LVMH Moët Hennessy Louis Vuitton sold 44.2 billion euros ($50.9 billion) worth of luxury goods – from handbags and ready-to-wear to wine and spirits – in the first nine months of 2021, up 46 percent from the same period in 2020 and up 11 percent from the first nine months of pre-pandemic 2019. During most recent 3-month quarter, which ended on September 30, the Paris-based conglomerate, which owns upwards of 75 luxury goods brands, revealed that sales grew by 20 percent to 15.51 billion euros ($17.90 billion), which appears to be something of a stabilization of the whopping 84 percent growth that it saw in Q2 of this year amid further loosening of pandemic restrictions and growth of vaccination campaigns.

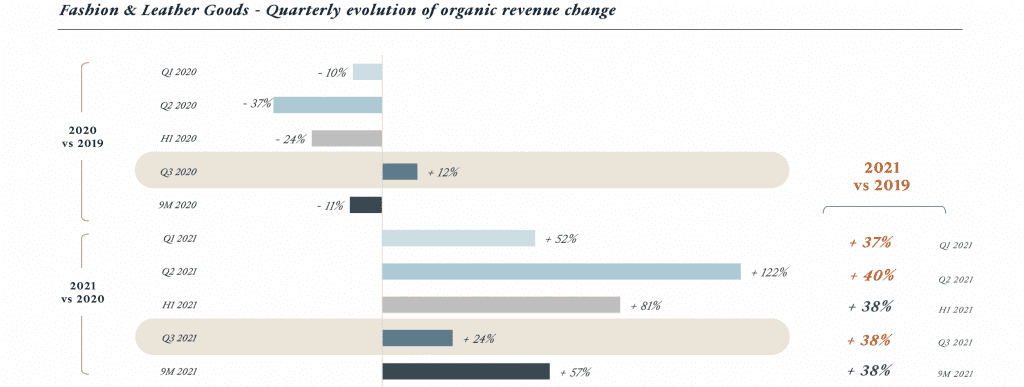

Specifically addressing the Fashion & Leather Goods group, which is responsible for almost half of the group’s revenues as a whole, LVMH asserted that sales reached “record levels” and posted growth of 24 percent, driven in large part by “sustained demand” in the U.S. and a “strong rebound” in China. The individual division boasted sales of 21.32 billion euros ($24.58 billion) for the first 9 months of 2021, up from 13.93 billion euros ($16.06 billion) for the same period in 2019.

LVMH states that the “remarkable performance” in the first 9 months of the year was driven in large part by sales at Louis Vuitton, Christian Dior, Fendi, Loewe and Celine, and thanks, in part, to an “enlarged product offering in all categories” at Louis Vuitton, the “great success” of Dior’s new Caro bag, “strong demand” for Hedi Slimane’s ready-to-wear at Celine and for the brand’s Triomphe leather goods line, and the success of Loewe’s new Goya bag. (It is worth noting that Celine got a specific ready-to-wear mention in a round-up of points that mainly highlighted leather goods sales; although, that is largely unsurprising given Slimane’s enduring ability to sell clothing as opposed to just accessories.)

On the jewelry front, LVMH revealed that its newest powerhouse brand, Tiffany & Co., had an “excellent” first 9 months, with its momentum proving to be “particularly strong in the U.S.,” where a major marketing revamp for the iconic jewelry company is underway. Specifically, LVMH noted the “solid performance of [the] Tiffany T line,” as well as the “successful launch of « ABOUT LOVE » campaign starring Beyoncé and JAY-Z,” among other new developments.

Perfumes & Cosmetics bounced back to 2019 levels for Q3 “thanks to continued strong progress in US and China, and improvement in Europe,” and in terms of the Selective Retailing group, which includes beauty retailer Sephora and duty-free entity DFS, revenues for Q3 were up by 15 percent compared to Q3 in 2020 but still down by 19 percent compared to the same quarter in 2019. Sephora had a “good performance” for the quarter “despite sanitary constraints,” per LVMH, driven by strong online sales, as well as “strong momentum in skincare and haircare.” Unsurprisingly, DFS’s recovery is still largely stunted by a recurring downturn in international travel, which has meant that its revenue is still lower than 2019 levels.

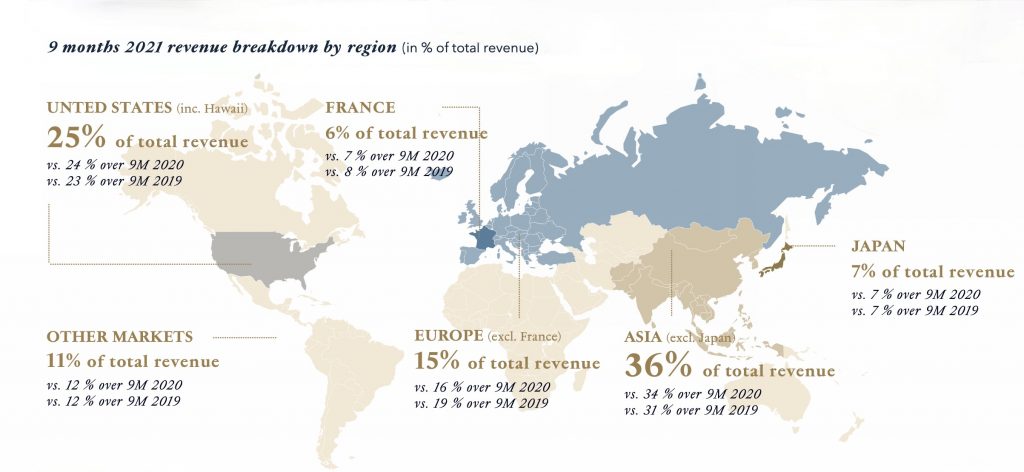

As for the geographical breakdown, for the first 9 months of the year, consumers in Asia (excluding Japan) were responsible for 36 percent of all of LVMH’s revenues, up from 34 percent in 2021 but more importantly, up 31 percent from 2019, a nod to the increasingly robust spending power of the Asian market. The U.S., which is LVMH’s second largest market, generated 25 percent of the group’s revenues, up by 24 percent (from 2020) and 23 percent (from 2019).

Looking ahead to the rest of the year, LVMH stated, “Within the context of a gradual exit from the health crisis, the Group is confident in the continuation of the current growth; it will maintain a strategy focused on continuously strengthening the desirability of its brands, by relying on the authenticity and quality of its products, the excellence of their distribution and the reactivity of its organization.”

In a corresponding conference call, LVMH management touched on the Chinese government’s push against wealth inequality, with CFO Jean-Jacques Guiony stating that they have not seen any major shift in consumer “sentiment” in response to the “Common Prosperity” agenda or crackdowns on celebrity culture, and does not anticipate any major blows from their main customers who occupy the upper middle class.

As for takeaways from its individual brands, LVMH revealed that Tiffany & Co. is performing particularly well in connection with the overarching revamp, which Guiony shed light on, saying that the aim is to give the brand “a broader appeal to a larger scope of clients,” both from a marketing and products perspective.

Reflecting on the groups’ two biggest Fashion & Leather Goods brands, LVMH said that Louis Vuitton has benefitted from strong growth in volume, which has made for greater growth than price increases, which not only tend to make up a smaller portion of growth but are also limited, per LVMH, when it comes to “evergreen” products compared to more novel offerings. Guiony emphasized the strength of Dior, which benefits from a greater diversity of products that Louis Vuitton, and still has room for development in terms of its physical footprint, asserting that LVMH can – and is looking to – develop the brand even further without fear of overexposure.

And finally, LVMH shed light on its stance supply and distribution, LVMH management stated that despite widespread supply shortages across industries, “Our supply chain is good enough so that we do not face a lot of shortage, but the cost is definitely rising. So that’s where we are, but is not not a particular burning issue for us.” In terms of distribution by way of third-party retailers, such as Farfetch, LVMH revealed, “We are still very doubtful as to our participation to outside platforms, even if they offer e-concession models due to the fact that we cannot have access to client data, which is a big issue for us.”