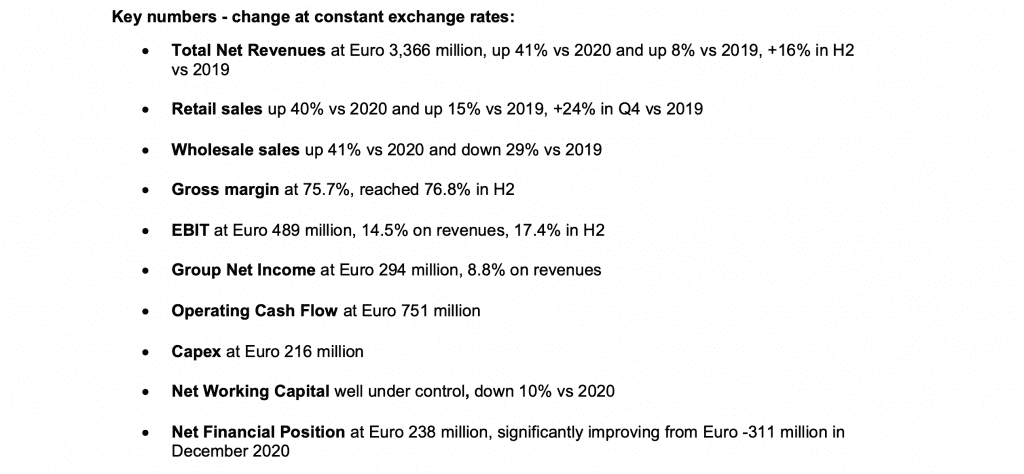

Prada released its full-year revenue for 2021, highlighting a “very strong second half of 2021 marked by an acceleration in retail sales with a sharp increase in profitability and a strong cash flow generation.” The Italian group reported revenue of 3.36 billion euros ($3.69 billion) for the year, up 41 percent from in 2020 and up 8 percent from 2019, and profit that rose to 294 million euros ($322.52 million) compared with a net loss of 54 million euros ($59.24 million) in 2020. The Prada and Miu Miu owner pointed to a rise in full-price sales and local spending for the second half of the year, strong results across all product categories, and “outstanding” growth in online sales, which grew by 5x compared to 2019, and now generate 7 percent of the group’s total sales.

In terms of sales by region, Asia Pacific sales amounted to 1.19 billion euros ($1.31 billion), up 29 percent compared to 2020 and 30 percent compared to 2019, with sustained demand coming from key markets throughout the period compared 2019. Sales in China, for example, were up by 56 percent compared to 2019, topped only by “Korea (up 90 percent) and Taiwan (up 61 percent),” according to Prada’s report. Meanwhile, in the Americas, where Prada’s customers are the youngest, sales saw a “sharp increase throughout the year,” reaching reached 572 million euro, up 103 percent compared to 2020 and 69 percent compared to 2019. Still yet, sales in Europe stood at 749 million euro, up 35 percent compared to 2020 and down 11 percent compared to 2019. Prada noted that “the trend turned positive in H2, up 2 percent compared to 2019,” and the EU region seeing “strong progress across all countries.”

Reflecting on Prada’s results, Bernstein analyst Luca Solca stated in a note on Monday that the group’s marquee Prada brand “led performance with 21 percent organic growth vs. FY19 and 29 percent vs. 4Q19,” putting Prada “in line with Moncler (+30 percent) and above Burberry (-3 percent) in 4Q21.” At the same time, the group’s smaller brands, including Miu Miu (-7 percent organic growth vs. FY19) and Church’s (-41 percent organic growth vs. FY19), “have yet to recover above [pre-pandemic] 2019 levels.”

“The Prada Group’s start to 2022 has been strong,” chief executive officer Patrizio Bertelli stated on Monday. “Our long-term strategy is on track, focused on distinctive brand identity, product quality and industrial know-how, direct distribution, and sustainability at the core of our values. Decisive actions to evolve the business and navigate the changing luxury market drove outstanding growth and increased profitability in 2021.”

The results come as Prada has been aiming to boost annual revenue to 4.5 billion euro ($4.94 billion) for the “medium-term,” with an operating margin target of approximately 20 percent. In furtherance of this, the group stated in November that it is angling to double its online penetration to 15 percent of retail revenue and increase retail sales density by 30 percent to 40 percent. Shedding light on how it plans to achieve such growth, Prada revealed last winter that from a brand point of view, it is looking to “consolidate strong awareness by leveraging its brand pillars,” and boost its marketing investment in digital and experience in order to “sustain and convert customers focus.”

In terms of product, Prada’s management previously stated that it is “investing in iconic products and newness” simultaneously, including by launching new categories, such as beauty, fine jewelry, and home goods, and doubling down on its sportswear-centric Linea Rossa collection in order to achieve “full potential” there. Finally, Prada said that it plans to accelerate within the customers pools that are driving market growth, namely, Gen-Z buyers, as well as those in China and the U.S.

In an earnings call on Monday, Prada confirmed its focus on bolstering its ominichannel approach, including by investing in both digital and retail operations, as well as its aim to attract younger consumers, especially in the U.S., where it is looking “not to maintain the current growth rate in the US, but to secure future customers by acquiring more young customers,” per Bernstein.

As for the the year so far, sales for 2022 are looking encouraging, per Prada, even in light of “uncertainty” due to Russia’s invasion of Ukraine. As of now, the group says that it has halted all operations in Russia, but noted that the impact is limited “even under the worst scenario,” which would see it “write off the limited inventories.” As highlighted by Bernstein, Prada Group management “indicated their interest in continuing to operate in Russia if the situation allows in future.”