Luxury goods from giants located in the European Union will no longer escape mounting sanctions that are being levied on Russia. In a statement on Friday, the European Commission revealed that as part of a fourth tranche of measures aimed at Russia, the export of luxury goods will be prohibited. “Tomorrow, we will take a fourth package of measures to further isolate Russia and drain the resources it uses to finance this barbaric war,” European Commission President Ursula von der Leyen said on Friday, adding that “those who sustain Putin’s war machine should no longer be able to enjoy their lavish lifestyle while bombs fall on innocent people in Ukraine.”

Not limited to luxury, the latest round of sanctions will impact Moscow’s “privileged trade and economic treatment,” according to Reuters, EU imports of steel and iron from Russia, and the use of cryptocurrencies by those in Russia should they attempt to work around other financial sanctions. In terms of the latter, the European Commission stated earlier this week that existing sanctions do, in fact, cover crypto assets, confirming that “the common understanding that loans and credit can be provided by any means, including crypto assets, as well as further clarified the notion of ‘transferable securities,’ so as to clearly include crypto-assets, and thus, ensure the proper implementation of the restrictions in place.”

As TFL reported last week, the implementation of SWIFT-centric sanctions – which cut certain Russian institutions off the Society for Worldwide Interbank Financial Telecommunication international payments system that enables banks and other financial institutions to communicate and transfer money among one another – is likely to prompt more significant reliance on crypto (and other versions of the SWIFT system), which already makes up a “greater part of Russia’s financial system than most other nations due to a distrust in its banking system.” Targeting Russia’s access to cryptocurrencies, such as Bitcoin and Ether, will “take sanctions policy into uncharted territory,” the WSJ reported last week, noting, however, that blocking such transactions will “be challenging, since by nature private, digital currencies are designed to exist without borders and for the most part outside the government-regulated financial system.”

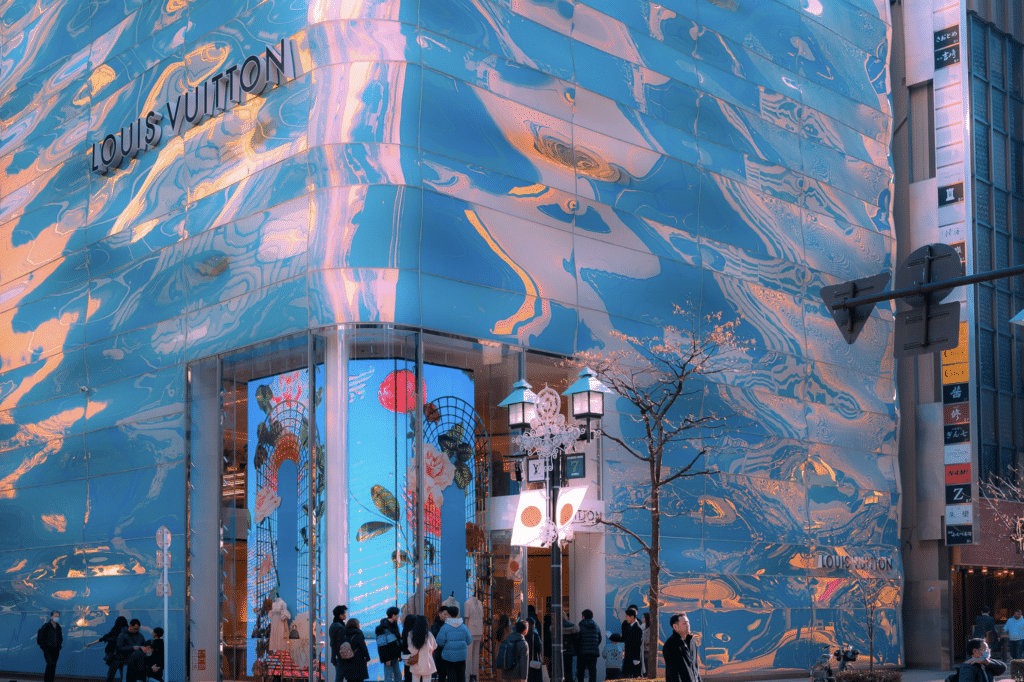

As for the impact of the luxury goods sanctions for brands in the European Union, which consists of the biggest names in the luxury space, the fallout will be somewhat minimal, given the relatively small exposure among luxury’s big groups in Russia. French luxury goods titan LVMH, for instance, generates less than 2 percent of annual revenue from Russia, while Cartier-owner Richemont derives roughly 3 percent of its annual sales from the country. (It is worth noting that no shortage of deep-pocketed Russian consumers already do their luxury shopping outside of the country in markets like London and Dubai, along with Milan and Paris, according to Jefferies.)

Meanwhile, the U.S. government confirmed sanctions of its own, with the U.S. Commerce Department’s Bureau of Industry and Security imposing restrictions on “the export, reexport, and transfer (in country) of luxury goods to all end users in the Russian Federation (Russia) and Belarus and to certain Russian and Belarusian oligarchs and malign actors located worldwide.” The agency states that the sanctions are “in response to Russia’s brutal, continuing invasion of Ukraine (as substantially enabled by Belarus) in flagrant violation of international law.”

Luxury Goods from Different Channels

The impending luxury goods sanctions paired with reported plans for the Russian government to potentially walk back on legal rules regarding parallel imports will likely make it so that coveted luxury goods will, in fact, continue to flow into Moscow – albeit not through brands’ owned/operated stores but via unauthorized channels. Local media outlets in Russia reported this week the Ministry of Economic Development may opt to do away with civil liability for trademark infringement in connection with goods that are in short supply due to sanctions or as a result of companies closing up shop for the time being, while also walking back on limitations on grey market goods.

Aside from a potential spike in the availability of illicit goods and services – from fake designer handbags to branded sneakers (and maybe even the unauthorized operations of makeshift “Starbucks” outposts), the language of the recently-released “Priority Action Plan for Ensuring the Development of the Russian Economy in the Conditions of External Sanctions Pressure” suggests that another outcome could be an influx of grey market goods. In the Priority Action Plan, which surfaced this week, the Russian Ministry of Economic Development seems to propose suspending liability for parties engaging in parallel imports for certain (not yet defined) “groups of goods,” thereby, potentially opening the door for a greater share of out-of-channel products to flow into Russia, which maintains some restrictions on the sale of grey market goods.

Depending on how long the sanctions last, the luxury goods ecosystem in Russia may begin to mirror that of China, which routinely sees a significant supply of grey market goods originating from the brands, themselves, but coming by way of multi-brand stores in places like Italy and landing on the mainland after passing through agents in Hong Kong. Given the rise of luxury-focused sanctions, brands may opt to look the other way, enabling multi-brand stores in other markets to order excess goods and ship them to Moscow with the help of parallel importers. (These products would likely be routed through another country, such as Turkey or Uzbekistan, and then to Russia.)

And while this approach would enable brands to boost their revenues thanks to larger orders to multi-brand stores, putting it in the realm of the traditional grey market model, it also would potentially provide them with the opportunity to uphold a formal position of distancing themselves from Russia and claim ignorance in the event of consumer pushback. Even still, the likelihood that luxury brands will begin feeding the grey market in Russia seems relatively small – at least as of now – in light of the small size of the Russian market for luxury goods, and the very real risk of serious reputational damage for brands should such a set up make headlines.