“French couturier Pierre Cardin, who made his name by selling designer clothes to the masses, and his fortune by being the first to exploit that name as a brand for selling everything from cars to perfume, died at age 98,” Reuters reported on Tuesday, noting that Cardin was “the first designer to sell clothes collections in department stores in the late 1950s, and the first to enter the licensing business for perfumes, accessories and even food, which later drove” – and continues to drive – “profits for many other fashion houses.”

With an empire that expanded beyond the runway to include “perfumes, foods, industrial design, real estate, entertainment and even fresh flowers,” Cardin – who trained under the likes of Christian Dior and Elsa Schiaparelli – was the forefather for an array of fashion industry revolutions. In 1959, for instance, “he became the first French couturier to create designer-label ready-to-wear clothes,” Mary Rourke wrote for the Los Angeles Times on Tuesday. Italian-born Cardin’s foray into ready-made clothing, alongside his couture creations, “was the first in a series of innovations that set new standards for designers of luxury fashion.”

Shortly thereafter, “In the early 1960s, he was the first women’s designer to launch a collection for men, [beginning] with neckties, followed with shirts and expanded to include a complete menswear line including suits, jackets, pants and accessories.” Still yet, Rourke notes that the celebrated fashion industry figure was also “the first French couturier to make inroads into the Asian fashion market, doing business in Japan starting in 1957 and China in the 1970s,” a strikingly forward-thinking move given that by Bain & Co.’s projections, Chinese consumers will make up roughly half of all sales in the global luxury goods market by 2025.

However, what the late Cardin might be best known, at least among the legally-minded, for his role as the “father of fashion branding,” a title that stems from his enduring exercise in trademark licensing, which involved trading off the rights to the name of his brand in certain categories of goods/services in exchange for hefty royalties.

No small matter, Cardin was estimated to be generating “between $35 million and $45 million a year in royalty income worldwide,” Richard Morais, author of “Pierre Cardin, The Man Who Became a Label,” wrote in 1991. But beyond his own personal earnings that came from contracting with third-party manufacturers to legally make, market, and sell products, including cosmetics to accessories, under his name, Cardin’s adoption of the licensing model set the stage for other high fashion houses and couturiers to follow suit, with many industry giants continuing to generate revenue by way of big-money licensing deals.

As of 2019, TLL’s Annual Licensing Business Survey put the value of licensed retail sales in the U.S. and Canada, alone, at an estimated $114 billion in 2019, with “apparel-based fashion brands seeing the greatest dollar increase among all sub-types tracked [in the survey].” Meanwhile, the figures associated with European luxury giants’ licensing ventures with the the likes of Coty, L’Oreal, Puig, Perfumania, and Inter Perfumes for fragrances and cosmetics collections, and/or with Euroitalia, Marcolin, Marchon, Safilo, and Essilor-Luxottica for eyewear have historically been mighty. In fact, the size of some of fashion’s most notable licensing deals – and the categories they fall into – are noteworthy, both in terms of the revenue generated by the licensed goods, goods themselves, and the lump sum and sales-based royalties amassed in connection with such deals.

Back in 2017, for example, Italian eyewear company Safilo Group maintained licenses to manufacture and sell eyewear for a handful of LVMH-owned brands that were worth $366 million. The license that Coty acquired from Burberry in 2017 in order to make and distribute cosmetics and fragrances bearing the British brand’s name and various other trademarks cost it $162 million, plus a $63 million payment for inventory. And ss of 2019, when LVMH revealed that it would not renew its licensing deal with Safilo for Dior eyewear, the sales of eyewear resulting from the parties’ deal, alone, were accounting for almost 15 percent of Safilo’s $1.1 billion in annual revenue.

In addition to helping launch a larger trend towards the embrace of widespread licensing, Cardin also unfortunately epitomized the downsides of such arrangements, which has almost certainly served to foreshadow the larger trend that started in the 1990s – and is still underway in at least some cases – with luxury giants looking to further regain control over these licensing deals from third-parties in order to ensure the proper distribution and quality of the products that bear their brands’ names.

As Rourke so aptly notes, “By the 1990s, the designer licensing phenomenon had tarnished the image of many of the biggest names in fashion, Cardin among them,” with Mr. Cardin opting to license his name and other brand assets expansively and in doing so, losing widespread control over these trademark-adorned products.

Faced with widespread distribution and quality control issues and the potential for brand diminishment as a result, increasingly controlling luxury brands, such as Christian Dior – which made a lot of money beginning in the 1950s or so by way of a web of licensing deals of its own that saw third-parties put the Dior name on everything from hosiery and handbags to jewelry and lingerie – began to reign in the expansiveness of their licensing deals at no small expense.

LVMH-owned Dior, for instance, under the watch of then-CEO Sidney Toledano led the charge in working overtime during the 1990s to reduce its outstanding licenses from 300 different agreements to just a few. Meanwhile, Kering’s Yves Saint Laurent, “which used to have more than 160 licenses around the world,” Reuters reported in 2012,” spent much of the decade buying them back. As of that same year, YSL maintained just two licensing deals: one with Safilo for eyewear, and another with L’Oreal for perfumes and cosmetics.

Kering has since brought its eyewear operations in house by via its Kering Eyewear endeavor, while L’Oreal – which entered into a $1.68 billion deal with Kering (then still PPR) in 2008 for the YSL Beaute license – still serves as Kering’s “strategic partner” for YSL’s beauty and fragrance offerings. And elsewhere in the luxury sector, Ferrari is aggressively cutting down on its licenses, revealing much more recently, in November 2019, that it was planning to significantly revamp its licensing strategy, one that has enabled it to transform the luxury appeal of its name into lucrative deals with third-parties, such as Tod’s and Oakley, which readily stamp the Ferrari name and prancing horse logo on leather loafers and sunglasses.

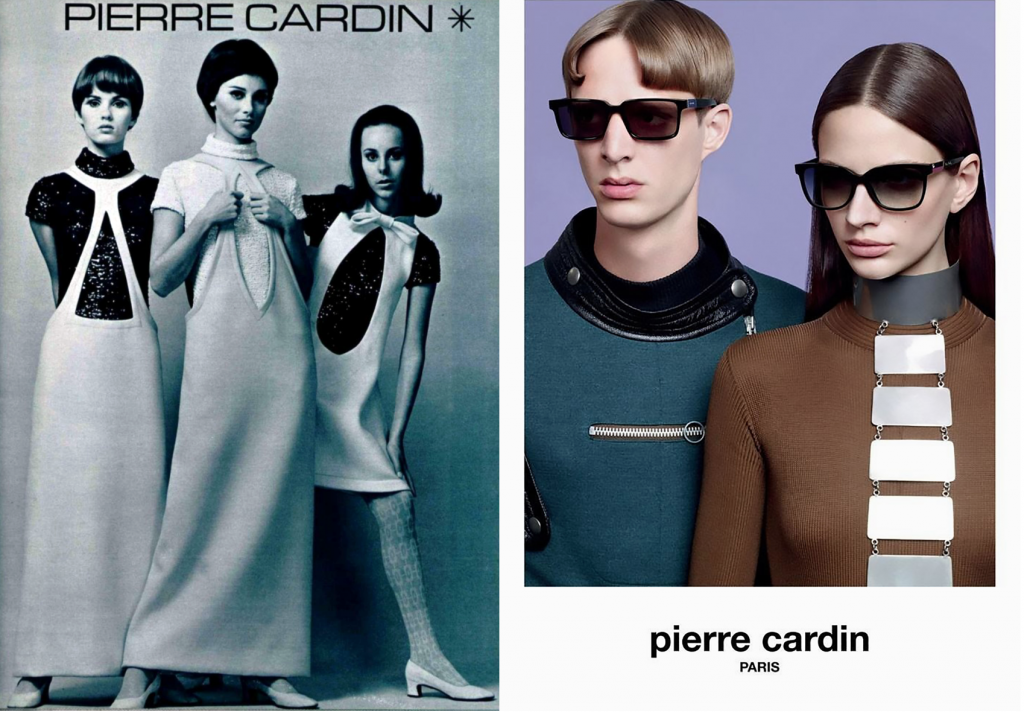

Mr. Cardin did not, however, follow suit, ultimately prompting his name to be more closely aligned – at least in the eyes of the general consuming public – with his licensed goods as opposed to the “Space Age” style he pioneered and other design-centric innovations that he brought to the table.

The fallout from the expansive and lucrative-yet-risky licensing path forged by Cardin has likely driven home even further the need for brands to carefully control any output that bears their names if they want to be able to maintain their carefully-crafted luxury images and the premium pricing that they can command as a result. Taken together with the significant supply chain disruptions that have resulted from the COVID-19 pandemic and an already-existing trend of large goods groups acquiring their suppliers in order to gain greater control over the oversight and distribution of their products, the idea that the former status quo of multi-hundred-million dollar – or even billion dollar – licensing deals may evolve further is not outlandish.

As for Mr. Cardin, himself, the fruits of his 60 year-long career, during which time he “drew scorn and admiration from fellow fashion designers for his brash business sense,” per Reuters, while also pushing design forward by way of “his space-age, futuristic bubble dresses and geometrical cuts and patterns,” will inevitably continue to influence runway looks as designers routinely comb archives of design greats as inspiration for their own works.