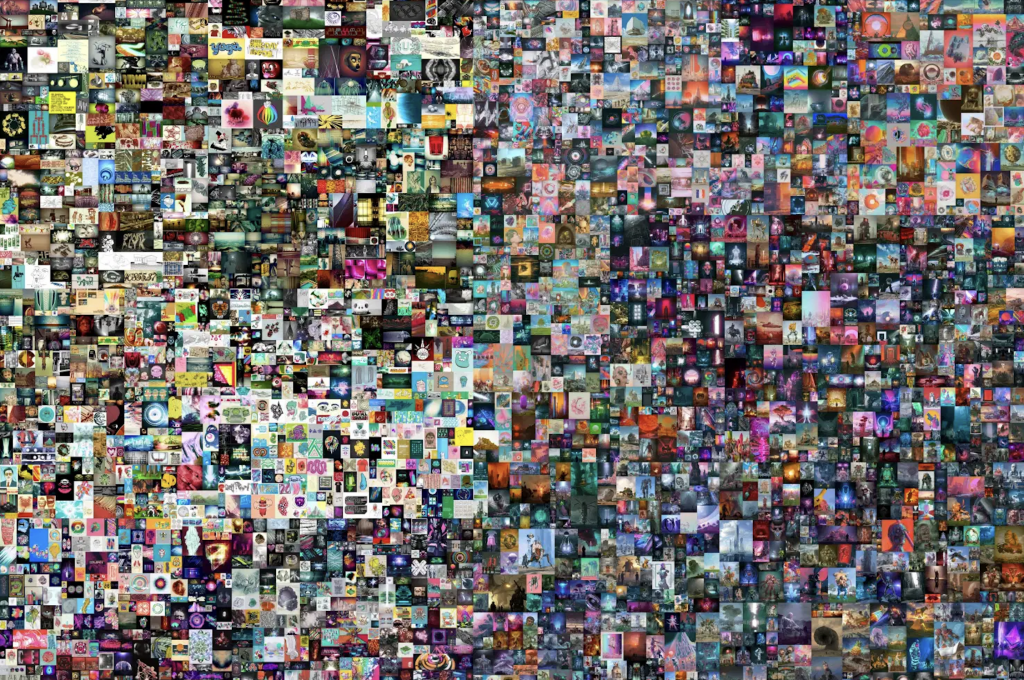

The convergence of blockchain technology and creative intellectual property through non-fungible tokens (“NFTs”) is having a mainstream moment. Media stories abound with reports of artwork, tweets, and other digital media selling for millions of dollars on blockchain marketplaces when they are represented by an NFT. In addition to addressing how NFTs are linked to sales of digital media, we take a look at the practical intellectual property considerations that can arise when buying or selling the creative works that the NFTs are attached to.

To understand how creative works become tied to NFTs, one has to understand how an NFT functions. First, an NFT refers to unique crypto tokens that are managed on the blockchain. A blockchain acts as the decentralized ledger that tracks the ownership and transaction history of each unique NFT. The main difference between NFTs and other traditional cryptocurrency like Bitcoin is interchangeability (or lack thereof). One bitcoin in a digital wallet is interchangeable for another bitcoin in a different wallet because each bitcoin has the same value and use. NFTs, on the other hand, are coded to have unique IDs and other metadata that no other token can replicate. This gives NFTs the attributes of originality and scarcity that make them so attractive when coupled with digital media.

NFTs are written with software code (called smart contracts) that governs actions such as verifying the ownership and managing the transferability of the NFTs. Like any software application, NFTs can be programmed beyond the basics of ownership and transferability to also include a variety of other applications and functionality, including linking the NFT to another digital asset. For example, a smart contract could be written to automatically allocate a portion of the amounts paid for any subsequent sale of the NFT back to the original owner, thus giving the owner an ability to realize the benefits of the secondary marketplace (see the proposed EIP-2981 standard for handling royalty payments for ERC-721 tokens).

Thus, when someone makes – or “mints” – an NFT, they are writing the underlying smart contract code that governs the qualities of the NFT and adding those qualities to the relevant blockchain on which the NFT is managed. Many blockchains can be used to manage NFTs, including Ethereum (with its long-established ERC-721 and ERC-1155 smart contract standards), FLOW, and Wax, but the process is largely the same with each. Notably, certain NFT marketplaces only function with certain blockchains, and so the choice of which blockchain to use for an NFT can have real commercial implications for the seller. NFTs could have applications beyond being used to transact in content, including supply chain management of physical goods and secured finance transactions. However, this post focuses only on NFTs when sold in connection with related content.

NFTs Govern Ownership of the Token, Not the Underlying IP Rights

Ownership of an NFT as a unique token – versus ownership of the content that such NFT may be associated with – is a critical distinction. When someone purchases an NFT tied to a piece of content, they have not automatically purchased the underlying intellectual property rights in such piece of content. Under Section 106 of the U.S. Copyright Act, a copyright owner has certain exclusive rights to reproduce, prepare derivative works of, perform, display, and distribute the copyrighted work. As a general rule, the purchase of a piece of art does not transfer all copyright in such work to the buyer. For example, when someone buys a painting at an art gallery for their home, they are acquiring the physical painting itself, which they can display, but not the underlying rights to reproduce, make derivative works of, or distribute copies of such painting.

In reality, the underlying copyright only transfers if the copyright’s owner evidences in writing that they intend to transfer those rights alongside the copy of the work. Unless the NFT owner has received explicit permission from the seller, the NFT owner does not automatically acquire the legal right to take pictures of the creative work attached to the NFT and make T-shirts or postcards for sale. Absent further documentation, the purchaser of an NFT acquires through that purchase an implied non-exclusive license to display the related media in their token wallet for personal purposes only, but does not own the underlying copyright in the content the NFT is associated with or the right to display that media on third-party products, websites, or platforms.

The question of “What rights are you buying?” when someone buys an NFT tied to a creative work is something that the parties can, and ideally should, contract around. For example, Dapper Labs, operator of the popular NBA Top Shot platform, has promulgated a template NFT License that NFT sellers can adopt to outline what rights are being licensed to the NFT buyer. The NFT License distinguishes the actual NFT token from the “art” associated with the NFT (the underlying image, music, sound, or combination thereof). The license clarifies that the buyer of the NFT receives (i) a personal license to use and display the art associated with the NFT, as well as (ii) a commercial license to make merchandise that displays that art associated with the NFT, a license subject to a $100,000 gross revenue per year limit.

To be clear, the NFT License is merely a suggested contract that buyers and sellers can use as they deem appropriate. For example, when the YellowHeart platform facilitated the sale of a new Kings of Leon album as an NFT, the terms of service of the YellowHeart platform included some elements of the NFT License, but with significant modifications. The YellowHeart Terms of Service state that buying the NFT gives the buyer a right to display the art (defined as the album artwork and images) and included merchandise (defined to include the music files) associated with the NFT, for as long as the buyer owns the NFT and only for personal purposes. The commercial license element of the NFT License was not included, and the YellowHeart terms include a host of clauses restricting commercial activity related to the creative works behind the NFT, such as prohibiting the use of the related art or included merchandise in third-party products or within movies or other media.

NFTs Do Not Inherently Authenticate IP Rights

Many market participants claim that NFTs can be used to prove authenticity. In fact, NFTs can authenticate ownership of a token itself, as well as the unique history of how such token was developed and linked to a creative work — on the public blockchains, anyone can see an owner’s wallet address and its linked metadata, as such information is available as a public record. However, a simple NFT by itself cannot help with matching the creator or owner of an NFT to a real person in the physical world, nor does it validate that the creator of the NFT has the underlying rights to tie that NFT to any specific creative work.

Counterfeiting is an issue associated with NFT artworks. Collectors can be easily left wondering whether some digital art they spent thousands of dollars on is a real Banksy work or merely a knockoff. To solve this issue, some platforms use an old-fashioned method to verify the identities of creators on their platform: manual verification. For example, SuperRare requires artists wishing to post their digital work for sale on its platform to first submit an application that requires information such as name, email, selection of artworks, social network presence, etc. Through this, SuperRare can ensure that collectors receive authentic artworks from reputable artists who have appropriate rights in the underlying art.

Other NFT marketplaces attempt to avoid the counterfeiting issue with broad disclaimers. For example, if a user attempts to buy a listing via the AtomicAssets marketplace, they encounter the following notice, which the user must accept to move forward with the purchase: “Anyone can create AtomicAssets NFTs and freely choose attributes such as name and image, including fake versions of existing NFTs or stolen intellectual property. Before buying an NFT, always do your own research about the collection and double check the collection name to ensure that you are buying genuine NFTs.”

Where Is the Creative Work Actually Stored?

In order to link an NFT with a digital creative work, the NFT needs to carry unique information about such digital work within its smart contract. One way to do this is to store the entire data for the video or song within the actual NFT code. This is often called “on-chain storage.” However, on-chain storage is impractical on most blockchains, since transfers on the chain incur a transaction fee based on the size of the token. Including the entire data for a large file into the NFT code would result in costly and time-consuming transfers. New technologies could resolve this issue, such as by developing secondary layers that allow for larger data sizes to be more easily transferred. However, as of the date of this article, that technology is still largely at the development stage.

In the meantime, the alternative way to link the NFT to the data for the creative work is to store such data off the chain, such as on a standard web server. The NFT then points to the address at which the digital asset is hosted online (in an ERC-721-compliant smart contract on Ethereum, that pointing happens via the TokenURI function). While simply pointing the NFT to the asset off-chain cuts down on monetary and time costs associated with transferring the NFT, the hosted content is now back to being centrally stored rather than being immutably stored on the blockchain.

This raises a legal question: Who has the legal obligation to host off-chain data for the associated creative works? NFT sales contracts or the terms of service for NFT marketplaces rarely specify whether the seller has a legal obligation to host the data in a way so that a specific NFT will always be retrievable by the owner. Absent such contract commitments, a buyer often has no guarantee that the URL or other web address will not be changed or be taken offline. This risk can defeat the whole purpose of using an NFT to secure immutability of the digital assets in the first place.

Some technology solutions attempt to solve this off-chain storage problem, such as the InterPlanetary File System (“IPFS”). At a high level, IPFS breaks up data for any image or other file into hashes — also called content identifiers or CIDs. The data for a specific piece of content is stored in chunks on decentralized nodes. No single web server hosts that content, so the content is still available and retrievable if a single node goes down.

Applications of NFTs Beyond Art

Buying and selling creative works is merely one application of NFT technology. NFTs appear to offer great promise in other spaces, such as a proxy for memberships or tickets to physical events. For example, Unlock offers users the opportunity to purchase an NFT with a key to unlock memberships to an ad-free version of the Forbes website. Other applications tie NFTs to physical items. For example, the Austrian Postal Service launched Crypto Stamp, a project through which it has issued physical stamps carrying private keys tied to some amount of ETH and digital versions of such physical stamps. This maintains the utility of the physical stamp, while also allowing collectors to include the stamp in their digital collections (permanently, if they want), and owners can easily trade the Crypto Stamps on NFT marketplaces.

While the world of NFTs is a fast-moving space, participants should be aware of some fundamental legal issues. First, a buyer of an NFT does not automatically receive all the intellectual property rights underlying the work associated with the NFT being acquired. The terms in the license agreement associated with the sale will usually determine a buyer’s specific intellectual property rights.

The law is still not settled on what exactly is acquired absent any such express intellectual property license or assignment grant. Second, buyers and sellers of an NFT should pay close attention to how the underlying media is being stored, and who has the obligation of storing the media associated with an NFT. Last but not least, despite all the uncertainties for NFTs, participants in this rapidly evolving area can expect to see more and more creative applications of NFTs beyond the current use, which is mainly for collectibles.

Ghaith Mahmood is a partner at Latham & Watkins, handling a full spectrum of IP and technology matters.

Jordan Naftalis is an associate in the Century City office of Latham & Watkins and a member of the Corporate Department.

Wenqian (Veronica) Ye is an associate in the Los Angeles office of Latham & Watkins.