In November, a $1.15 billion deal came to light, bringing together Cartier’s parent company Richemont, fashion retail platform Farfetch, and Chinese e-commerce titan Alibaba. The headline-making transaction followed from reports that a China-centric “mega deal” had been in the making. Among other things, that alliance saw Farfetch reveal that it would launch luxury shopping channels on Alibaba’s platforms, namely, its Tmall Luxury Pavilion and its Luxury Soho platform, the latter of which is Alibaba’s “luxury outlet destination” within the Tmall marketplace, and also operate on Alibaba’s cross-border marketplace Tmall Global.

Formally uniting three major names in the fashion sphere in furtherance of an effort that largely focuses on “providing luxury brands with enhanced access to the China market,” the deal bolstered Alibaba’s already-established dominance in the luxury space. The Jack Ma-founded conglomerate had begun making serious inroads in the luxury market in the summer of 2017 thanks to the launch of its Luxury Pavilion, an invite-only online outpost for premium and luxury brands and their consumers in East Asia. To date, the platform has managed to woo more than 200 high-end names since its founding, including the “recently added” Piaget, Prada and Gucci brands, and as Alibaba revealed on Thursday, sales on the Luxury Pavilion, alone, grew 159 percent for the first quarter of 2021.

Against the background of its swiftly growing pavilion, the news that Alibaba had won over Farfetch and Richemont, appeared as though it might be the death-knell for the Richard Liu-run JD.com, which has been locked in a bitter battle with its larger Hangzhou, China-headquartered rival for years for China’s luxury-happy consumers. Add to that, rumblings around the very same time that Farfetch would terminate the preexisting partnership it launched with JD.com in March 2019 as a result of the Alibaba alliance. Early this year, Chinese media outlet Dianshang Zaixian reported that Farfetch had, in fact, shut down of its store on JD.com in December 2020.

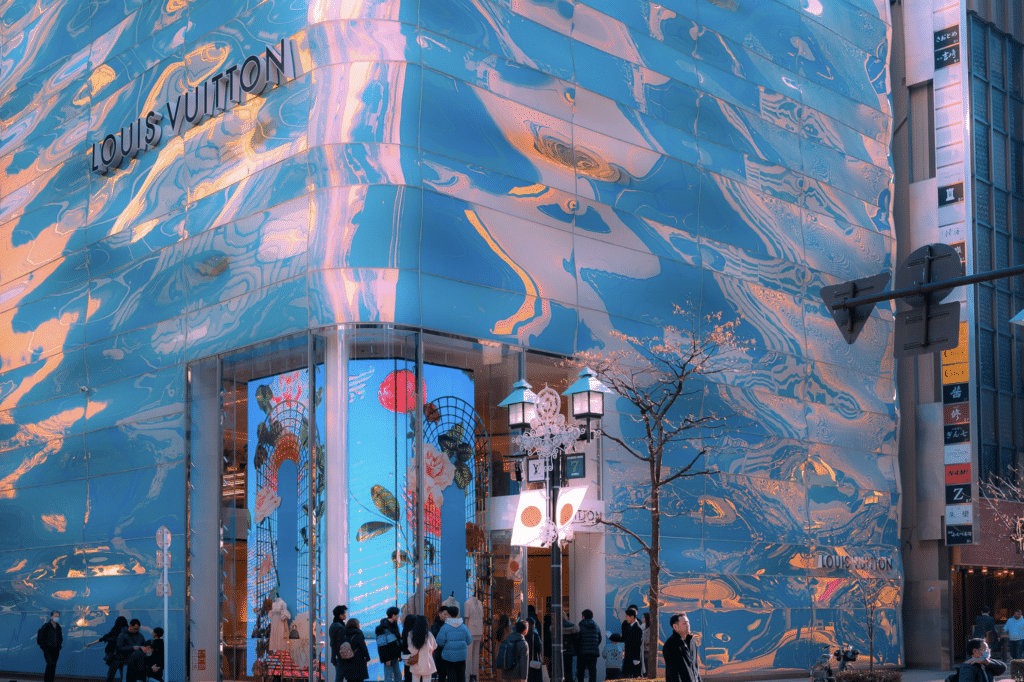

The stronghold that Alibaba maintains on the market may have just gotten a bit less intense this week, as Louis Vuitton revealed that it is partnering with JD.com in an effort to expand its reach in the Chinese market. While Louis Vuitton’s parent LVMH Moet Hennessy Louis Vuitton readily stocks 17 of its brands on Alibaba, “including Rimowa, Marc Jacobs, Dom Perignon, Kenzo, Hennessy, Dior Beauty, Guerlain, Givenchy, Tag Heuer and Zenith,” a rep for Chinese behemoth stated in a connection with its FY20 revenue release on Thursday, the group decided to partner with JD.com for the marketplace launch of its marquee label beyond its WeChat program and its specific Louis Vuitton .cn e-commerce site.

Specifically, “JD.com will begin to share its 471.9 million annual active customer accounts with Louis Vuitton from Thursday midnight Beijing time, by redirecting ‘LV’ search results on the JD.com app to Louis Vuitton’s official WeChat mini-program,” according to WWD. Kevin Jiang, the president of international business at JD Fashion and Lifestyle, stated on Wednesday that this “unprecedented model, provides a seamless shopping experience, enabling more high-quality consumers to enjoy all that Louis Vuitton has to offer.”

WWD revealed that the partnership is “a creative way for Vuitton” – which sells exclusively through its own stores and e-commerce sites – “to increase its online reach in China, and deliver further growth for the brand,” all without being to a lack of control that comes with listing on a third-party platform, something that most luxury brands have traditionally shunned.

As for JD.com, its deal with Louis Vuitton – which holds the title of the largest luxury goods brand in the world by revenue (followed by Chanel) – will inevitably help it to regain some competitiveness, particularly as Alibaba faces scrutiny from Chinese regulators in connection with its allegedly anticompetitive practices, which have resulted in a record-breaking RMB18.228 billion ($2.8 billion) penalty from China’s State Administration for Market Regulation.

In its Q4 and FY2020 revenue report, the 23-year-old JD.com highlighted its efforts in the fashion and luxury space, stating that “multiple renowned brands launched flagship stores on JD.com, including Hermès Group’s luxury shoe brand John Lobb, Italian luxury brand Stefano Ricci, British designer brand Vivienne Westwood, LVMH Group’s fashion brand JW Anderson, and designer accessories brand Anya Hindmarch,” among others. Beyond that, the company notes that “Prada and Miu Miu became the first batch of luxury brands to partner with JD.com to implement pioneering omni-channel initiatives,” thereby, giving customers on JD platforms “access to a wider range of Prada and Miu Miu products, including exclusive items from their physical stores.”

The news come more than five years after LVMH first chose JD.com to act as the local platform for its Sephora retailer, a move that Reuters characterized as a blow to Alibaba given that “China’s e-commerce platforms often compete for [Western] brands to launch exclusively with them.” In 2015, the French group revealed that it had chosen JD.com “partly due to its focus on fighting counterfeit goods,” Reuters reported at the time, noting that an abundance of fakes was “an issue that has plagued China’s online retail market including sector leader Alibaba Group Holding Ltd. Alibaba and JD.com.”

“We are very concerned about having control of the product. For China’s e-platforms, this has been the biggest question mark,” Helen Zhou, Sephora’s former vice president for Greater China, asserted back in 2015.

While the tie-ups between the likes of LVMH and these Chinese marketplace behemoths and Kering’s adoption of these same platforms (Gucci revealed in December 2020 that it would launch not one but two flagship stores on Alibaba’s online luxury shopping platform, including one that offers up its ready-to-wear), clearly highlights the importance of the Chinese market for luxury brands, they are also striking in that they are indicative of a growing willingness of players in the luxury sphere to adopt these formerly shunned platforms. The news that Gucci would partner with Alibaba, for instance, came just a few years after the back-to-back lawsuits that Kering filed against Alibaba, accusing the internet goliath of knowingly and actively enabling counterfeiters to sell their products on its sweeping platforms, and thereby, directly profiting from the sale of counterfeit goods.

Working overtime to build trust among brands – including by way of intellectual property-centric initiatives, a move to clearly separate luxury goods sales from those of its larger consumer goods platforms, and extensive PR pushes – has increasingly enabled the likes of Alibaba and JD.com to win over demanding luxury brands. With such a foundation in place, the head-to-head battle of which platform can land the title of the largest luxury goods retail in China, which consumers spent nearly $54 billion on luxury goods in 2020, remains underway. While Louis Vuitton is just one brand, the significance of its new partnership with JD.com should not be underestimated given its reputation for shunning nearly all third-party partnerships, and very-closely controlling everything from the marketing to the end-of-life process for its coveted products.

With this in mind, having Louis Vuitton as part of its roster – even in a new and unconventional capacity – could very well prompt other brands to also side with JD, especially if the company is amenable to other such alternative arrangements going forward, as luxury brands are still relatively new to e-commerce and certainly, partnerships with marketplace-centric sites. Of course, winning Louis Vuitton’s trust (to an extent) does not mean that the likes of Hermès and Chanel will be offering up their handbags or apparel by way of JD.com or Alibaba anytime soon. However, if TFL’s sources are any indication, JD.com has other plans in the works to fill that void, as it charges ahead in the larger fight for nearly half of all global personal luxury goods sales, which is what Chinese consumers are on track to account for by 2025.