The COVID-19 pandemic accelerated the digitalization of the fashion industry – including for luxury brands, which have historically been slow to embrace electronic and digital commerce. Indeed, in 2020, e-commerce in the United States achieved an astounding ten years’ worth of growth in a three-month period. While brick-and-mortar still holds a significant market share for luxury brands, the future undeniably includes a significant digital component. To that end, there are a number of digital trends – and key legal issues that they raise – that luxury brands need to consider in 2021 (and beyond).

Non-Fungible Tokens

Non-fungible tokens – or NFTs – are one-of-a-kind digital assets that can be used to represent items, such as works of art, videos, and even digital (or physical) garments, and can be bought and sold like any other property. While they have been around since 2014, they are having a mainstream moment in 2021, with artists driving multi-million dollar auctions for their NFT artworks and luxury brands like Gucci, Rimowa, Burberry, and Louis Vuitton launching NFTs in order to reach increasingly digitally-connected consumers.

NFTs also have touted as promising anti-counterfeiting applications, a particularly relevant proposition in light of the ever-growing global market for counterfeits and the rise of secondhand fashion, which has led to the increased sale of counterfeit luxury goods. Not necessarily a simple process, NFTs can be used to record the provenance of associated physical products, and then aid in authentication efforts, potentially restoring consumer confidence in a resale industry that is been riddled with counterfeiting controversies.

Arianee, an Ethereum-based project, for instance, is building a business in order to meet this growing need and establishing “NFT digital passports for luxury goods,” which will also digitize service history and repairs. At the same time, the Aura Blockchain Consortium similarly takes aim at counterfeiters by recording all newly-made products on a shared blockchain ledger and issuing digital certificates of authenticity. LVMH-launched Aura’s digital certificates will also detail products’ sourcing and sustainability metrics, a benefit that Aura hopes will promote trust in brands’ increasingly-widely-marketed sustainability and ESG credentials.

NFTs are an increasingly important tool for fostering – and soon, for protecting – brand value, but they also pose novel enforcement challenges. The rising demand for digital luxury goods has brought an insurgence of NFTs that trade on luxury brands’ rights. For example, the “Baby Birkin” NFT, an animation of a baby growing inside an Hermès Birkin bag, recently sold for $23,500 – over twice the initial retail price of Hermès’ “baby”-sized Birkins. This NFT references the “Birkin” word mark and famous trade dress, but is not affiliated with – or authorized by – Hermès.

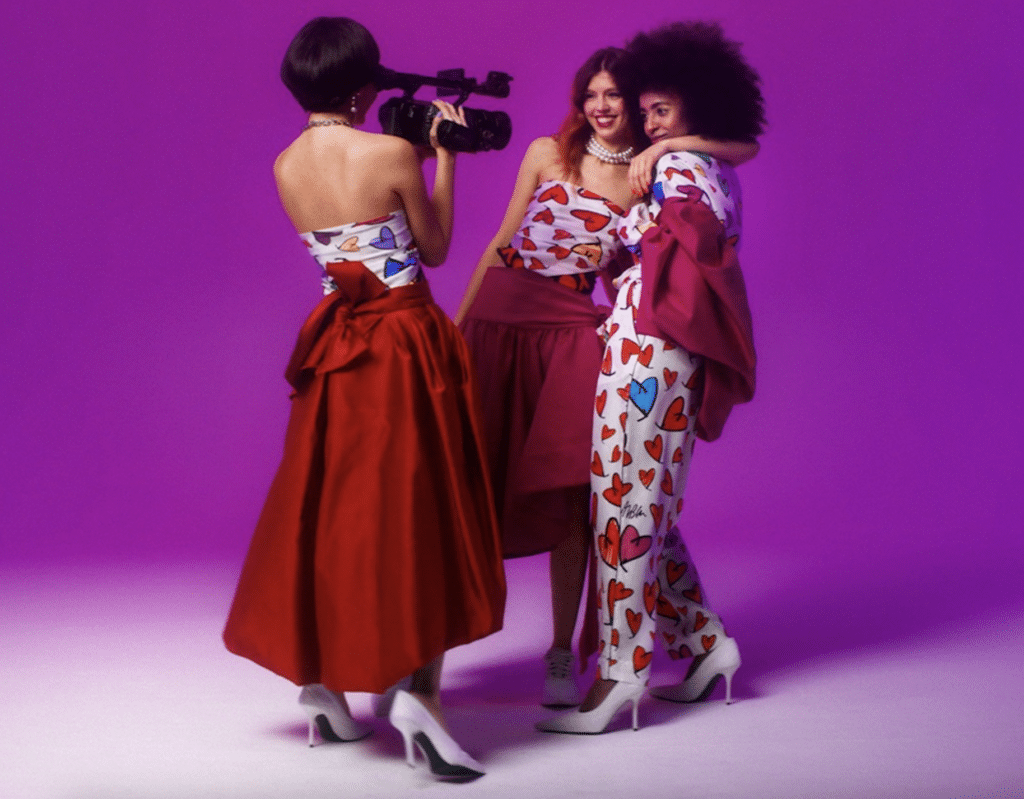

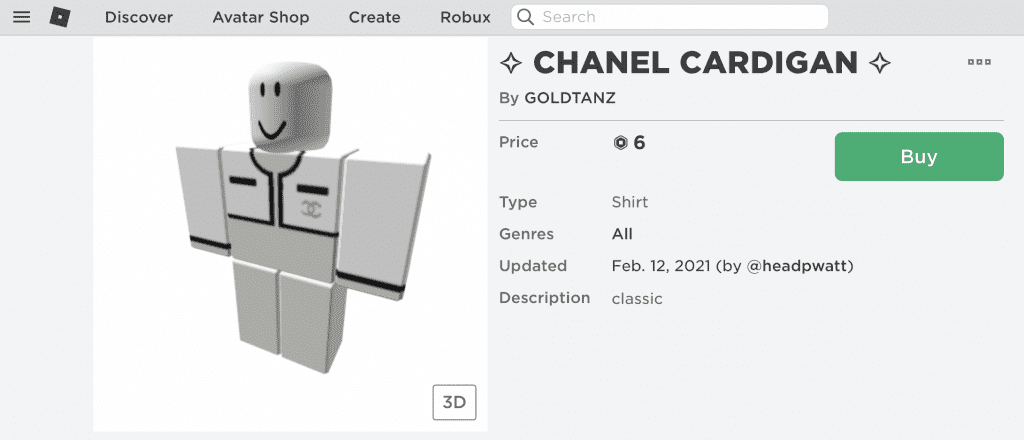

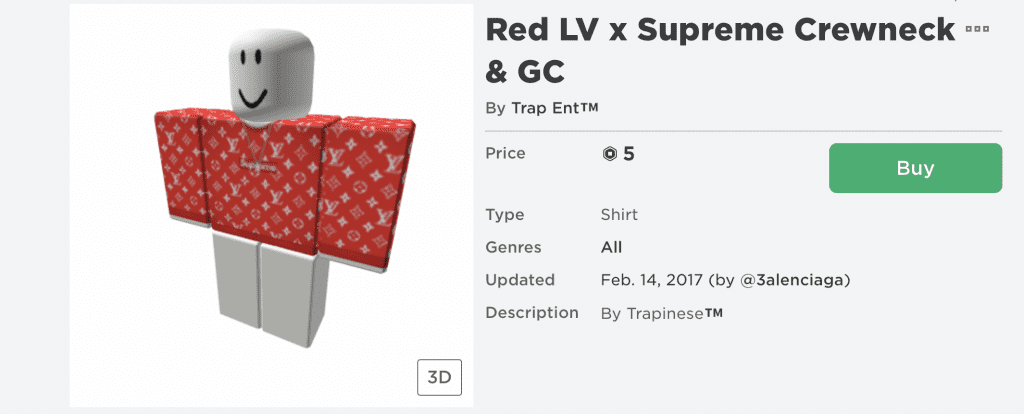

While the “Baby Birkin” NFT may qualify as fair use of the Hermès’ trademarks, there are numerous other examples that more plainly infringe. For example, in the Roblox metaverse, where virtual fashion is finding an increasingly important home, users can accessorize their avatars by purchasing unauthorized luxury products, including Cartier Love bracelets, Supreme hoodies, and Chanel blazers. These virtual products infringe brand owners’ trademarks and could dilute brand value if left unchallenged. (The prevalence of such unauthorized branded wares could also serve as a hurdle to brands’ willingness to officially partner with the online game platform.)

Brands should establish effective online monitoring and takedown programs to police against infringing digital uses – including NFTs and virtual fashion. And at the same time, NFT creators should develop clearance processes before incorporating third-party assets – including (but not limited to) trademarks, copyrights, and famous individuals’ likenesses – into an NFT, and should take care to understand the still-unsettled regulatory landscape of blockchain-based assets, including NFTs.

Virtual Try-Ons

“Virtual try-on” uses augmented-reality (“AR”) technology to allow consumers to sample products via webcam or camera-equipped devices, like smartphones. Technology in the virtual try-on arena – which enables shoppers to virtually try on anything from cosmetics to clothing, and to even use biometric scanners to find the perfect-fitting sneakers – is not new. However, it is particularly noteworthy given that the COVID-19 pandemic has accelerated its wide-scale adoption across e-commerce channels.

Now that physical shops have reopened, brands and retailers are continuing to rely on digital experiences – or “connected shopping” – to drive in-store purchasing, where consumers have been found to spend more (compared to when they shop online), and where margins tend to be higher and return rates significantly lower. And thus far, the stats in the space are promising. According to a recent study by Snapchat and Foresight Factory, 35 percent of U.S. consumers would go out of their way to visit a store if it had interactive virtual services such as a smart mirror for trying on clothes or makeup. In addition, 62 percent of U.S. consumers who have used AR said that the technology encouraged them to make a purchase.

Virtual try-on tech clearly can provide brands with benefits, but it also comes with a range of risks – the most important of which is compliance with biometric laws and regulations, which govern the collection and use of facial recognition templates and other biometrics. In the United States, a handful of states (including Illinois, Washington, Texas, California, Colorado, and Virginia) have adopted laws that regulate the collection, use, and disclosure of biometric data. Meanwhile, as of this summer, New York City enacted a new biometric ordinance regulating how businesses handle biometric identifier information. Failure to comply with these laws poses significant risk for brands.

For example, class-action lawsuits have been filed against cosmetics powerhouses Mary Kay and Ulta, alleging their virtual try-on tools violated the notice and consent requirements of Illinois’ Biometric Information Privacy Act. Both lawsuits allege that the companies failed to obtain consent prior to collecting scanned images and videos of consumers’ faces, and the respective plaintiffs are seeking damages of $1,000 per negligent violation, $5,000 per “willful or reckless violation,” or actual damages.

Biometric laws and regulations generally require businesses to provide clear notice and obtain informed consent from individuals prior to collecting their biometric data. It is worth noting that these laws and regulations define “biometric data” slightly differently; so, brands should start by evaluating; (1) where the virtual try-on technology will be deployed (e.g., doing a more limited rollout in a handful of states versus a global launch) and (2) what type of data will be processed. Given the prevalence of biometric-related litigation, it is critical for brands to understand and address their compliance obligations in this space.

E-Commerce: Emerging Channels and Challenges

The pandemic has fundamentally changed the way consumers purchase products, namely, by supercharging the e-commerce sector, which grew from 16 percent to 19 percent of global retail sales in 2020. According to a recent global survey from Shopify, a whopping 84 percent of consumers shopped online during the pandemic, and many consumers, including ones that were previously less comfortable using e-commerce, are expected to continue to rely on digital consumption going forward.

All the while, the pandemic has also increased demand for convenient, immediate, and streamlined e-commerce experiences. To meet such enduring consumer demands, brands have adopted omnichannel e-commerce strategies to sell across numerous digital channels. Social commerce, in particular, has become an important tool in brands’ omnichannel strategy, with social commerce streamlining purchases by selling directly through social media platforms, and thereby, emerging as a key sales channel during the pandemic due to its integrated and frictionless shopping experience – especially among Gen Z and millennial consumers.

Notwithstanding its benefits, social commerce also poses challenges for brands. For example, brands may not have the ability to establish a direct relationship with the consumer and to leverage all of the data collected in connection with a transaction. There are also important legal considerations around who acts as the merchant of record and who is responsible for making required consumer disclosures, maintaining data security, and processing returns. Brands also need to understand and comply with each social platform’s terms, restrictions, and other requirements relevant to social commerce. As such, brands are encouraged to work with counsel to understand their obligations before pursuing social commerce.

Further, while the proliferation of e-commerce has benefited brands, it has also created a perfect storm for counterfeiters. In 2017, counterfeiting was a trillion-dollar problem for brands, with nearly one-third of the lost dollar value relating to online sales. In that year, alone, brands lost $323 billion globally to online counterfeits.

Online marketplaces provide counterfeiters with a certain degree of anonymity and truly sweeping access to consumers, which allows them to sell products to the masses without a supply chain verifying authenticity. COVID’s erosion of brick-and-mortar retail has also enabled bad actors to target less sophisticated and/or experienced online shoppers, as well as those looking for luxury knockoffs through social media influencers. For example, counterfeiters have capitalized on the need for face masks by flooding social media with infringing goods. A quick scroll through Instagram’s #designerfacemask feed reveals countless counterfeits of designer brands like Chanel, Louis Vuitton, Burberry, Fendi, and Gucci. These designer replicas are also widely available on popular online marketplaces such as Etsy, eBay, etc.

Brands can combat online piracy by adopting a multipronged protection, monitoring, and enforcement strategy.

Optimizing Retail with Big Data

Finally, brands and retailers are increasingly using artificial intelligence and machine learning to evaluate thousands of consumer data points to optimize every aspect of their supply chains. Through cloud computing, brands can analyze past purchase behavior, demographics, locale, and shopping patterns to forecast consumer wants and needs, and more effectively market to them. Proper use of big data has numerous benefits for fashion brands, including:

Lean and Sustainable Inventory Management: Understanding consumer behavior can help brands to maintain lower inventories while still meeting consumer demands. By producing less product and reducing unnecessary waste, brands can also satisfy the increasing demand for environmentally friendly products – especially among younger generations;

Projecting Trends: Brands can now leverage data tools that analyze internet searches, social posts, e-commerce sales, and consumer feedback to forecast the rise and fall of fashion trends. Brands can also use this data with other data, such as information about weather or travel, to formulate a robust view of current and expected consumer demand. This optimizes seasonal planning by informing, for example, which products to launch or retire, how much of certain products to produce, and where to send inventory or open new stores; and

Product Recommendations: By analyzing consumer browsing and purchase histories, brands can make more precise and tailored recommendations, which will result in higher sales conversions.

Big data can improve nearly every element of the seller/consumer experience – but, in order to leverage it appropriately, brands should consider the privacy law and reputational risks of collecting and processing consumer data. For instance, new privacy regulations in California, Colorado, and Virginia impose robust obligations on businesses that collect and process personal data about consumers in those states. Similar obligations exist outside the United States thanks to laws like the EU’s General Data Protection Regulation, Brazil’s General Data Protection Law, and other omnibus privacy laws that continue to crop up around the world.

Aside from its importance relating to legal compliance, transparency about data collection and use can also engender consumer trust. In a recent survey, data consultancy Transcend found that 98 percent of respondents said that data privacy is important to their lives. In a study of its own, email encryption software company Echoworx data discovered that over three-quarters of Gen Zwill consider abandoning a brand after a data breach.

Against this background, brands should develop transparent data-privacy practices to comply with relevant laws and to preserve consumer goodwill, while also engage in appropriate diligence when it comes to external data sources to ensure compliance with contractual and regulatory requirements.

Miriam Farhi is the Co-Chair of Perkins Coie’s Privacy & Security practice and Vice Chair of the firm’s Technology Transactions & Privacy practice. Andrew Grant is a partner in Perkins Coie’s Technology Transactions and Privacy Practice, and the Chair of Perkins Coie’s Outdoor Industry Practice. Colleen Ganin is an associate in Perkins Coie’s Trademark, Copyright, Internet & Advertising practice.