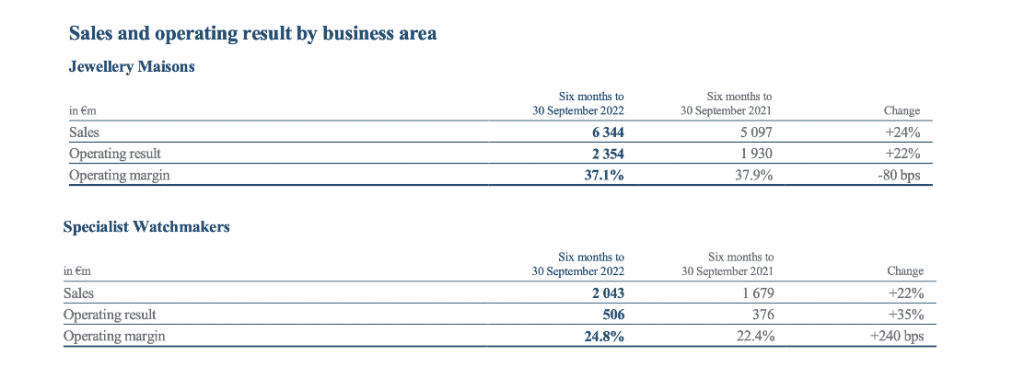

As for the group’s individual divisions: Its three Jewelry Maisons – Buccellati, Cartier and Van Cleef & Arpels – generated a combined 24 percent YoY increase in sales for a total of 6.34 billion euros, with “all product categories” performing well. “Iconic jewelry collections, such as Clash and Trinity (Cartier), Alhambra and Fauna (Van Cleef & Arpels) and Opera Tulle and Macri (Buccellati), to name a few, continued to outperform.”

Richemont management said in a call with analysts on Friday that they see “untapped opportunities in the branded jewelry segment alongside strong pricing power.” At the same time, though, they also see “intensifying competition in hard luxury” – presumably from LVMH with its budding Tiffany & Co. revamp, for instance – “and is prepared to continue to invest, when needed, to maintain a leading position.”

The “Specialist Watchmakers” division generated 2.04 billion euros (up 22 percent), with performance here driven by “strong direct-to- client sales: Retail and online retail sales continued to expand sharply, and combined, contributed to 54 percent of the Specialist Watchmakers sales.”

Finally, the “Other” division – which includes the Fashion & Accessories Maisons, Watchfinder, the Group’s watch component manufacturing and real estate activities – generated 1.29 billion euros in revenue. “Nearly all Maisons recorded strong growth, with Delvaux and Peter Millar being particularly noteworthy,” according to Richemont. Alaïa sales also “grew sharply, benefiting from a renewed creative vision.”

Delving into the headline-making YNAP deal, Richemont chairman Johan Rupert stated on Friday that the agreement for Farfetch and Alabbar to acquire 47.5 percent and 3.2 percent of YNAP, respectively, which leaves Richemont holding 49.3 percent, “will realize my long-standing goal of making YNAP a neutral industry- wide platform, with no controlling shareholder.” Richemont will receive Farfetch shares, “expected to represent 12-13 percent of Farfetch’s issued share capital, to further align interests,” he stated, noting that “subject to a number of conditions, including the receipt of certain antitrust approvals, the initial stage of the transaction is expected to complete before the end of calendar year 2023.” By that point, he says that Richemont’s Maisons will “adopt Farfetch’s technology to create the best ‘route to market’ and realize their ‘Luxury New Retail’ vision.”