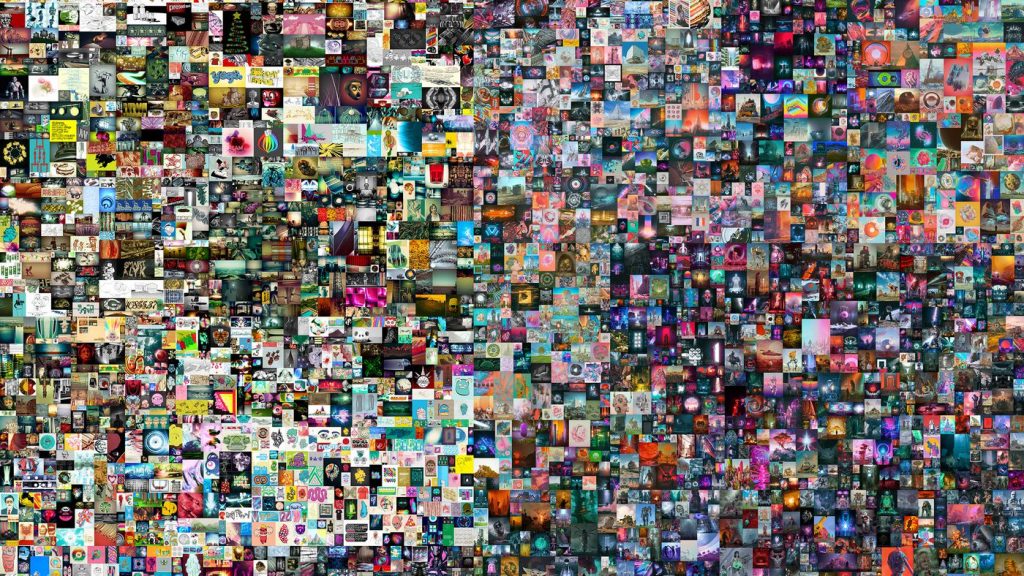

One year ago, an artwork was sold for $69 million by the prestigious auction house Christie’s. This was no lost Matisse or rarely seen Van Gogh. Instead, it was a composite collection of digital art by the then relatively unknown artist Beeple. What makes the piece – Everydays: The First 5000 Days – truly remarkable, is that it was sold as a non-fungible token (“NFT”). In the year since that sale, NFTs have gone from a relatively obscure tech-world phenomenon to the mainstream. NFTs are digital tokens that exist on a secure record-keeping system called a blockchain. These tokens are akin to certificates of ownership a gallery might give to an art collector – albeit for digital items.

For the collectors, NFTs are arguably a digital extension of benign hobbyist pursuits. In recent generations, collectors may have sought rare Magic The Gathering cards or obscure stamps. Today, those with an impulse to own rare items are attracted to a world where rarity can be transparently recorded and easily verified. For the creators, NFTs provide a clear path toward monetization. Artists have historically struggled to continue to make money from their works, but NFTs may be sold in accordance with terms that provide creators (and potentially, brands) with royalties.

The Right-Click Approach

Despite their growing popularity, NFTs still baffle most people because we are not really used to the concept of owning digital art. After all, anyone can just right-click and save an image to their computer. This, of course, misses the point. As with all currencies, NFTs have value because of the meaning a community ascribes to them. In the online culture that NFTs belong to, “on-chain” blockchain items are meaningful – and some have more value than others.

The characteristic missed by the right-click perspective is that when you own an item on the blockchain, this is verifiable and everyone in your community can see the recorded transaction. This can translate into prestige, for example, when outrageously wealthy entrepreneurs bid on rare NFT items, like Beeple’s work or a rare cryptopunk – and when Bored Ape Yacht Club owners turn their social media icons into an image of their ape. Still yet, owning an NFT can simply be a sign to other community members that you belong.

NFTs Garner Mainstream Attention

Popular attention is not always positive. As NFTs grow, so has the proliferation of cash grabs and scams, especially from social media influencers. YouTubers, such as Logan and Jake Paul, for instance, are notorious for their litany of low-quality NFT “rug pulls.” when a crypto project is abandoned by their creators once the money flows in. Melania Trump, to pick another example, has released several NFT projects of her own. However, blockchain analysts were able to uncover how one of these projects was bought by none other than the creator of the NFTs. This practice, known as wash trading, sees NFT creators buying their own works either to save face due to a lack of interest or to generate hype around an influencer or artist and boost the price of the next sale.

As NFTs have gone mainstream, another capacity for these tokens has emerged: their potential for fundraising. In what started as a meme, ConstitutionDAO was created by a group of cryptocurrency enthusiasts to buy one of the 13 surviving copies of the U.S. constitution that was up for auction at Sotheby’s. This group – a decentralized autonomous organization – sold governance tokens (called $PEOPLE tokens) in exchange for Ether that was then used to bid on the constitution. Within a week, ConstitutionDAO raised $47 million. And while that was not enough to win the auction, it revealed just how financially powerful this corner of the web has become. (Also worth noting: in August 2021, Wyoming became the first U.S. state to grant legal company status to DAOs that operate on a blockchain, provided they are organized as a Wyoming limited liability company.)

NFTs: Failure, or the Future?

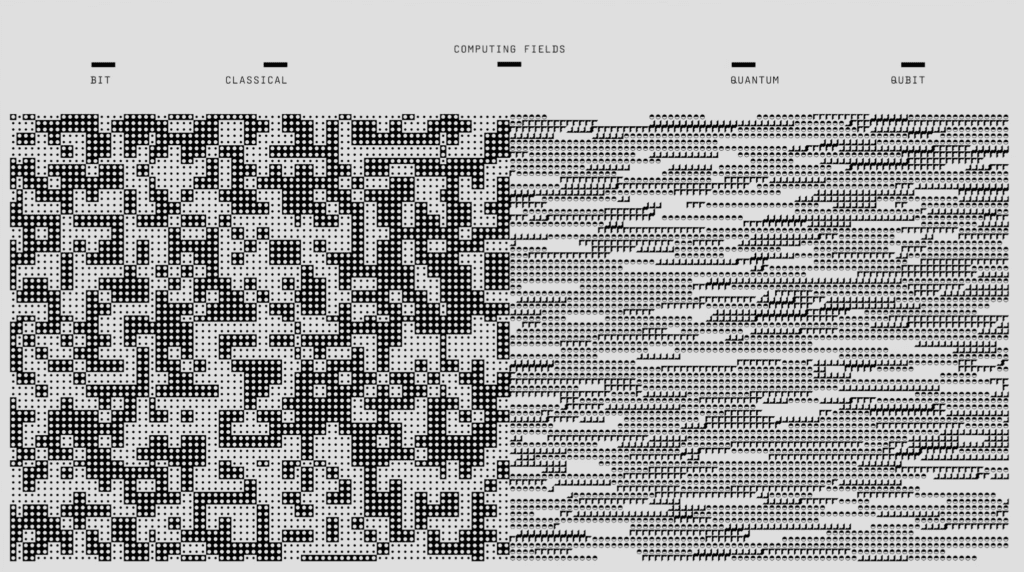

Among the harshest critiques of NFTs come from the socially conscious art world that sees the infrastructure of NFTs as the problem. NFTs mostly exist on the Ethereum blockchain, which relies on vast computational resources to function, and can generate a huge carbon footprint. Ethereum is transitioning away from its current mechanism to another, which will hopefully alleviate this concern. Perhaps the more subtle defense of NFTs resides in how they push the medium of digital art in interesting directions. Damien Hirst’s The Currency playfully challenges the collector to choose whether to keep the NFT (the digital token) or exchange it later for a physical artwork. This forces the collector to make a bet on the future: physical or digital, which retains the most value?

This places NFTs in a curious spot. They appear at once a benign hobbyist pursuit, a means to value and make money from scarce digital art, a cash grab for unscrupulous influencers and celebrities, a new mechanism for online fundraising and an explored avenue for legitimate art. However, you view them, NFTs have crossed fully into the mainstream and as such, are worthy of attention.

Paul Dylan-Ennis is a Lecturer/Assistant Professor in Management Information Systems at the University College Dublin. (This article was initially published by The Conversation.)