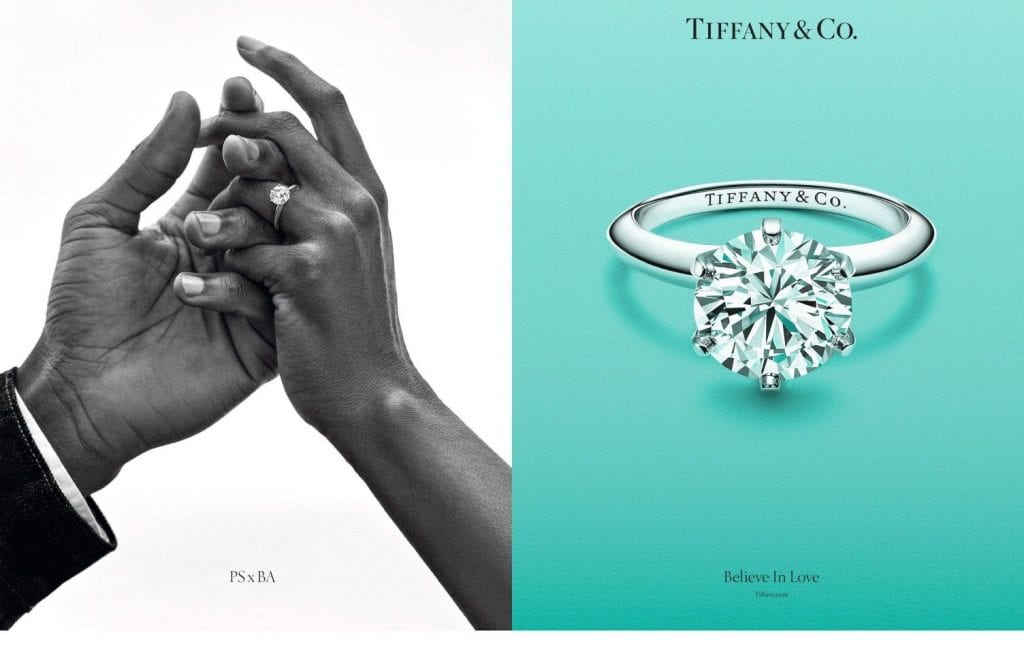

LVMH Moët Hennessy Louis Vuitton and Tiffany & Co. have managed to salvage their deal, with the French luxury goods conglomerate agreeing to pay a few dollars less per share to acquire the New York-based jewelry company. In a statement on Thursday, the parties confirmed that LVMH will pay $131.5 per Tiffany share, down from the $135/share price tag they initially agreed to in November 2019 before the onset of the COVID-19 pandemic. As a whole, the deal amounts to a whopping $15.8 billion merger.

“We are as convinced as ever of the formidable potential of the Tiffany brand and believe that LVMH is the right home for Tiffany and its employees during this exciting next chapter,” LVMH chairman Bernard Arnault said in the statement. More than merely shoring up the transaction, which had gone awry in the midst of the global health pandemic, the new deal brings an end to the bitter legal dispute that Tiffany & Co. initiated in a Delaware court. “Tiffany and LVMH have also agreed to settle their pending litigation in the Delaware Chancery Court,” the statement from the companies said.

In the lawsuit that it filed in September, Tiffany sought a court order requiring LVMH to “abide by its contractual obligation under the merger agreement to complete the transaction on the agreed terms” on the heels of LVMH pulling out of the deal, citing a letter from the French government requesting that it push back the closing date for the merger (in light of a tax battle between the U.S. and France over the latter’s digital services tax). More than that, LVMH argued that it had grounds to drop out of the deal because the management of the COVID crisis by Tiffany’s management and its Board of Directors fell short, enacting the Material Adverse Effect clause in the deal, and thereby, putting the validity of the deal at risk.

The headline-making transaction – which received all of the necessary regulatory approvals as of this week – is expected to close in early 2021, subject to Tiffany shareholder approval. “We are very pleased to have reached an agreement with LVMH at an attractive price and to now be able to proceed with the merger, said Tiffany Chairman Roger Farah. “The board concluded it was in the best interests of all of our stakeholders to achieve certainty of closing.”

In a note on Thursday, Bernstein analyst Luca Solca said that he sees “material value that LVMH could unlock at Tiffany,” including as a tool to “reinforcing its watches and jewelry business – so far the weakest division in terms of Return on Invested Capital performance.” As for the “relatively modest discount” that the parties agreed upon, that “seems to confirm the strength of Tiffany’s negotiating position, a common willingness to find a practical solution, and – possibly – a point of principle on Tiffany’s decision to continue to pay a dividend under the current fiscal year circumstances.”

With its $15.8 billion price tag, the deal still maintains the title of the largest deal in the luxury goods sphere, topping the $13.1 billion that LVMH paid in 2017 to take full control of Christian Dior – both the brand, itself, and the larger holding company – in a complex internal transaction aimed at simplifying the structure of the businesses, which had “long been requested by the market,” per Arnault.