Luxury groups are feeling the effects of a shift to digitalization and concentration of winning brands – which is taking place against a background of unprecedented government cash injections into the global economy – which has created a pressure-cooker environment in the luxury mergers and acquisitions market. There are a lot of good reasons to make acquisitions right now, and there is plenty of cash to fund them. Headline-making deals have proliferated in this market environment, including LVMH’s $15.8 billion acquisition of iconic jewelry company Tiffany & Co. and before that, Moncler’s acquisition of Stone Island, the upscale Italian sportswear brand.

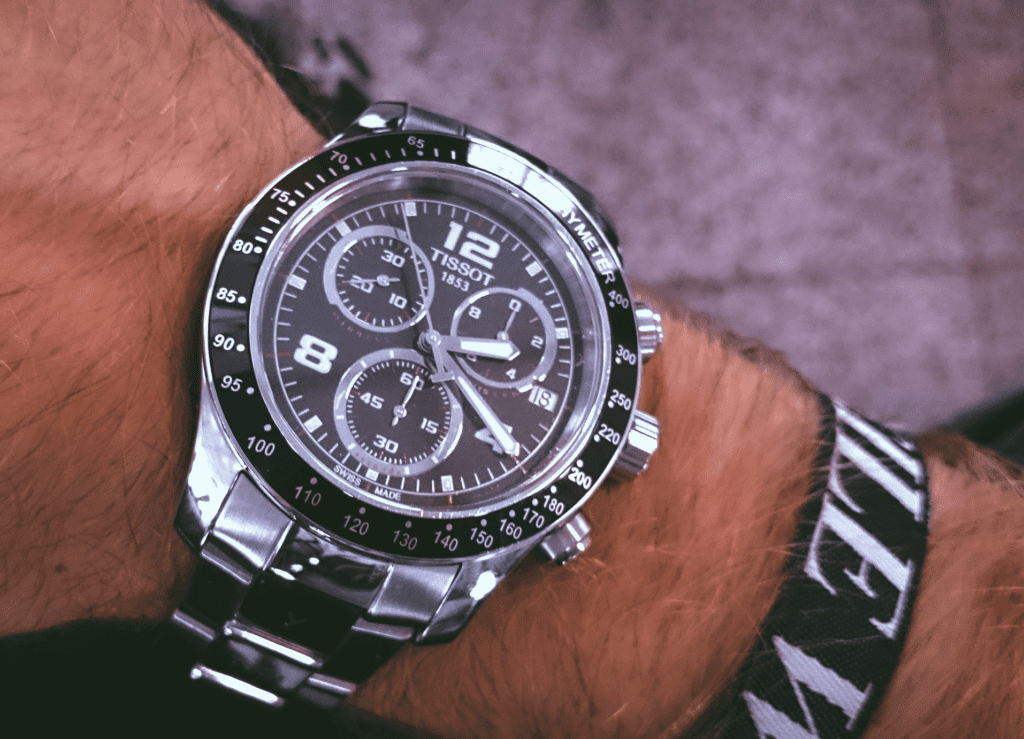

There was a time when private equity and investment money struggled to compete with strategic buyers in the fashion and luxury sector because of the inherent advantages luxury groups have in driving synergies, which can be huge. For example, Tapestry Inc.’s 2017 acquisition of Kate Spade projected synergies of $115 million. More recently, private equity and investors have come to not only sit on war-chests of cash, but many have changed their approach in the sector in a way that increasingly means founder-sellers see them as the more attractive option than in the past. Recent examples of private equity deals have seen CVC Capital take a controlling stake in watch company Breitling and Carlyle Group acquire Swiss watch parts-maker Acrotec.

Where this becomes particularly interesting is in mid-cap acquisitions, when companies are acquired directly from their founders, as for such founder-sellers, a deal is often about their legacy and the future of their company, as much as it is about the headline price.

Never give less than 100 percent?

Strategics typically prefer to acquire 100 percent of a target, whereas private equity will almost always provide some opportunity for founders to retain a portion of their investment in the target. That roll-over investment allows sellers to enjoy a “second bite of the apple,” when the fund exits its investment. This has driven luxury groups to become more creative on the management incentives that they offer to key people on the seller’s team, who are willing to stay with the business, in place. In addition, earn-out arrangements may be structured to provide a clear and attractive option, as compared to the unquantifiable upsides on a future exit. The terms of those incentives and earn-outs can become complex, and so, it is important that they are presented in a clear and transparent way.

The market zeitgeist, though – as originally driven by Millennials and the occasional older Generation Z-er – is that these financial calculations do not necessarily hit the emotional buttons needed to get founders and entrepreneurs excited about their businesses taking the next step. Whatever the generation of the seller, we are increasingly seeing a preference to retain a meaningful, long-term and direct stake in the business. Strategics – and long-term funds – have the advantage here compared to the traditional private equity model, as the former group of buyers do not need to bake in the need for an exit in, say, five years. We have seen this approach in Puig’s acquisition of beauty brand Charlotte Tilbury, who retained a “significant minority” stake, and Coty Inc.’s acquisition of a simple 51 percent majority of Kylie Jenner’s Kylie Cosmetics.

Private Equity in the industry is increasingly long-term in its thinking

In accordance with the classic private equity model, the shorter the turn-around time, the better. That flatters returns and attracts heightened interest from investors in the next fundraising round. However, in the post-pandemic world, many private equity and fund investors have concluded that the luxury market changes too quickly to rely just on balance sheet engineering to work its magic in three to five years. Therefore, this private money is increasingly approaching the fashion/luxury sector as a longer-term play to allow for their investments in digital transformations and sustainability to deliver the expected rewards.

Luxury groups should recognize that private equity and other funds are often not only very smart about selling their ability to transform businesses, but increasingly, they can point to an enviable track-record of walking the walk. For example, the investments put into Missoni by Italian investment fund FSI Mid-Market Growth Equity Fund, which acquired a large stake in the family-owned fashion brand in 2018.

Where luxury groups and strategic buyers may be open to leaving sellers with a material stake, or a direct financial interest (like an earn-out), they, therefore, need to be more on the front foot than ever as to how they will leverage their group balance sheet, and deploy their industry know-how, to drive the future success of the business.

Separating the winner from the losers

Other than price and future upside, what can separate the winner from the losers in an M&A auction process?

Culture: For a founder-owned business, selling into the “right hands” can make all the difference. Being able to demonstrate a track-record of nurturing other acquisitions, and introducing the individuals on those deals to tell their stories, is a common step. The value of ensuring that the culture and ethos and approach of your operation is on display in every interaction cannot be underestimated.

Speed: To match the speed that private equity will bring to the process, strategic buyers and luxury groups might consider getting advisers on board from day one.

Precision: Strategics often bring big teams to diligence so they can really kick the types and understand the potential synergies that will drive their bid pricing. The risk is that the number of follow-up questions this creates may overwhelm the sellers, particularly sellers without a lot of M&A experience. Having a senior point-person streamlining the questions can help make a better impression.

Candor: In today’s market, “pre-emptive” offers (a take-it or leave-it offer) should be anticipated from private equity. Having candid conversations with the sellers about what a competing bidder can do to reduce the chances of a pre-emptive offer from another party being accepted, before it is too late, can help avoid wasted efforts.

Certainty: Minimizing closing conditions can make a huge difference to the attractiveness of an offer. There are typically two aspects to this. Firstly, if there is an anti-trust angle then doing that analysis early is crucial to convince sellers that an offer is deliverable. Secondly, requests for a “material adverse change” closing condition. This can become an emotive issue for buyers and sellers and lead to discussions around highly hypothetical, or even slightly absurd, scenarios. Taking a step back as to what level of risk is worth arguing about is usually time well-spent.

Locked-Box v Completion Accounts: A private equity buyer will typically get comfortable with a proper locked-box approach if that is the sellers’ preference. A strategic buyer who is willing to do the same may help convince the sellers that they are a buyer they can do business with.

Reduction of Risk: Taking the risk of warranty and indemnity claims largely off the table by obtaining W&I insurance makes a huge difference as to how a bid is perceived. Although not right for every deal, it should at least be considered early. If the sellers are retaining a direct or indirect interest, then it should be the default position to reduce the risk of damaging the relationship by bringing post-closing claims against the sellers.

The real competitive threat of SPACs

In the first half of 2021, 430 Special Purchase Acquisition Companies (“SPACs”) were launched, raising $104 billion. We are also just starting to see the anticipated wave of European SPACs coming to market. There are a lot of SPACs, with a lot of cash, out there hunting for targets – including in the luxury sector. Sector interest in selling to SPACs (“de-SPAC transactions”) was further heightened this past July, following the announcement that Ermenegildo Zegna would list on the New York Stock Exchange via a $3.2 billion deal with a SPAC. The deal was driven by factors, such as having greater visibility in the U.S. luxury market and a desire for funds for expansion in newer territories.

For regulatory and practical reasons, de-SPAC transactions (i.e., the acquisitions of targets) are not small deals. Last year, the average size of a de-SPAC transaction was $1.1 billion and, in practice, SPACs would not typically target businesses with a value below around $250 million. They will therefore only occasionally be a realistic route for founders. Where a strategic buyer does find itself competing with a SPAC, then it should be ready to offer what a de-SPAC cannot. If the founders would prefer a clean exit then a de-SPAC should not be their first choice, as they would be expected to roll-over some exit and have a post-transaction holding period. Equally though, if they want to retain a real seat at the table then it would be worth testing if the requirements of public company life will really allow them to do that and how ready they are to start operating in the glare of life with public shareholders.

Finally, an informed view of the real deliverability and pricing of a de-SPAC transaction should be sought. These are typically expensive transactions, with sponsors ending up with up to 20 percent of equity as a fee, and so the headline price may not be exactly what the sellers receive. If the target company is otherwise considering an IPO, then a de-SPAC will often be the smarter move. However, for founders who want a partial exit, a strategic buyer should often be able to provide a more compelling alternative by offering what a de-SPAC cannot.

Don’t be afraid of take-private deals

Twenty years ago, private equity in Europe hardly looked at public takeovers. In the post-financial crisis world, that changed as they saw that public companies were often available without having to compete in an auction process, and at lower multiples than often expected by private sellers. Today, private equity is the driving force in the public takeover market, already taking 14 companies private in London in 2021, alone. However, the private equity players with takeover track-records have not shown quite the same appetite for luxury companies. Admittedly, there is a limited universe of targets but there are a number of interesting luxury businesses trading at relatively modest multiples on European growth markets (like AIM or Nasdaq First North in Stockholm).

We may see some of these become targets for private equity in the next couple of years – unless luxury groups take a leaf out of private equity’s book and get there first.

Nick O’Donnell is a partner in Bird & Bird’s Corporate practice in London. He has a focus on international M&A across a number of sectors, including luxury and retail and consumer.