The luxury segment “remains poised” to post striking growth for 2022 and keep rising thereafter, projected to achieve a market value of “some 1.4 trillion euros” ($1.45 trillion) in sales revenue this year, a 21 percent rise over 2021. According to the 21st edition of its Luxury Study, which it released in collaboration with Italian luxury goods body Fondazione Altagamma, Bain & Company states that the luxury market showed “a continuation of 2021’s potent recovery in 2022, despite rising macroeconomic pressures throughout the year,” with the global consulting firm projecting that gains could carry well into 2030.

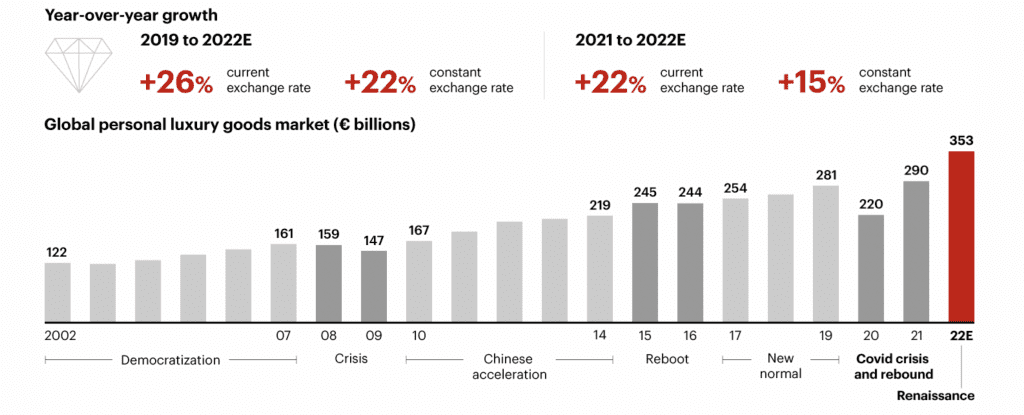

While “all luxury categories thrived,” having now recovered to 2019 levels or better, and 95 percent of luxury brands seeing “positive growth” thus far in 2022, Bain revealed that the personal luxury goods industry, in particular, “saw further growth acceleration this year, coming on the heels of the V-shaped rebound [it] enjoyed in 2021.” (Bain highlights hard luxury, leather goods, and apparel as “leading the resurgence following the pandemic.”) Boosted by a strong market performance across quarters, and “despite macro-economic indicators worsening globally,” including increased labor costs, interest rates, supply chain challenges, and energy costs, as well as specific challenges in China, the personal luxury sector is set to see the value of its sales jump to 353 billion euros in 2022, “marking an advance of 22 percent at current exchange rates (or 15 percent at constant exchange rates)” compared to the previous year.

Looking at the luxury market from a regional perspective, and mirroring what luxury groups like LVMH and Gucci-owner Kering have stated in recent revenue reports, Bain’s analysts found that South Korea and Southeast Asia were “stellar” luxury markets in 2022, and the U.S. and Europe “enjoyed strong growth.” Bain notes that the companies’ performances during the last quarter of this year will be “largely dependent on the progressive lifting of Covid-19 pandemic restrictions in China, as well as evolution of European and American luxury consumer confidence in the face of rising inflation and cost of living pressures, and potential recession in the U.S. and European economies.”

In terms of mainland China, in particular, which has been constrained by strict Covid-19 lockdowns, Q4 will be telling. Bain says that it expects China to recover next year, and depending on the strength of that key market, the consultancy says that it sees “two likely scenarios” for 2023: Personal luxury goods sales growing by 3 percent to 5 percent or growing at a heightened 6 percent to 8 percent at constant exchange rates.

Looking further ahead to 2030, Bain states that the prospects for personal luxury goods market are “highly positive, with the market’s value projected to rise to 540 to 580 billion euros – up 60 percent or more from the 353 billion euros estimated for 2022. Such growth is likely to be driven by “new tech-enabled profit pools” and “strong generational trends,” according to Bain’s report. In the coming years, spending by Gen-Z consumers and their even younger “Gen Alpha” counterparts is set to grow “three times faster than for other generations until 2030,” and will make up a third of the market. “This is, in part, driven by a more precocious attitude towards luxury, with Gen-Z consumers starting to buy luxury items some 3 to 5 years earlier than Millennials (at 15 years-old, versus at 18-20 years-old), and Gen Alpha expected to behave in a similar way.” (Generation Alpha are defined as those born between 2010 and 2024.)

Reflecting on other “key trends,” Bain asserts that “new markets are surprising the industry,” with South-East Asia and South Korea, for example, “winning in terms of growth and potential,” as the U.S. luxury market remains “strong.” There is little likelihood of there ever being “another China” in terms of luxury goods sales growth, but Bain contends that “India and emerging Southeast Asian and African countries have a significant potential nevertheless,” assuming that they catch-up in terms of infrastructure to facilitate the expansion locally. “Among the rising stars,” according to Bain, is India, which “stands out for growth potential, which could see its luxury market expand to 3.5 times today’s size by 2030, propelled by an increasing interest and evolving attitudes and behaviors among (young) customers towards luxury goods.”

As for other trends: (1) A mix of physical and e-commerce retail will continue to play out, with stores expected to play a solid role going forward, as online channels are seeing a normalization in their growth; (2) The luxury market’s consumer base is broadening with some 400 million consumers in 2022 expected to expand to 500 million by 2030, and in the process, the consumer base is becoming more “elevated,” with consumers “hungry for unique products and experiences, and putting brands VIC (Very Important Client) strategies into overdrive;” and (3) An elevation shift is underway, as brands look to increase prices “across the industry (driving around 60% of the 2019-2022 growth) without damaging volume growth.”