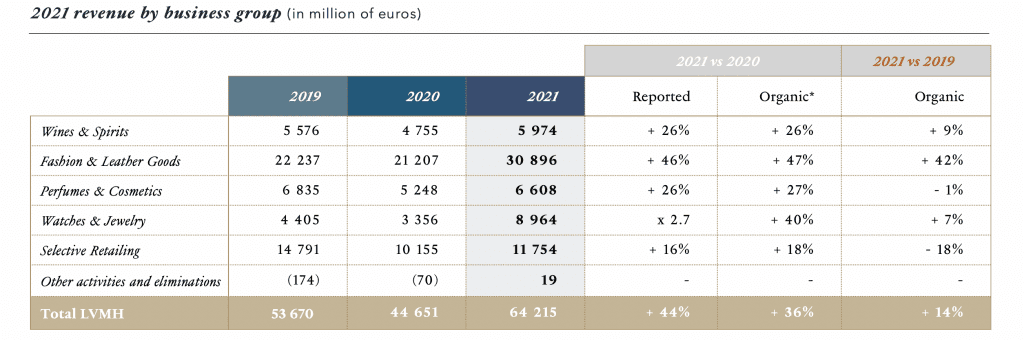

Sales for LVMH amounted to 64.2 billion euros ($71.55 billion) for the 2021 fiscal year, an increase of 44 percent compared to the year before and 20 percent compared to pre-pandemic 2019, the French luxury goods group reported on Thursday. Organic revenue growth was up by 36 percent and 14 percent compared to 2020 and 2019, with the group saying that its performance for the year “confirms a return to strong growth momentum following the severe disruption to the first half of 2020 resulting from the global pandemic,” and noting that “within the context of a gradual recovery from the health crisis,” it is “confident in its ability to maintain its current growth momentum.”

Delving into the performance of Fashion & Leather Goods over the course of 2021, Bernard Arnault-led LVMH revealed that its largest division “reached record levels,” with revenues totaling 30.8 billion euros ($34.32 billion) for the year – up from 21.2 billion euros and 22.2 billion euros in 2020 and 2019, respectively. Operating margins were up for 2021, as well, totaling 41.6 percent (from 33.9 percent and 33 percent in 2020 and 2019). These results were helped along by a strong fourth quarter, according to the group.

Louis Vuitton, Christian Dior, Fendi, Celine, and Loewe achieved “record levels of revenue and profitability,” while Marc Jacobs “also performed particularly well.” (The big name missing here is, of course, Givenchy.) Louis Vuitton and Dior, in particular, turned “an exceptional performance,” complete with enduring rises in profitability, which LVMH confirmed was “already at an exceptional level.” Specifically, Dior – which saw the success of its new Caro bag and its caning pattern, as well as strong demand for micro bags, and the launch of seasonal capsule collections – boasted “exceptional growth in all its product categories among local customers” over the course of the year. Meanwhile, demand for Louis Vuitton was driven by its “reinvention of iconic models,” along with new artistic collaborations.

Speaking of local customers, LVMH management stated during a post-release call with analysts that local customers “are getting more selective in terms of brand choice,” with the group attracting new local customers in Europe to compensate for the lack of Asian tourists. Also worth noting: LVMH management stated that under the watch of creative director Hedi Slimane and CEO Séverine Merle, Celine has one of the fastest growth rates in the industry.

In terms of Fashion & Leather Goods sales by region, LVMH said that sales in the United States and Asia – which account for the majority of revenue – rose “sharply” in 2021, followed by Europe, finally returned to growth in Q4 compared to 2019, and Japan “with more limited growth.”

Turning to the Watches & Jewelry division, LVMH saw “a strong rebound of activity in own stores and the successful integration of Tiffany & Co.,” which helped to send revenues up by 167 percent in 2021 compared to 2020, and boosted profits from recurring operations almost six times compared to 2020 and up 128 percent compared to 2019. The division generated the bulk of its sales in Asia (excluding Japan) and the U.S., which LVMH says are “the best performing regions.” Tiffany, alone, saw “record performance in terms of revenue, profits and cash flow, and increased its global attractivity as a result of its high impact innovations and collaborations” during its first year under the LVMH umbrella. The New York-headquartered brand – which benefitted from “strong interest” in its Knot collection, and the rapid development of iconic lines T and HardWear – was also responsible for “increased intangible assets” and “increased inventories” for the division.

Elsewhere in the group, the U.S. was responsible for the greatest increase in Perfumes & Cosmetics sales, which grew by 27 percent in 2021 compared to 2020. LVMH specifically highlighted the “enormous success” of Dior’s Miss Dior and Sauvage fragrances, noting that in 2021, Sauvage became the highest selling fragrance in the world (women’s and men’s lines, included), which is “a worldwide first for a male fragrance.”

Selective Retailing, the division that houses the likes of Sephora and duty-free venture DFS, saw organic revenue rise by 18 percent compared to 2020 but was nonetheless, down by 18 percent compared to 2019 due to the impact of travel retail. While DFS suffered from “the very limited recovery in international travel, travel restrictions in China, and quarantine measures in Hong Kong,” not all was lost, as growing demand from local customers helped to boost sales at the seven T Gallerias outposts in Macao. Still yet, Sephora helped buoy the Selective Retailing division by “surpassing its 2019 level of activity, benefiting from the strong rebound in its stores and the continued momentum of its online sales.”

In addition to growing e-commerce sales for Sephora, LVMH also pointed to Loewe and Marc Jacobs, stating that Loewe’s “online sales grew significantly” and Loewe enjoyed “a highly impressive surge in online sales.” In what is likely a nod at least in part to the role of e-commerce, LVMH states that “investments in [Celine’s] omnichannel strategy played a key role in the Maison’s new gains.”

As a whole, the group reported “continued strong growth of online sales alongside the gradual return of customers in stores,” noting that in terms of efforts, including continued online endeavors, it “made the choice to keep the distribution [of its major Maisons] highly selective, limit promotional offers and develop online sales through their own websites” in order to “preserve their exceptional image – a key element of their lasting appeal.” Going forward, LVMH says it expects to double-down on “the digitization of its Maisons to enrich customers’ experiences online and in stores.”

In a post earnings call on Thursday, LVMH chairman and CEO Bernard Arnault stated that he believes that the group “has enough wiggle room to raise prices” – which has been a common move across the luxury landscape over the past couple of years, in particular – “and protect its margins in an inflationary environment,” per Reuters. He cautioned, however, that management has to “remain reasonable” when it comes to boosting prices of the group’s offerings in the year ahead.

On the topic of group’s ambitions on the metaverse, LVMH does not appear as gung-ho as some of its rivals, with Arnault saying that LVMH “is not interested in selling 10 EUR virtual shoes,” noting that “at this stage, we are very much in the real world, selling real products.” On this same note, he further asserted, “We have to be wary of bubbles,” he said. “At the beginning of the internet, there were all sorts of things popping up and then the bubble burst. There may be relevant applications, but we have to see what universes might actually be profitable.” In terms of NFTs, in particular, Arnault stated that “it will be interesting to see how it generates profit, [as] NFTs are generating profits, and I’m sure this will have a positive effect if things are done properly.”

As for what the group is interested in is what Arnault called “more useful features in the future to support real life activities,” as indicated by LVMH’s recent expansion of the Aura Blockchain Consortium, which now includes Aura SaaS, a blockchain-based platform that aims to “help brands to address authenticity, ownership, warranty, transparency and traceability … [with] lower license and onboarding fees.”