Nike made headlines this week after altering its terms to include additional resale-specific provisions. New language – which appears to be primarily directed at bulk-buyers and/or those whose orders are “placed with automated ordering software or technology,” and which states that Nike can decline refunds, charge restocking fees, and suspend the accounts of users it suspects of reselling – joins already-existing terms that prohibit purchases for the purpose of resale. Not unique to Nike, such terms mirror similar sentiments maintained by an array of other companies, including those in the upper echelon of the luxury spectrum, such as Hermès, which states in its terms, “When you purchase a product … you represent and warrant that you are purchasing [it] for personal and not commercial purposes and that you do not intend to resell, directly or indirectly, Hermès products for commercial purposes.”

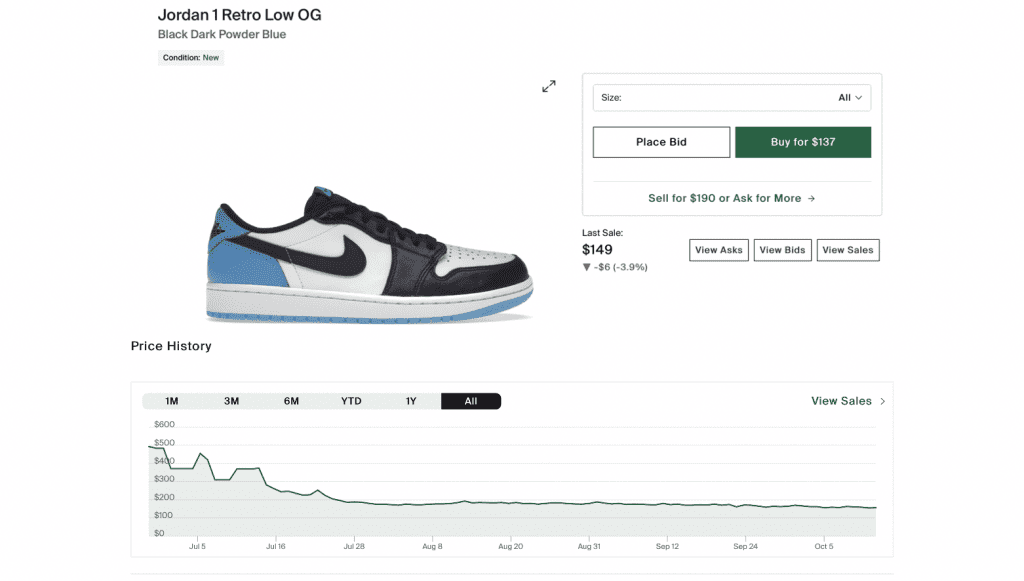

Brands like Nike remain in an interesting position when it comes to resale, as in many cases, at least some of their relevance and the demand for certain products is driven by robust resale prices. This is true for luxury handbags and hard-to-get sneakers, alike. The bigger picture here on the footwear front is that the resale market is cooling down, with the prices for hot sneakers generally trending downwards compared to a year or so ago. Here’s the price history for one Jordan style courtesy of resale site StockX …

If a Sotheby’s auction last month is any indication, the same trend is not necessarily carrying over to the most in-demand Hermès bags. A Himalaya Retourne Kelly 25 bag sold for €352,800 in a Paris auction, almost 3X more than Sotheby’s pre-sale estimate. The caveat here, of course, is that this is one of the brand’s rarest bags; Himalayas routinely fetch record-breaking sums at auction. At the same time, when it comes to Birkin and Kelly bags made of more traditional materials, there is no real shortage if the resale market is any indication. These bags are being offered up by resale sites – from The RealReal and Rebag to Privé Porter – en masse; as of Friday morning, The RealReal had over 600 Birkins in stock, two of which were Himalayas. Upwards of 400 of those bags are in “Pristine,” “Excellent,” or “Very Good” condition, according to The RealReal. It is difficult not to wonder at what point this will catch up to Hermès and impact its sales across various categories.

In litigation developments, Warhol Foundation for the Visual Arts v. Goldsmith went before the Supreme Court. (Transcript of the oral arg. can be found here.) And on the heels of filing an answer to the trademark case that Chanel filed against it over jewelry crafted from Chanel buttons, complete with 21 affirmative defenses, Shiver + Duke has withdrawn 17 of them, including its unclean hands and fraud defenses.

This week’s examples of fashion’s refusal to quit collaborating comes by way of LVMH-owned Rimowa, which is teaming up with RTFKT for what the Nike-owned web3 brand calls “a one of a kind collab drop.” (Rimowa took its first pass at web3 by releasing limited edition NFTs in May 2021.) Meanwhile, Gucci is teaming up with Palace for a collab that will launch on Gucci’s Vault platform on Oct. 21.

In recent deal-making news: Goat Group Inc. will acquire Grailed in furtherance of an effort to grow its footprint in the secondary apparel market. The deal follows closely from news that Naver Corp will acquire resale platform Poshmark for $1.2 billion, prompting heightened expectations that more consolidation is coming to the secondary market segment.