In a first quarter trading update, Burberry reported £589 million ($773.8 million) in revenue, an 18 percent rise in comparable store sales, and a 46 percent jump in sales in China. Burberry CEO Jonathan Akeroyd said that the company “made good progress” in the three-month period ending on July 1, delivering high teens comparable revenue growth led by the ongoing recovery in Mainland China” (as distinct from negative growth for the U.S. market during Q1) and “well-performing” core categories, namely, outerwear and leather goods. Additionally, he noted that Burberry is “excited about [creative director] Daniel [Lee]’s product arriving in stores in September.”

The Q1 report comes amid an enduring overhaul at Burberry under the watch of Akeroyd, whose tenure began in March 2022, and Daniel Lee, who made his debut in the top creative job for the British brand in February of this year following a 3-year stint at Bottega Veneta. According to the investor overview that Burberry also released on Friday, the brand is coming out of a 5-year-long effort (from 2017 to 2022), that involved: (1) elevating the brand; (2) redefining the brand’s image; (3) establishing its leather goods product; (4) reworking its commercial distribution by “reorientat[ing] to full price, clean[ing] up wholesale, and upgrad[ing] store network;” and (5) addressing operation efficiency.

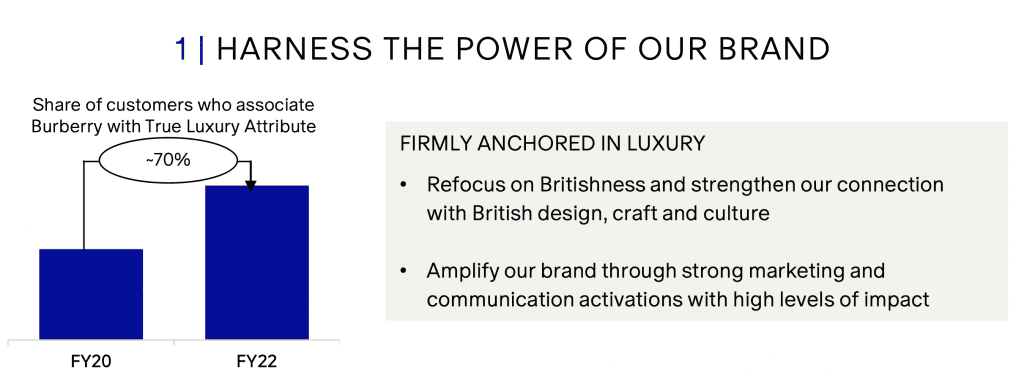

The London-headquartered company revealed that its efforts have directly contributed to a new view of the brand by consumers, with the share of customers who associate Burberry with the attribute of “True Luxury” growing by 70 percent from FY 2020 to FY 2022.

In 2023, Burberry is now moving into a new phase that will see it: (1) “improve clarity, broaden appeal through a modern luxury aesthetic, [and] refocus on Britishness;” (2) “drive [a] consistent brand message across all touchpoints, and supercharge customer focus;” (3) bring all product categories to their “full potential – specifically by “broadly doubl[ing] sales of leather goods, shoes and women’s ready to wear and grow outerwear by around 50 percent in the medium term; (4) accelerating store refurbishments and “seiz[ing] the opportunity in e-commerce;” and (5) focusing on “seamless execution.”

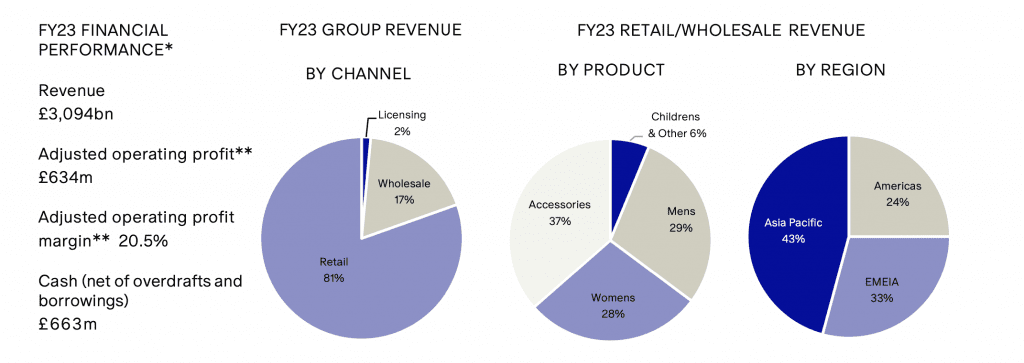

From a “medium term” standpoint (through FY2024), Burberry – which has been busy refurbishing its stores, developing new handbag shapes, emphasizing its heritage rainwear offerings, reviving its Prorsum branding, and introducing a slew of takes on its famed Check pattern – is angling for high single digital revenue CAGR to £4 billion. It is also seeking “meaningful margin improvement.” Specifically, this means increasing adjusted operating profit margins by 20 percent or more in large part by way of a 2x increase in the sale of leather goods, shoes, and women’s ready-to-wear and a 1.5x increase in outerwear sales. The almost-170-year-old company also aims to have all stores refurbished by FY26 and to drive store productivity to £25k/sqm in the process. All the while, Burberry is looking to increase e-commerce sales by 2x so that it amounts to roughly 15 percent of total retail sales.

Management said in a Q1 conference call on Friday that they are “confident” about reaching medium-term guidance and optimistic that Daniel Lee’s new collections will continue to elevate the brand.” (A testament to the prowess of Lee and his designs, Bernstein analyst Luca Solca noted back in May that Burberry saw “an overnight improvement in shoe offerings within four months of Daniel’s starting date.”) The order book for Lee’s first collection was completed during Q1 and wholesalers responded positively to the new designs.

A note on wholesale and outlets: Burberry does not appear to have immediate plans to do away with wholesale distribution – which accounted for 17 percent of revenue last year – entirely. Instead, it is looking to “maintain [its wholesale] presence to reach new luxury customers,” it said in the investor overview, but cut it down to 15 percent in the medium-term. At the same time, Burberry is “in the process of converting some of their high-performing wholesale distribution, especially at department stores, into concessions,” Bernstein revealed this spring. “This is an ongoing process, and the company plans to provide more details in the future.”

The consultancy further confirmed that “outlet channels serve a critical function for Burberry, primarily in liquidating end-of-season products. The company intends to continue focusing on this approach in the near future.”

But back to Lee … the all-important Chinese customer, “keen on iconic products, appears to be familiar with Daniel Lee’s work and enthusiastic about his upcoming designs,” which will first hit stores in September, per Solca. Meanwhile, the response to Lee’s collection from American customers “remains slightly ‘wait-and-see’, and within expectations.”

The Road to £5 Billion

Looking beyond the medium term, Burberry is aiming to become a £5 billion brand. (For some context, it most recently generated $3.73 billion in full-year revenue. For some broader perspective, in 2021, Prada publicly set a goal to boost annual revenues to 4.5 billion euro ($5.11 billion at the time) for the “medium-term,” with an operating margin target of approximately 20 percent.)

As for what that looks like from a practical point of view, Burberry’s management stated in the “overview” that this entails growing the company’s accessories business to generate more than 50 percent of group sales. It will also see the company increase e-commerce sales to amount to 20 percent of retail sales.

In terms of the timing, Solca stated in May in connection with the release of Burberry’s FY23 results that he expects the brand’s “self-help story will likely move on at a moderate pace,” with retail profitability, for example, depending on productivity, and at Burberry, “productivity is moving in the right direction.” It is not realistic for management to announce aggressive slashing of wholesale to high single digits to match peers like Gucci and/or to cut off-price,” he stated.

Reflecting on the status of the brand now, Interactive Investor’s Richard Hunter told Reuters that Burberry is “undergoing something of a quiet revolution.”