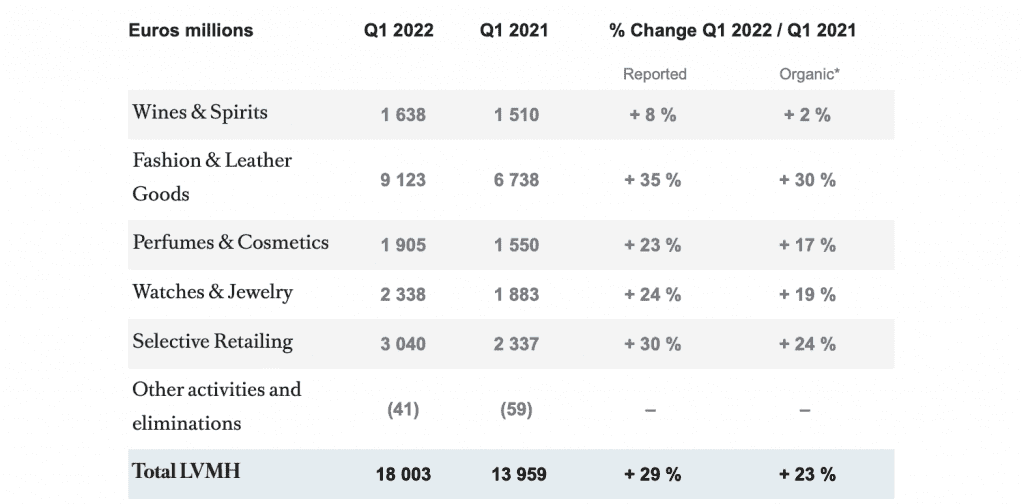

LVMH Moët Hennessy Louis Vuitton touted a “good start” to the year, reporting 18 billion euros ($19.59 billion) in revenue for the first quarter of 2022, up 29 percent compared to the same period in 2021, and stating that it is “well positioned to continue to gain market share” in the luxury sphere. Despite “continued disruption from the health crisis and the dramatic events in Ukraine,” the French luxury goods conglomerate revealed that all of its business groups – from Fashion & Leather Goods to Selective Retailing – achieved double-digit revenue growth, except for Wines & Spirits, which continued to see supply constraints.

Delving into its biggest division, LVMH stated on Tuesday that Fashion & Leather Goods, which is responsible for just upwards of 50 percent of the group’s total revenues, recorded revenues of 9.12 billion euros for the first three months of the year. The group pointed to Louis Vuitton, which had “an excellent start to the year,” Dior, which “enjoyed another remarkable performance,” Fendi’s “solid growth, driven in particular by the success of Kim Jones’ collections,” and Celine, which achieved “very strong growth thanks to the remarkable success of its ready-to-wear and leather goods lines designed by Hedi Slimane.” Loro Piana, Loewe, and Marc Jacobs “all had a very good quarter,” per LVMH.

A standout in terms of growth within the Fashion & Leather Goods division is Dior, with Bernstein analyst Luca Solca stating in a note on Wednesday that the brand is doing “somewhat better” than the others within the division. As for Louis Vuitton, he states that management does not intend to be overwhelmed by demand,” as they have a lot of initiatives in place for supply to keep up with demand, like the two new precious leather workshops in Vendôme, France.” At the same time, “The strategy remains that of controlling volumes.”

In a call on Tuesday, LVMH Chief Financial Officer Jean-Jacques Guiony specifically cited the strength of Dior, noting that Dior and Celine grew faster than other labels. Although, top-earner Louis Vuitton “is never very far from the average for the division.”

Within the realm of Watches & Jewelry, which recorded organic revenue growth of 19 percent year-over-year, with revenues reaching 2.34 billion euros, Tiffany & Co. had “an excellent start to the year, still driven by strong growth in the United States.” The new Knot collection was particularly successful, according to LVMH, which is currently in the midst of a major youth-focused overhaul at Tiffany & Co. under the watch of EVP of Product and Communications, Alexandre Arnault. Bulgari was another standout, thanks to strong demand – for both it and Tiffany & Co. – in the U.S. and Europe, as well as Singapore and Korea.

LVMH noted “strong growth of perfume and makeup, robust progress in the U.S. and a rebound in Europe,” with the division generating 1.91 billion euros, up from 1.55 billion euros for the same quarter last year.

Elsewhere under the LVMH umbrella, the Selective Retailing division, which is home to the likes of beauty retailer Sephora and duty-free chain DFS, among others, generated 3.04 billion euros in revenue, up 30 percent compared to Q1 2021. Specifically, LVMH cited strong performance from Sephora, which demonstrated a “solid performance in stores, especially in North America, France and Middle East,” driven in large part by fragrance sales and the “recovery of makeup.” At the same time, DFS – which has been hit significantly in the wake of the pandemic and limited international travel, saw revenue increase but “at a lower level” amid the continued impact of the pandemic on travel.

Geographically speaking, LVMH revealed that the United States up 26 percent), Europe (up 45 percent), and Japan (up 30 percent) achieved double-digit revenue growth, while Asia (up 8 percent) continued to grow over the quarter even in the wake of tightening health restrictions in China in March. The group pointed to a “balanced geographic revenue mix,” with 37 percent of Q1 sales coming from the Asian market (excluding Japan), 24 percent coming from the U.S. and 14 percent coming from Europe (excluding France), followed by sales in “Other Markets” (12 percent), Japan (7 percent), and France (6 percent).

Solca emphasized the importance of the U.S. market, which is “the largest country in terms of percentage revenue for LVMH – even more so than Mainland China.” He further states that this U.S. market is currently “less dependent on cosmetics than several years ago, as makeup has seen some slowdown in the past years and has been replaced by other categories under cosmetics and Fashion & Leather Goods.”

In terms of e-commerce, LVMH reported that it continued to see “strong momentum of online revenue and omnichannel developments” in Q1, with e-commerce sales in the U.S., for instance, remaining above 2019 levels even though they are slowly normalizing in favor of brick-and-mortar sales.

And finally, in a brief note on the metaverse, LVMH management stated that it is difficult to comment on this as of now, but confirmed that the group is eyeing the space “very carefully,” and stated that the group “will be part of whatever the future holds for the metaverse.”