“The latest season of couture offers elaborate creations, including micro-studded jeans that shimmer from waist to toe and a metallic dress that is as fine as jewelry,” the Wall Street Journal stated this weekend, reflecting on the wares of Chanel, Armani Privé, Maison Margiela, Fendi, and co. But look beyond rhinestone-encrusted jeans and cowboy boots from John Galliano’s most recent Maison Margiela Artisanal collection and the “thin, shiny feather-like rhodoïd fringe” material that Alexandre Vauthier used to construct pants for Fall 2022 couture, and you will see that there is another type of “extra flourish” coming from luxury brands: Warranties and repair services.

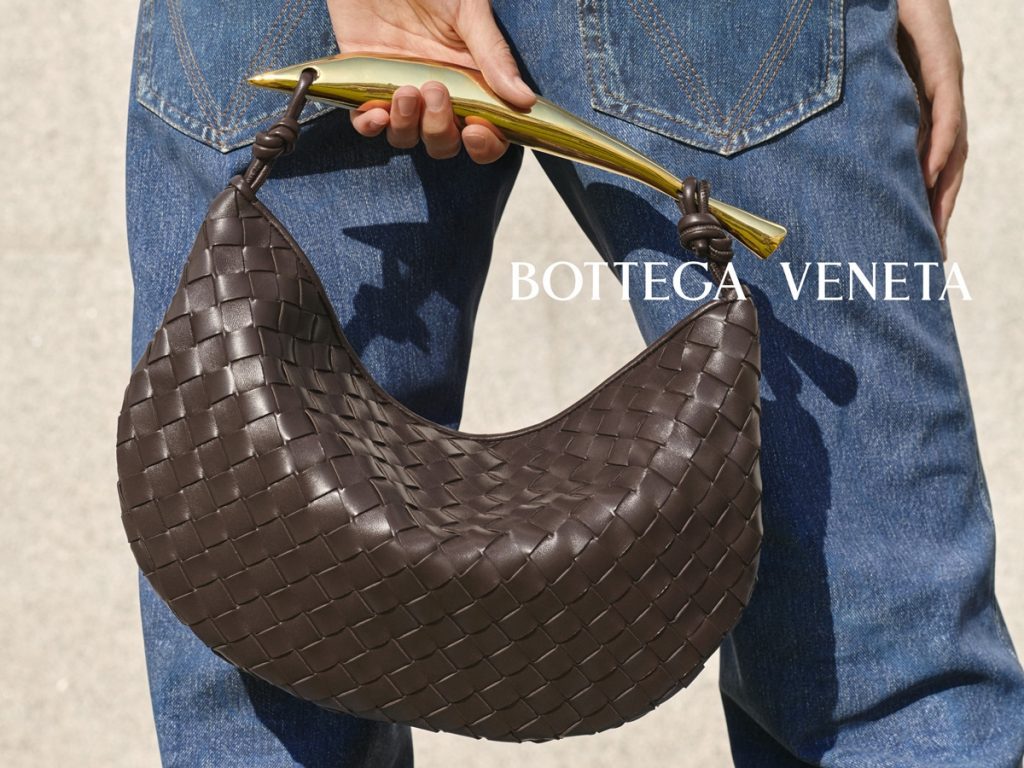

Bottega Veneta, for one, made headlines recently in connection with its “Certificate of Craft” initiative, which sees it offering a lifetime warranty for Bottega handbags purchased from the brand and its authorized retailers beginning this month. As part of the warranty, the Kering-owned company will proffer complimentary refresh and repair services for a growing list of bag styles. Speaking about the new endeavor, Bottega Veneta CEO Leo Rongone said that it is “born out of a desire to offer our clients a superior service of long-term preservation of their products,” noting that in conjunction with its “focus on responsible growth,” Bottega wants to “maintain products in use for longer, reducing the need for replacement.”

Rising Repair Initiatives

The Italian luxury brand is not the only one that is readily marketing repair services. As we first reported last year, Chanel has been putting its weight behind similar efforts, as primarily indicated by a budding number of trademark applications filed for its name and other branding – from “Ready to Care” to “Chanel & Moi” – for use on services, such as the “cleaning of clothing, textiles, shoes and leather goods.” Chanel has since introduced its “Warranty” initiative, in furtherance of which it “pledges an exclusive 5-year guarantee for all CHANEL handbags and CHANEL wallets on chain” acquired from its boutiques beginning in April 2021.

Reflecting on the influx of warranties in the upper-echelon of the luxury segment, Jefferies analysts Flavio Cereda and Kathryn Parker recently revealed that behind Bottega (and Brunello Cucinelli, which also provides a lifetime of free repairs for its products), “Chanel offers the second most comprehensive repair service with [its] 5-year warranty,” while Gucci provides a 2-year warranty for its handbags.

Cereda and Parker state that Louis Vuitton’s “bags do not have a warranty.” However, the brand “emphasized efforts to offer repair services for its products” this summer, and more recently, stated that it repairs some 500,000 bags per year, some of which are facilitated by its “e-service” in the U.S. Still yet, the Jefferies analysts point to Hermès, which “does not offer free repairs and refurbishment,” but carries out “Hermès Spa” services for its handbags at “a cost dependent upon the level of restoration needed.”

The brands that are rolling out warranties and related initiatives join a long list of watchmakers, such as Rolex, Audemars Piguet, Patek Philippe, LVMH-owned Tag Heuer, and Richemont’s Vacheron Constantin, just to name a few, and other luxury brands that have long – but often quietly – tendered warranties, and corresponding maintenance and repair services to buyers.

Marketing & Price Justification

The growing emphasis on product warranties and lifespan-extending services by luxury brands – which have traditionally been viewed as potential impediments to the volume-based model maintained by most brands, including ones in the “luxury” sphere – is being driven by a confluence of critical factors. For one thing, these increasingly-heavily-marketed repair services enable brands to tout sustainability credentials in the face of rising consumer concern about the environment. “Being environmentally virtuous” – including when it comes to fashion consumption – “has transitioned from niche consideration to central parameter of desire,” Luke Leitch wrote for Vogue last year in a nod to the growing adoption of repair services by luxury players.

At the same time, brands know that the messaging behind these ventures is particularly important when it comes to younger consumers, who are climate-conscious and who will, one day, be their biggest spenders. Repair services “have become far more interesting to young customers – even those who can afford something new,” according to McKinsey analyst Anita Balchandani. Hence, the push by buzzy companies like Bottega Veneta, which have found favor among millennials, to promote circularity by way of product longevity programs.

In addition to bringing about benefits on the marketing front and helping brands to attract new customers, these initiatives enable brands to engender goodwill and strengthen their bonds with existing clients, as well.

Beyond that, luxury brands’ warranties/repair benefits – which often apply only to new products that are purchased from the brands and/or their authorized retailers – serve as a way for companies to entice consumers to purchase products through authorized channels as opposed to the secondary market. In turn, this is a way for control-happy luxury giants to further hold on to – or in some cases, regain – as much control as possible over the market for their products. This puts the onus on brands to find ways to attract and sell to consumers directly, including by offering up benefits that unauthorized retailers and resellers cannot.

Still yet, there is the undeniable element of pricing. It is almost certainly not a coincidence that a number of the newly-introduced warranty/maintenance initiatives come as brands across the board have been aggressively raising their prices. By advertising these services, luxury brands like Chanel, for instance, are essentially providing consumers with additional value, potentially with the aim of softening the blow of soaring price tags.

The Rising Role of Web3

The increasing offering of warranties and repairs by brands will likely bring more of the practical aspects of web3 into the mix (this sphere is not just limited to expensive blockchain-linked MetaBirkins or Bored Ape jpegs, after all), with such efforts potentially pairing neatly with companies’ heightening adoption of blockchain technologies. It is not difficult to imagine brands opting to immutably record ownership and warranty information, as well as product repair histories, via blockchain-hosted tokens or QR codes.

We are seeing these endeavors come by way of luxury watch brands and auto manufacturers, alike. Breitling, for instance, was an early mover in this space, introducing blockchain-based product passports for its watches, and enabling customers to not only verify authenticity of their watches and transfer ownership of them upon resale, but to register repairs “with a timestamp on the blockchain.” Additionally, the watch company stated back in 2020 that it planned to roll out “upcoming insurance services and resale warranties enhance” with ties to the product passports. Panerai has also exploring this space, revealing early this year that “in time, every Panerai watch will be issued a Digital Passport, as a service to protect its valuable, singular identity, maintain an open line of communication with the brand and unlock benefits and services.”

More recently, Italian automaker Alfa Romeo announced that each of its new Tonale SUVs will come equipped with a blockchain-based certificate that tracks the car’s maintenance record. The Stellantis-owned company said in February that the “blockchain-guaranteed certification of the car’s life record” will provide a “confidential and non-modifiable record of the main stages in the life of [each] individual vehicle [that] can be used as a guarantee of the car’s overall status,” creating “a positive impact on its residual value.”

It will be interesting to see how brands will use blockchain tech hand-in-hand with their budding interest in repairs. Rolex seems like it may be eager to take part, filing a new trademark application with the U.S. Patent and Trademark to register its famous name for use across an array of goods and services, including “watches and chronometric instruments with digital codes, labels, tags and digital chips” (in Class 14). Not long before that, Hermès filed an application in something of the same vein, with an emphasis on services, such as “blockchain technology for representing a collectible item,” among other things.

Chances are, this is part of where luxury is headed, especially in light of the bigger picture, which is the enduring impact of the resale market and consumers’ treatment of certain luxury goods as investable (and tradable) assets. There will, of course, as the WSJ notes, be elaborate couture creations in the mix, as well.