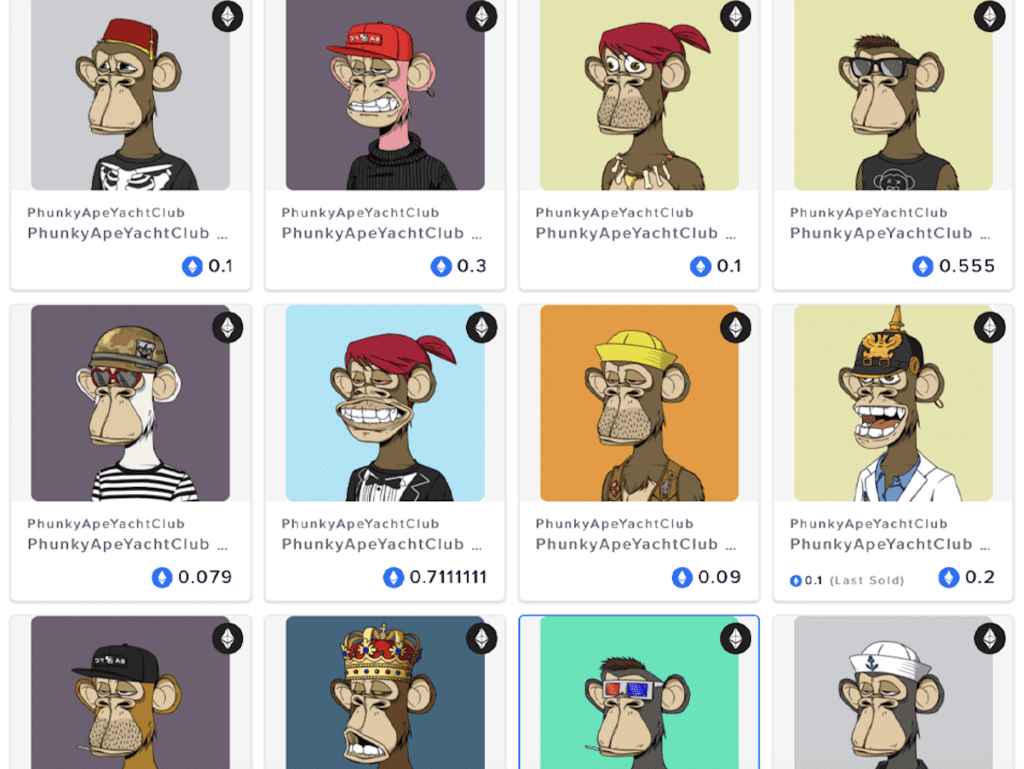

A case over a stolen Bored Ape Yacht Club (“BAYC”) NFT must be resolved in arbitration, according to a federal court in Texas. In an order on Wednesday, Judge Alfred Bennett of the U.S. District Court for the Southern District of Texas granted Ozone Networks d/b/a/ OpenSea’s motion to compel arbitration in the lawsuit filed against it last year by a former BAYC NFT owner, who accused the NFT marketplace of failing to address “security vulnerabilities in its platform” that led to a widely-reported breach that cost its users millions of dollars in stolen NFTs. OpenSea argued in a motion back in May 2022 that Plaintiff Timothy McKimmy “repeatedly and unambiguously agreed to its Terms of Service,” which includes a binding arbitration clause, making arbitration “the proper forum for this dispute.”

In its push for arbitration, OpenSea argued that McKimmy agreed to its Terms “through at least three different acceptance flows: when purchasing his first NFT using OpenSea’s services, when connecting his crypto wallets to OpenSea, and when using OpenSea’s mobile application.” Specifically, OpenSea alleged that “prior to buying or selling NFTs using [its] services, users must first connect their third-party crypto wallets, such as MetaMask or Coinbase Wallet, to OpenSea.” In order to do so, OpenSea says that “users must agree to [its] Terms of Service … [which] notify users upfront, in bold capital letters, that the Terms ‘REQUIRE ANY DISPUTES BETWEEN US TO BE RESOLVED THROUGH INDIVIDUAL ARBITRATION RATHER THAN BY A JUDGE OR JURY IN COURT.”

As a “consistent and frequent OpenSea user since at least December 2021,” OpenSea claimed that McKimmy agreed to its “terms and the arbitration agreements therein when he repeatedly purchased NFTs, connected his crypto wallets to OpenSea, and signed in to OpenSea’s mobile app.” Against that background, OpenSea argued that McKimmy’s negligence and breach of fiduciary duty, trust, and contract claims fall within the scope of its arbitration agreement, which it says is not “so grossly unreasonable or unconscionable in the light of the mores and business practices of the time and place as to be unenforceable.”

Setting the stage in his March 22 order, Judge Bennett stated that the parties disagree over whether McKimmy assented to the arbitration agreement, with McKimmy claiming that he did not assent because he “did not see a clickable link to [OpenSea’s] Terms … [and] did not review the Terms” when he signed up for or accessed OpenSea’s NFT marketplace site.

The critical inquiry here, according to the court, was whether “the user had reasonable notice of the existence of the terms – i.e., whether the notice was ‘reasonably conspicuous.’” The judge stated that in the “digital context,” courts have held that users of mobile apps entered into valid arbitration agreements when they had such notice. He also noted that there is reasonable notice when a user is “required to click a ‘Continue’ button and a statement is displayed directly above that informs users that by clicking ‘Continue,’ they are agreeing to the website’s terms.” At the same time, “notice is particularly sufficient,” the judge said, “when the terms of service are hyperlinked and typed in bold colored font.”

Against that background, the court found that McKimmy was reasonably notified about the Terms and the arbitration agreement, as OpenSea makes use of a “Continue” button with corresponding language in a bold font in a contrasting color with a hyperlink. Even if McKimmy did not see the link and review the terms, the court held that he was still reasonably notified of OpenSea’s Terms when he purchased NFTs on the site, as OpenSea alters users of its Terms and requires users to agree to them before they can complete a purchase transaction. And with this in mind, the court held that a valid arbitration agreement exists between the parties.

As for the arbitrability of the case, the court asserted that OpenSea took the position that its Terms “clearly include delegation clauses by giving the arbitrator exclusive authority to determine the scope and enforceability of the arbitration agreement, and adopting the JAMS Rules.” Pushing back, McKimmy claimed that “even if the arbitration agreement is valid, the limited exception within it that allows users to seek equitable relief in court for infringement or misuse of intellectual property rights applies to this case.”

Siding with OpenSea, Judge Bennett stated that as a preliminary matter, “the exception in the arbitration agreement that allows users to seek equitable relief in court does not apply.” While McKimmy is seeking injunctive relief to get OpenSea to “pause and/or stop any listing or sale of the Bored Ape [NFT] in question,” he “did not assert [in his complaint] that he has any intellectual property rights arising from his purchase of the Bored Ape NFT, nor does he claim that his rights have been infringed or misused to trigger the exception in the June Terms.” Instead, the court found that McKimmy argued for the first time in his response [to OpenSea’s motion to compel] that his intellectual property rights were infringed. As a result, his argument is “not properly before the Court.”

(In his response in May 2022, McKimmy argued – citing the BAYC terms – that the purchase and possession of a Bored Ape NFT “provides the owner ‘an unlimited, worldwide license to use, copy, and display the purchased Art for the purpose of creating derivative works based upon the Art.’” By failing to “reverse” the fraudulent sale of his NFT and refusing to freeze the OpenSea account that currently has the stolen NFT, McKimmy claims that OpenSea has “effectively” taken the “intellectual property rights [that come with a BAYC NFT] away from him.”)

Moreover, the court stated that OpenSea’s Terms “express adoption” of the JAMS Rules “presents clear and unmistakable evidence that the parties agreed to arbitration arbitrability,” and as a result, held that all of McKimmy’s claims must be submitted to arbitration. The judge similarly refused to grant McKimmy’s request for pre-arbitration discovery, stating that “it is unclear how the discovery [he] seeks is relevant to his claims,” and thus, these issues are better suited for the arbitrator to decide.

Now that the arbitration issue has been decided, McKimmy’s case “may turn on how much you can get away with disclaiming under New York contract law,” which is the state that OpenSea lists in the choice of law provision in its terms of service, according to lawyer and intellectual property researcher Mike Dunford.

McKimmy filed suit against OpenSea in February 2022, claiming that his Bored Ape NFT (#3475) – which is “unquestionably valuable” but “arguably” worth something in “the millions of dollars” – was stolen from him due to a phishing attacked targeting OpenSea users, and then sold by an unknown third party. McKimmy says that he paid 55 ETH ($232,000 at the time) for the NFT in December 2021, and it was swiftly sold after being stolen in February 2022 for 98.9 ETH (then $300,000). McKimmy is seeking injunctive relief, as well as damages of over $1 million.

The case is Timothy McKimmy v. OpenSea, 4:22-cv-00545 (S.D. Tex.).