Nearly a dozen big-name celebrities have landed on the receiving end of a new class action lawsuit, accusing them of having “promoted, assisted in,” or “actively participat[ing] in” the offer and sale of unregistered securities by way of failed crypto exchange, FTX, which filed for bankruptcy on November 11. In addition to naming FTX founder and former CEO Sam Bankman-Fried as a defendant in the case, Plaintiff Edwin Garrison claims that Tom Brady, Gisele Bundchen, Stephen Curry, Shaquille O’Neal, Udonis Haslem, David Ortiz, William Trevor Lawrence, Shohei Ohtani, Naomi Osaka, Lawrence Gene David, and Kevin O’Leary, as well as the Golden State Warriors, are on the hook for engaging in deceptive and unfair trade practices and civil conspiracy, among other things.

According to the newly filed lawsuit, which was lodged with a Florida federal court on Tuesday, Garrison claims that thanks to “false representations and deceptive conduct,” FTX carried out a “scheme designed to take advantage of unsophisticated investors from across the country,” causing consumers to “collectively sustain over $11 billion dollars in damages.” Part of the alleged fraud “employed by the FTX involved utilizing some of the biggest names in sports and entertainment—like [the named] defendants—to raise funds and drive American consumers to invest in [FTX’s] yield-bearing accounts” (“YBAs”).

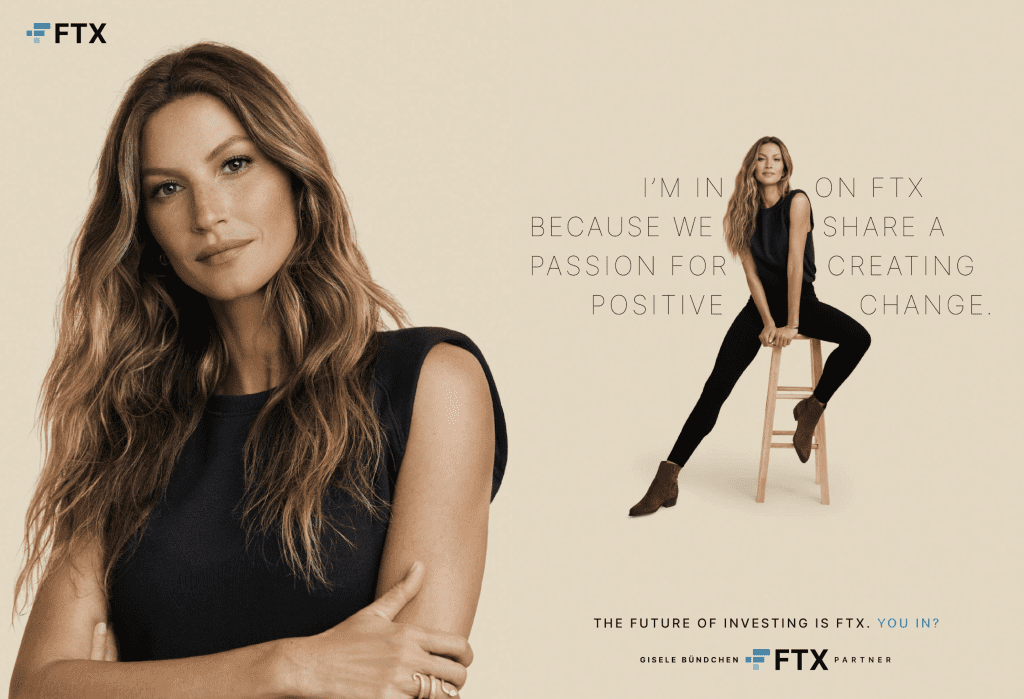

Specifically, Garrison alleges that the celebrity defendants acted as “brand ambassadors” for 3-year-old FTX, which rolled out large-scale branding and advertising projects, including a $20 million television-slash-social media campaign that debuted last year, starring Tom Brady and Bundchen, who “took equity stakes in FTX.” The other named defendants appeared in subsequent commercials, including a Super Bowl campaign featuring Larry David, and/or participated in social media promotions, with some, such as tennis star Naomi Osaka, being paid in “an equity stake in FTX and payments in unspecified amounts of cryptocurrency.”

Importantly, Garrison claims that while the celebrity defendants disclosed their partnerships with FTX in connection with such advertisements, “They have never disclosed the nature, scope, and amount of compensation they personally received in exchange for the promotion of the deceptive FTX platform.” Garrison asserts that the the U.S. Securities and Exchange Commission (“SEC”) “has explained [that this is] a violation of the anti-touting provisions of the federal securities laws,” pointing to the SEC’s action against boxing champ Floyd Mayweather and music producer DJ Khaled over their crypto promotions, as well as prosecutions of other celebs, including Kim Kardashian and basketball player Paul Pierce, for failing to disclose their paid endorsements.

(“The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion,” Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, said in connection with the agency’s settlement with Kardashian in October. Kardashian allegedly failed to abide by 17(b) of the of the Securities Act, which “makes it unlawful for any person to promote a security without fully disclosing the receipt and amount of such consideration from an issuer.”)

Garrison also cites the Eleventh Circuit’s decision in Wildes v. Bitconnect Int’l PLC as a basis for naming the celebrity endorsers as defendants alongside Bankman-Fried; in that case, the federal appeals court held that “promoters of cryptocurrency through online videos could be liable for soliciting the purchase of unregistered securities through mass communication, and no ‘personal solicitation’ was necessary for solicitation to be actionable.”

In addition to failing to disclose the full scope/nature of their compensation from FTX, Garrison asserts that “none of these defendants performed any due diligence prior to marketing these FTX products to the public,” thereby, making them liable for the damages he and other similarly situated individuals suffered as a result. As a result of the “misrepresentations and omissions made [by the celebrity defendants],” which were “broadcast around the country through the television and internet,” Garrison argues that they are liable to him and the other class members that acquired crypto accounts from FTX for “soliciting their purchases of the unregistered YBAs.”

With the foregoing in mind, Garrison claims in the lawsuit that the FTX-promoting defendants ran afoul of the Florida Securities and Investor Protection Act, which makes it unlawful to sell or offer to sell unregistered securities, and the Florida Deceptive and Unfair Trade Practices Act. More than that, he alleges that the defendants engaged in civil conspiracy by making “numerous misrepresentations and omissions … about the deceptive FTX platform in order to induce confidence and to drive consumers to invest in what was ultimately a Ponzi scheme.” And still yet, Garrison sets out a declaratory judgment claim, asserting that “there is a justiciable controversy over whether the YBAs were sold illegally, and whether the defendants illegally solicited purchases from [him] and the class.”

In addition to seeking certification of the class action complaint, which seems to easily meet the $5 million class action threshold, and looking to get the court to order “declaratory and/or injunctive relief stemming from the offer and sale of FTX’s … yield-bearing cryptocurrency accounts,” Garrison is aiming to “hold the defendants responsible for the many billions of dollars in damages they caused.”

As for whether Garrison will be successful in pursing the celebrity plaintiffs (as distinct from Bankman-Fried) even under Florida’s investor-plaintiff friendly statutes, experts expect that it is unlikely. Full disclosure issues aside, at least some of Garrison’s success will depend on if and/or how he is able to show that the celebs engaged in deceptive practices (i.e., did they mislead reasonable consumers) and that he and other class members were “directly and proximately” harmed as a result of the celebrity defendants’ allegedly misleading promotions of the company.

THE BIG PICTURE when it comes to the rising number of crypto-related litigation, which continues to ensnare not only the companies and their directors, but famous endorsers, as well, is that “there can be little question that crypto companies – and their promoters – do not simply need to be attuned to anticipated new regulatory edicts and scrutiny,” according to Bilzin Sumberg’s Philip Stein. “They must also be wary of lawsuits alleging misrepresentations of value and overstatements of likely returns on investment.”

The case is Edwin Garrison v. Sam Bankman-Fried, et al., 1:22-cv-23753 (S.D. Fla.)