In November 2019, Nike stopped selling its goods wholesale to Amazon. It did not need Amazon at the time, and it needs them even less today – accelerated by the COVID-19 outbreak, direct e-commerce jumped to 30 percent of Nike’s sales, a mark it had previously expected to hit only in 2023. Amazon, on the other hand, does need Nike. After the split, the possible scenarios were that Amazon would find a different way to source Nike goods wholesale, the third-party marketplace would source the full Nike catalog, or that Nike would reverse its decision. None of those scenarios happened. Shoppers, instead, bought other brands on Amazon’s platform.

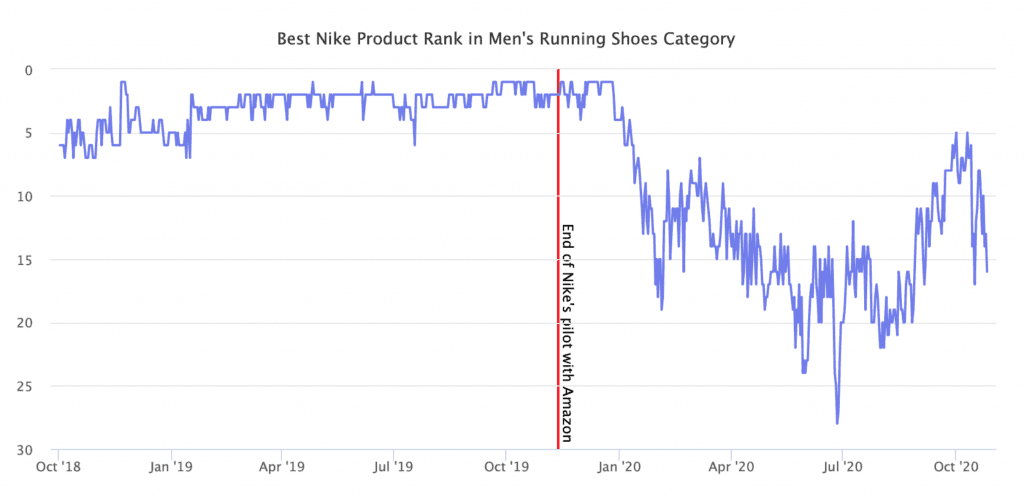

According to Marketplace Pulse analysis of best-selling products in relevant categories, Nike products mostly lost their position after pulling out of Amazon. For example, in the Men’s Running Shoes category, Nike was one of the best-sellers for years. Amazon sold out by the end of 2019, and since then, the best-selling Nike product has been averaging #15 place.

“As part of Nike’s focus on elevating consumer experiences through more direct, personal relationships, we have made the decision to complete our current pilot with Amazon Retail,” a representative for the said the company last year of its decision to cut ties with the Jeff Bezos-founded behemoth. As it turns out, Nike had primarily agreed to the pilot in 2017 in exchange for Amazon increasing its efforts to police counterfeit and unauthorized third-party sales.

“For years, Nike had refused to sell directly to Amazon, fearing it would undermine its brand. Nike executives were unhappy with how unauthorized sellers continued to be widely available on Amazon,” wrote Khadeeja Safdar at the Wall Street Journal. The pilot did not work. “Nike officials were disappointed the deal with Amazon didn’t eliminate counterfeits and give the brand more control over gray-market goods.” As a result, Nike never brought its full catalog to Amazon, and instead, pulled the plug on the parties’ “pilot” entirely.

Shoppers did stop looking for Nike on Amazon, though. Searches for its products have remained in the top 1,000 most-searched terms, and Amazon’s third-party marketplace continues to provide some, though limited, selection. “Nike shoes for men,” one of the brand’s most searched terms, most often lead to shoppers buying the Nike Men’s Revolution 5 Running Shoe. It costs more on Amazon than it does on other sites, and has a subpar product page compared to other category-leading products.

Nike is likely okay with being presented poorly on Amazon. That makes shoppers go to Nike.com or download its app instead. The strategy is working because Nike is averaging 100 million visits to its own website and maintains one of the top 10 most-downloaded shopping apps in the world. As a result, Nike’s online sales were up 83 percent in the second quarter, adding $900 million to its total sales. “The accelerated consumer shift toward digital is here to stay,” said John Donahoe, CEO at Nike, discussing the quarter’s results in September.

Nike’s departure from Amazon sent waves through the brand’s ecosystem. However, Nike is an exception. In other words, it looks for channels that can create new growth. For Nike, Amazon could sell – Nike would argue poorly – to its existing audience, an audience that is increasingly taking the extra steps to transact directly with Nike. With that (and other factors) in mind, it does not need to accept the tradeoffs that come with selling on Amazon at the expense of maximizing revenue.

Nike realized that it does not need to fix its issues with Amazon. It could instead build a channel without those issues. Nike is focusing on what it can control and ignoring what it cannot.

Joe Kaziukenas is the founder of Marketplace Pulse, a business intelligence firm focused on e-commerce.