Rising inflation (and corresponding shifts in consumer spending), enduring supply chain disruptions, market volatility in China due to stringent COVID policies, and mounting unsold inventory are among the issues that retail companies are currently facing, putting them in precarious positions amid fears of recession. Luxury brands are known to generally weather economic downturns better than their mass-market retail counterparts, and those in other industries, but how well positioned is the fashion industry as a whole to cope with a future that is rife with disruptions, including on the economic front? In other words, how do these companies rank when it comes to future readiness?

That was one of the critical questions that researchers at the International Institute for Management Development (“IMD”)’s Center for Future Readiness set out to answer in analyzing top companies across industries. Measuring seven equally weighted factors – from financial health and growth prospects to Environmental, Social, and Governance elements, brand value, and research and development efforts – and evaluating what leading players are doing differently, IMD Professor of Management and Innovation Howard Yu and his team determined that to get ahead and stay on top, luxury fashion and sportswear brands must “leverage digitalization and embrace learning.”

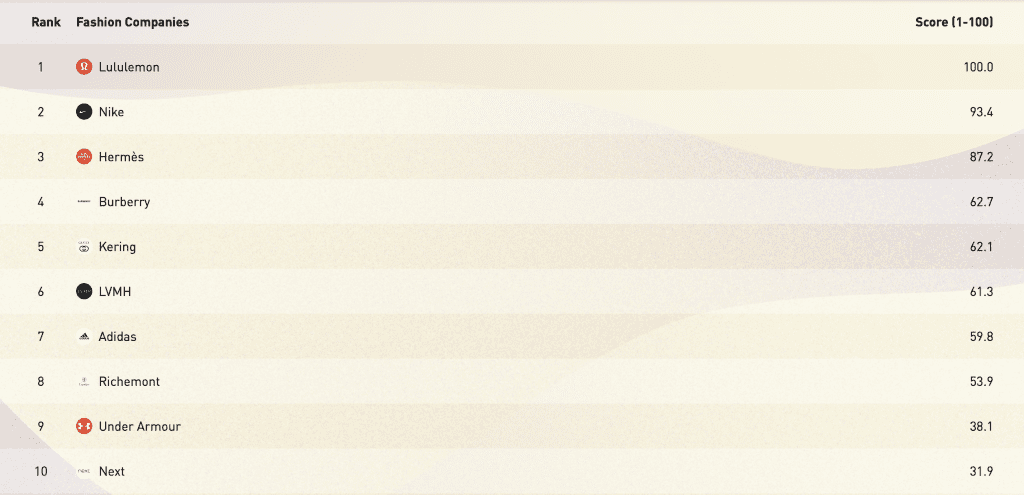

Taking these factors into account, IMD found that Lululemon, Nike, Hermès, Burberry, and Gucci-owner Kering take the top five sports on a ranking of future readiness, while LVMH, adidas, Cartier’s parent company Richemont, Supreme and North Face-owner VF Corp., H&M, Inditex, and Fast Retailing also nab positions.

According to IMD, one of the key takeaways from its study, which was completed last year and took 10 years of data into account, was the link between “digital competence” and financial returns. The report notes that “digitalization is not merely about the front-end consumer experience: a sleek website and a clean mobile app are the starting points, but there are a lot of make-or-break technologies to master behind the scenes,” such as supply chain digitalization and optimization. Looking at how readily companies have worked digitalization into their models, IMD found that sportswear brands and mass-market entities were more “digitally ready” than others, H&M, Lululemon, Nike, and adidas, for instance, were among the companies that had higher levels of digital “savviness.”

Traditional luxury brands/groups proved to be the opposite (somewhat unsurprisingly), with Hermès, French conglomerate LVMH, and Richemont scoring poorly in terms of digitalization efforts. (The high-fashion outlier here is Burberry, which ranked highly in terms of digital savviness, likely thanks to early digital experiments and subsequent AR/VR-focused endeavors.)

Digital Readiness vs. Shareholder Returns

As for how that digital readiness translated to shareholder returns, the results were mixed. While Burberry and H&M, for instance, boasted the highest levels of digital savviness, they also had the lowest shareholder returns over the 10-year period. (Burberry, whose stock price has been trending downward in recent years, is currently in the throes of an ongoing revamp aimed at repositioning the British brand and boosting its margins.) On the other hand, the likes of Hermès and LVMH, which scored poorly in terms of digitalization, performed well from a shareholder returns perspective. And still yet, Nike, adidas, and Lululemon scored well on both fronts.

These results demonstrate that “being highly digital is important for sportwear brands, but it is less important for high-end fashion,” per IMD.

Looking at Nike, in particular, Yu and his team stated in an article for HBR this spring that the Swoosh is “a prime example of a future-ready brand in sportswear, [as] it employs a digital, direct-to-consumer, and data-driven approach, which annihilates the boundary between the online and physical world.” In addition to “leverage[ing] advanced data analytics to gather insights around the clock,” Nike enables consumers to use the Nike App in while in-store to “gain access to limited release items, fun facts, and reward schemes.” This is an example of “a digital, direct-to-consumer, and data-driven approach, which annihilates the boundary between the online and physical world.”

Another one of the top-line takeaways from the study was the link between luxury brands and learning. “A handbag maker may not need to experiment with advanced materials other than leather” – that has not stopped the likes of Hermès, of course, which revealed in 2021 that it had spent the past 3 years working with material science company MycoWorks Inc. to create a material called Sylvania, a leather alternative made from mushrooms. But companies in the upper-echelon of the industry “still need to learn how changing consumer tastes might redefine the meaning of ‘exclusivity,’” per IMD, which is what makes a company’s “learning orientation” a valuable indicator of future readiness.

Hermès joins the likes of Under Armour, adidas, Nike, and Lululemon as the brands with the highest learning orientation, prompting IMD to determine that “high-learning organizations generate outsized returns over the long run, whether they focus on becoming digital or not; there is always something new and critical for them to master. In other words, learning pays off for everyone all the time.”

Meanwhile, Yu and his team spotlighted Lululemon, which they say has “built a robust digital channel upon innovation beyond apparel design.” The company maintains patents for “well-being metrics [tech], a biometric sensor belt, and a three-dimensional texture for the surface of a yoga mat,” while also engaging in notable acquisitions, such as its acquisition of Mirror in 2020, which falls in line with other direct-to-consumer relationship that “help the company to better discern consumer taste and detect new behaviors.”

Reflecting on their fashion-specific findings in action, Howard Yu, Jialu Shan, Angelo Boutalikakis, Lawrence Tempel, and Zuriati Balian stated this spring that companies that have fared the best in the wake of the pandemic “have been the ones who have scaled [their digitalization] capabilities ahead of their competition.” Stock prices for Hermès, Nike, and Target, for example, “have hit all-time highs,” as they have more firmly embraced e-commerce, which is “in stark contrast to the parade of bankruptcies among some of retail’s most iconic names: Brooks Brothers, J. Crew, and JC Penny.”

But adopting “direct-to-consumer, omnichannel, and personalized offerings” is not enough, they assert, as despite current market volatility, “the future is still arriving at an accelerating pace. Climate change, quantum computing, Web3, AI and machine learning, and the metaverse are just a few examples of the deep trends that are reshaping the ways companies innovate and compete.” In order to be “future ready,” they argue that companies need to weigh these important trends with the risk of “los[ing] sight of their core customers and the present economic environment.”