Thom Browne prevailed in the trademark lawsuit waged against it by adidas, with a New York jury finding that the fashion brand did not infringe or dilute adidas’ 3-stripe trademark by way of the 4-stripe motif that has appeared on its apparel + accessories for 15 years. At the heart of adidas’ case was its claim that consumers are likely to assume – especially in a post-sale capacity – that TB’s goods “originate from the same source, or that they are affiliated, connected, or associated with [adidas]” since TB uses stripes in a manner that is “similar to [its] 3-stripe mark in appearance & overall commercial impression.”

Defending its use of a 4-stripe motif, Thom Browne argued, among other things, that it and adidas “operate in different markets, serving different customers, and offer their products at strikingly different price points.”

Stripes – but more than just stripes … Competition was one of the most interesting elements at play, with adidas arguing that TB was “encroaching” into its “core market category” – both by way of its apparel and footwear offerings, as well as its partnerships with the likes of FC Barcelona. As TB has been expanding into sportswear, adidas has continued its well-established pattern of collaborating with high fashion brands, some of the most recent of which have been Gucci, Prada, Balenciaga, etc., in order to diversify their offerings.

I don’t think it’s a massive stretch to argue that such expansion/collaboration efforts align adidas and Thom Browne more closely than ever before, and in fact, brands across the industry are becoming competitors in ways that they previously were not.

$$$ – There is also the issue of TB’s growing revenue footprint in the market. While adidas and Thom Browne are very different in size (adidas generated €6.41B in Q3 2022 vs. €69M in Q3 for TB), there is a chance that the growth of Browne’s business was a factor for adidas. After all, TB-owner Zegna has been touting the brand’s growth, stating in Oct. that TB continued to be a “significant growth driver for the group,” with its sales up 29.5% YoY in Q3.

THE BIGGER PICTURE: As I noted in my coverage of the jury verdict, the parties’ expansion efforts are noteworthy, with Browne’s efforts reflecting a larger trend of brands looking to cater to existing consumers more holistically (whether that be by expanding to offer sportswear, cosmetics, or restaurants and/or hotels in order to meet consumers where they are) and to new ones, as well. These efforts bring revenue and other upsides, but as the case at hand clearly demonstrates, they can set brands up for trademark clashes.

In non-adidas litigation updates …

Nike v. StockX – There was movement in the parties’ discovery disputes, with a magistrate judge precluding StockX from seeking certain revenue-related discovery from Nike & overruling StockX’s objections to the adequacy of a Nike witness’s testimony w/ respect to Nike’s NFT prices and “why” Nike priced its NFTs in crypto, as well as Nike’s “plans” to enter the secondary market, among other things. Nike does, however, have to search for/produce docs that “analyze the secondary marketplace and its effect on Nike’s primary sale business.”

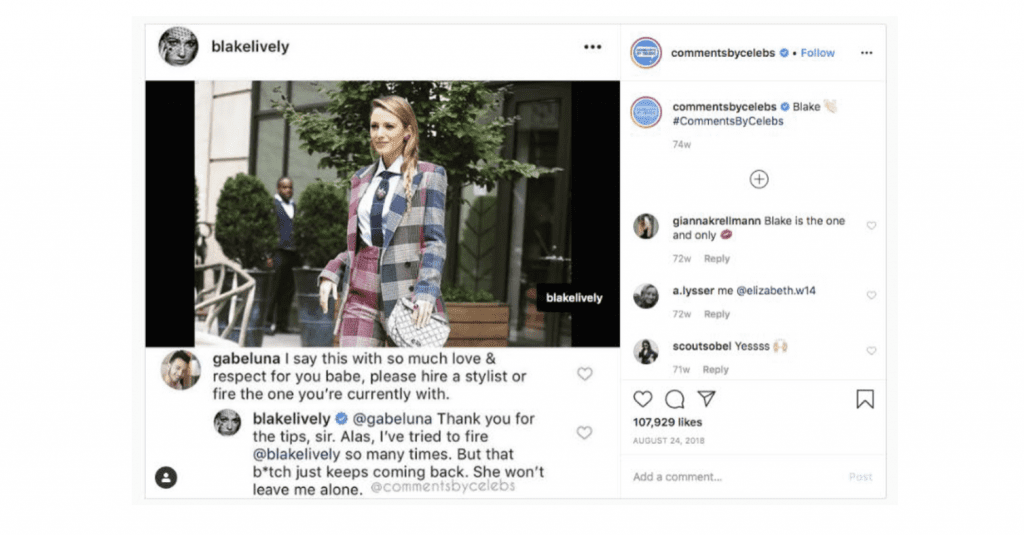

O’Neil v. Comments by Celebs – Litigious paparazzi photog Robert O’Neil is suing Instagram meme account Comments by Celebs for posting a photo he took of Blake Lively – along with a comment from Lively. (O’Neil previously sued Lively for posting the same photo to her own Instagram.)

NOTE THIS: Amazon continues to bulk up its high fashion endeavor even as not shortage of top brands opt not to collaborate with the platform. After launching a partnership with luxury reseller What Goes Around Comes Around in Oct., Amazon has added Rent the Runway to its marketplace, with the rental co. selling both “pre-loved” apparel and never-worn pieces from its “design collective.” The move brings third-party brands like Maison Margiela to Victoria Beckham to the RTR storefront” on Amazon.

And in a bit of deal-making – and prospective deal-making – news this week … The parent company of Lacoste, Gant, Aiglem and the Kooples is looking to add to its roster of brands, with MF Brands Group CEO Thierry Guibert telling the WSJ that the group is looking for brands that “transcended borders and had at least €500 million in annual sales.” The brands “don’t necessarily need to be in fashion, and could be in areas like hospitality or experience, but do need to be upmarket.”

Sustainability-focused companies continue to raise funds …

– Grounded People, an emerging sustainable shoe startup, raised $2.5 million from Vancouver-Based Right Season Investments Corp to “expand the company’s involvement in the sustainable fashion movement, and expand their vegan footwear line.”

– Sortile, a startup that touts itself as “empowering the textile industry with solutions to unlock the current challenges for scaling textile recycling,” finalized its seed round, raising $1 million.

And in acquisition news: Style3D, a leading digital solution provider in the global fashion industry, has acquired Munich-headquartered Assyst, a leading fashion tech company.