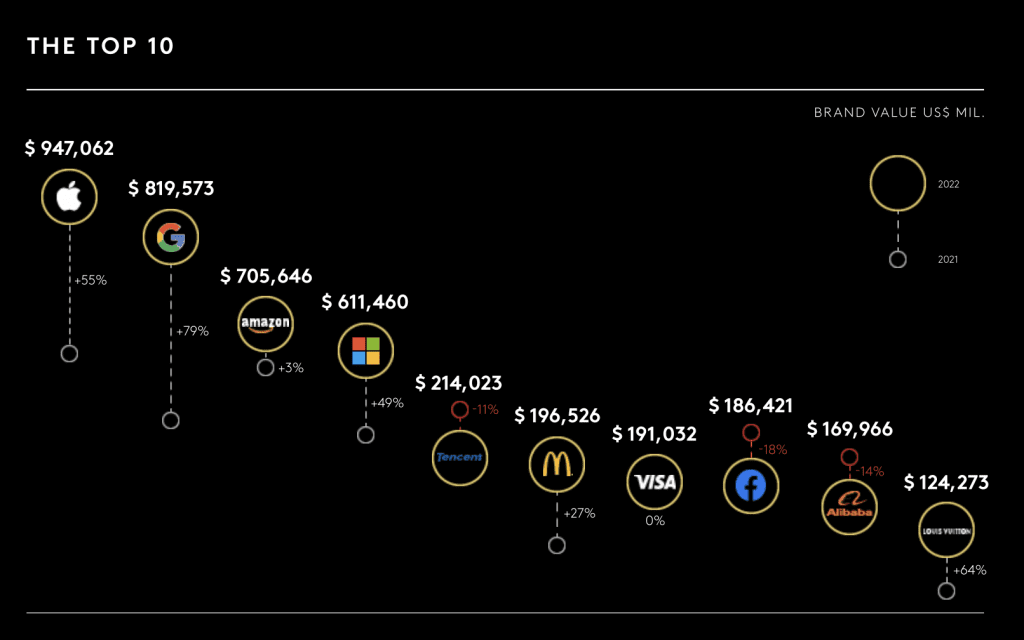

Apple has topped a list of the most valuable brands, putting the Cupertino, California-based consumer tech company on track to become the first trillion-dollar brand, followed by Google, Amazon, Microsoft, and Chinese tech and media conglomerate Tencent. While tech companies dominate the top spots of the Kantar BrandZ Most Valuable Global Brands 2022 report, which ranks companies based not just on financial results but their intangible assets (including trademarks) and consumer perceptions of their brands, as well, fashion and luxury names have also garnered meaningful positions on the latest version of the brand valuation ranking, with Louis Vuitton, for instance, landing in the top 10 for the first time ever – and Cartier topping the list of the fastest-rising brands for the year.

Relying on input from millions of global consumers and tens of thousands of brands to measure how “meaningful, different, and salient” brands are to consumers, Kantar found that the total value of the names on the 2022 Most Valuable Global Brands list grew by 23 percent to reach almost $8.7 trillion, which it says is “reassuring, considering the backdrop of high inflation and an unpredictable global economy.” Among the strongest brands (i.e., those that benefit from demand power – or consumers’ predisposition to choose one brand over others in their category, pricing power, etc.) of the year are those that fall within the luxury sphere, per Kantar, which notes that luxury brands, in particular, “have performed exceptionally well” on a year-over-year basis.

Louis Vuitton, which landed in the number 10 spot with a brand valuation of $124.3 billion, is the first luxury brand to reach the global Top 10, according to Kantar, which “reflects the growth of the luxury market worldwide and in China in particular.” (Luxury brands were among the fastest growing, up 45 percent, on this year’s ranking, following only behind consumer tech brands, which saw growth of 46 percent.)

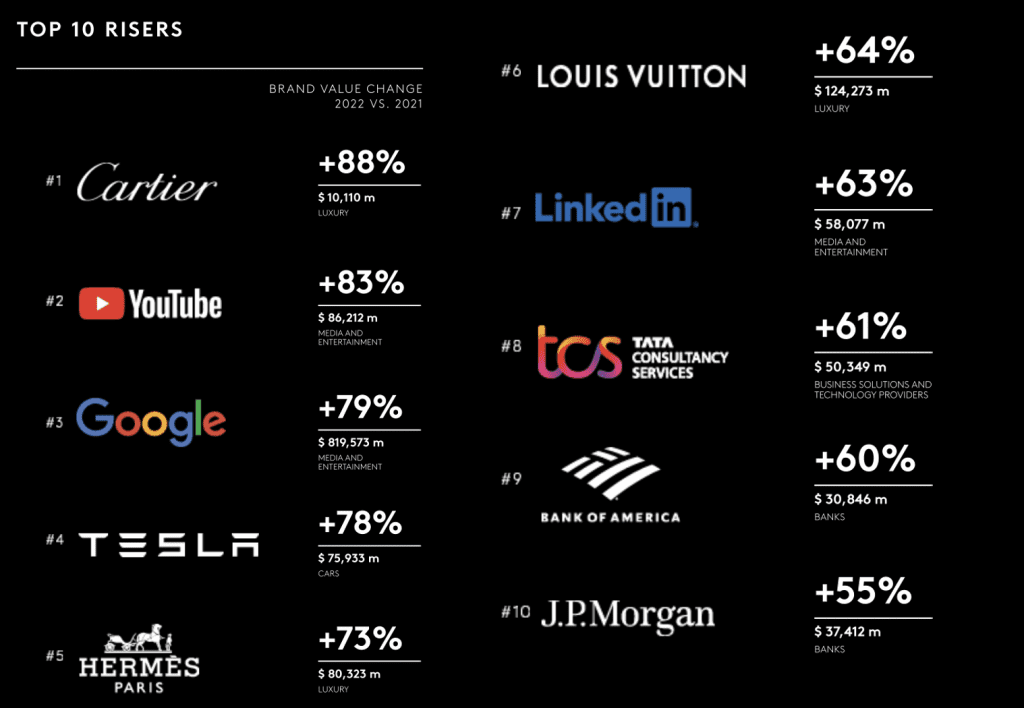

Elsewhere in the luxury space, Richemont-owned Cartier was named the fastest-rising brand across all categories, growing its value by 88 percent to $10 billion since last year’s report. Other brands doubling their brand value over the past year include: YouTube (No.24, $86 billion), Google (No.2, $819 billion), Tesla (No.29, $75 billion) and Hermès (No.27, $80 billion). In terms of Cartier, in particular, Kantar stated that the company “is seen as an especially smart buy when it comes to offering products that retain their worth over time,” presumably a nod to enduring resale demand for the brand’s offerings, including in a pre-owned state.

Resale & Sustainability

Kantar specifically touches on the effect of resale as part of the larger picture of brand valuation, stating that “the notion of ‘resale value’ has long informed brand value in the cars category, burnishing the reputation of brands as ‘good buys.'” That impact has since expanded beyond cars, with the help of “a variety of resale startups, [which] have brought the same financial calculus to bear on luxury, streetwear, and footwear brands – as consumers can see in real time which products can best ‘hold their value’ on the secondary market.” The result, according to Kantar, has been “a boon for brands with more classic, iconic ‘hero products’ in their stables – as well as those that manage to bring out the seasons’ hottest, hard-to-find viral sensation.”

(Kantar further claims that “iconic brand codes can prove especially important in turbulent times. For brands like Louis Vuitton, Chanel, and Hermès, signature heritage offerings like the Speedy, 2.55, and Kelly handbags are so much more than mere marketing mascots. They’re crucial revenue drivers in volatile economic climates. That’s when consumers turn away from risk, and instead, gravitate towards heritage products that are proven sources of value, comfort, and continuity.”)

The burgeoning resale market neatly ties in with one way for brands to boost their valuation: sustainability initiatives. While Kantar asserts that consumers’ expectations vary by category, brand, and market when it comes to sustainability, it notes that “one way that brands can move the needle on sustainability is by making products that last longer.” Kantar continues, asserting that the “opposite of planned obsolescence is the concept of future-proofing: finding ways to build, maintain, and service goods that last beyond typical product lifestyles,” with “service” being the key here, as it “enables brands to continue to unlock profits,” while also enabling brands to grow brand value in the eyes of consumers.

Microsoft, Zara, and IBM lead the way in the new Kantar Sustainability BrandZ Index, which the London-based firm says shows that sustainability already accounts for 3 percent of brand equity and is expected to rise further, according to Kantar.

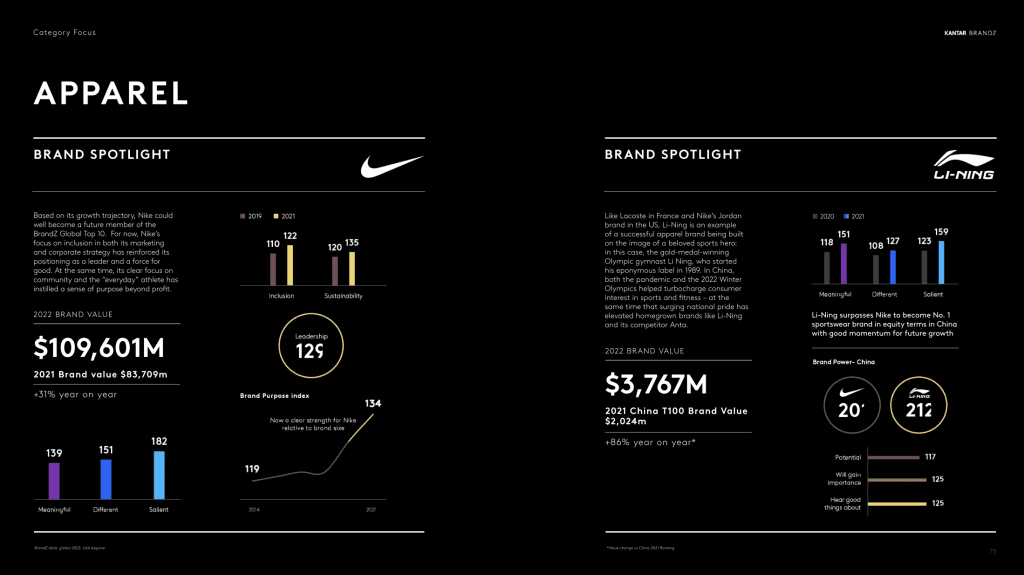

In terms of other fashion and/or luxury entities on the Top 100 ranking, Nike took the number 13 spot with a $109.6 billion brand valuation and a 31 percent increase from last year; Hermès came in at number 27 with a brand valuation of $80 billion (up 73 percent year-over-year); Chanel came in at 45 with a valuation of $53 billion (up 13 percent); Gucci landed at number 58 with a valuation of $37.9 billion (up 12 percent); Spanish fast fashion company Zara made it into the Top 100 in the 83 spot with a valuation of $25.4 billion (up 19 percent); and finally, adidas took the number 89 spot with a valuation of $23.8 billion (up 6 percent).

China, Data Privacy & the Metaverse

As for other key takeaways from this year’s report, Kantar pointed to the expansion of Chinese brands, stating that as American and European brands “remain dedicated to expanding their operations in China, they will increasingly have to contend with competition from mature, differentiated Chinese brands in their home markets.” While Kantar points to Chinese tech companies, including smartphone makers like Xiaomi, Oppo, and Viva, as key examples of this, fashion and sportswear companies come to mind, as well. For instance, Kantar highlights labels like Anta and Li-Ning, which it says have made “significant gains in market share over the past few years thanks to their cultural fluency and heritage appeal.” Non-native brands can still succeed in the Chinese market, of course, Kantar contends, but “their engagement with the Chinese market must shift toward a ‘higher quality’ approach,” meaning that they must demonstrate that they “truly understand Chinese society and that they are committed to improving China as a long-term partner for ‘quality growth.'”

Beyond that, Kantar highlighted the importance of the “post-cookie era,” which has been “hastened by a combination of regulatory pressure from jurisdictions like Europe and China, as well as strong pro-privacy stances by hardware manufacturers like Apple.” Kantar states that it is certainly likely that in the absence of third-party trackers, “the advantage will go to those brands and platforms with which consumers are most willing to share their own first-party data,” and it cites brands like Nike, which has built out a content suite that includes fitness tools, fan communities, and the SNKRS shopping app, “all of which should work together to provide the brand with rich consumer profiles and dynamic marketing opportunities.”

“Companies have long aspired to build interactive ‘brand universes,’” according to Kantar, which says that “now it really pays to have one.” In something of the same vein, Kantar states that the rise of the metaverse may have “all sorts of outré implications for categories like fashion, furnishings, and beauty – not to mention immersive marketing experiences for products of all time.” This could prove to be exciting for brands and consumers, alike, but for now, it states that “the greatest test for the metaverse will be to see if it can prove useful in a far more mundane corner of life: the routine business meeting.”

Finally, one “big story in branding today,” Kantar says, is the use of collaborations as a “shortcut to creating a cultural moment around a product.” This could include creative partnerships between a brand and a celebrity (for instance, McDonald’s and BTS) – or between two large brands, in different but adjacent categories (e.g., Gucci and Adidas). “But even more striking is the rising trend in collabs between two equally large competitors,” such as Kering-owned brands Gucci and Balenciaga, as well as Fendi and Versace, which Kantar rightly notes is more unusual since the two brands do not share a corporate parent.