Jack Ma has allegedly fallen out with the Beijing government. Several recent articles have reported that Mr. Ma – the 56-year old Chinese tech billionaire behind e-commerce giant Alibaba and financial services powerhouse Ant Group – offended the Chinese authorities by delivering a speech in Shanghai in October criticizing financial regulation, and that he and his colleagues were called in for questioning not long thereafter.

The planned IPO of Mr. Ma’s Ant Group for over $30 billion, which was expected to be one of world’s largest initial public stock offerings to date, was suddenly suspended. At the same time, antitrust investigations were instigated against his other major company, online retailer Alibaba, which previously nabbed the title of the largest IPO ever in September 2014, when it raised $25 billion, while Chinese tech giant Tencent was similarly targeted in an antitrust probe.

The regulatory action did not stop there, though, and towards the end of last year, Ma received a “rectification order” from the People’s Bank of China, the country’s central bank, outlining five ways in which Ant Group must comply with the regulator. And to cap it all, the entrepreneur has reportedly not been seen in public since October.

Whatever the reality behind Ma’s government relations, many of these actions are part of steps to increase Chinese tech regulation that have been years in the making. Indeed, Ma almost asked for it himself when he mentioned in his October speech that China’s financial sector lacks regulation. All the while, the reforms may also provide a glimpse of what might happen elsewhere as governments across the globe boost their attention on the anticompetition front – which means that Silicon Valley should take note.

China’s antitrust regime in three acts

The recent Chinese pushback against big tech coincides with three major movements in Chinese tech regulation over the past decade. The first Anti-Monopoly Law came into effect in August 2008. It aimed to outlaw monopolistic practices, but authorities were hesitant to enforce the rules against tech companies in the heyday of China’s internet boom. Except for a few high-profile cases, such as a private action concerning anti-virus software that was brought under the act against Tencent by rival Qihoo 360, China’s focus was on building digital capabilities and increasing consumption.

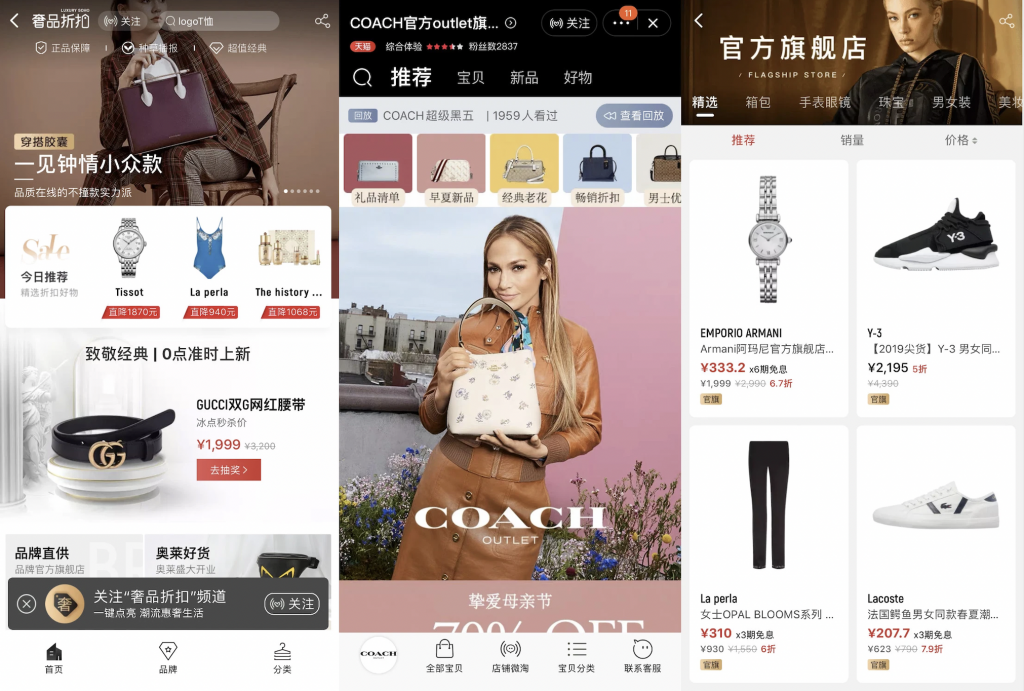

Major new laws began to appear years later. The E-Commerce Law came into effect in January 2019, for example, thereby, requiring e-commerce operators to register as market entities, and more importantly, they became jointly liable with merchants for selling counterfeit merchandise. Operators could be fined up to $300,000 for serious intellectual property infringement.

But it was really in 2020 when China’s antitrust regime for big tech came into focus. July saw the first concrete action as China’s State Council’s Anti-Monopoly Commission investigated Ant Group payments arm Alipay and Tencent’s WeChat Pay. The Alipay investigation did not seem to cool investor interest in the Ant Group IPO. But well ahead of the November suspension and Ma’s Shanghai speech, it was a clear warning to the market.

Major data-protection legislation also came into play during 2020: the Draft Data Security Law was issued for public comments in July, followed by the Draft Personal Data Protection Law in October. Together with the Cybersecurity Law of 2016, it means that three fundamental pieces of legislation are now in place in this arena.

On the back of this, the Civil Code of the People’s Republic of China, which became effective on January 1, expressly provides the right of privacy and personal information protection to citizens. This regime is clearly with an eye to the EU data protection rules, and coincides with a new investment treaty between China and the European Union that gives them more access to one another’s markets.

November then saw a consultation draft of the Anti-Monopoly Guidelines on the Sector of Platform Economies. It was published one day before Single’s Day, China’s huge retail extravaganza to celebrate people not in relationships. The annual November 11 shopping day has become Alibaba’s hallmark annual sales event, with the retail behemoth raking in a record $115 billion or so over the 24-hour period, shattering previous records.

These anti-monopoly guidelines attempt to address shortcomings in applying the existing rules to companies like Ant Group. They restrict behavior such as price discrimination favoring certain types of consumers, preferential treatment for merchants who sign exclusive agreements with platforms, and compulsory collection of user data. In sum, Chinese big tech – retail entities, included – will likely have to fundamentally rethink the way it does business in future. The window of opportunity to scale at will without boundaries has closed shut.

Pay attention, Google and Facebook

What will the immediate effects be? Newcomers like Bytedance and Pinduoduo – the latter of which has integrated social components into the traditional online shopping model to create a popular “team purchase” experience – were already eating market share from Alibaba and Tencent, and the antitrust reforms could well accelerate that trend.

Flagship changes like loosening merchant exclusivity might have had more impact several years ago, before competition intensified, but the direction of travel is clear. In a sign of its new tougher stance, the authorities also issued fines of 500,000 yuan ($77,214) in December against Alibaba, Tencent subsidiary China Literature and Shenzhen Hive Box Technology for not declaring past acquisitions.

Meanwhile, the central bank’s December 2020 order to Ant Group will broadly require the company to go back to its roots as online payments business Alipay, which was originally spun out of Alibaba. Having branched into areas like insurance, credit and wealth management, these businesses now have to be restructured into a separate holding company. Ant Group must also introduce new data privacy rules and improve compliance around the securities that it manages for investors.

Some players not (yet) facing the same scrutiny appear to be paying close attention. JD Finance, another fintech spin-off, this time from Alibaba e-commerce rival JD.com, has appointed its former chief compliance officer as the new CEO. And while incumbents look over their shoulders, TikTok owner Bytedance just moved into financial services by launching a one-stop consumer finance app in October.

If we compare all this with the recent U.S. congressional hearings for Facebook’s Mark Zuckerberg and Twitter’s Jack Dorsey, it is tempting to conclude that while China acts, America puts on a show. Of course, U.S. antitrust cases are underway against Facebook and Google. But now that China has taken a major step towards a comprehensive regime for regulating competition among digital platforms, the big question is to what extent this chilling wind will blow to the west.

Mark Greeven is a Professor of Innovation and Strategy at the International Institute for Management Development.