Audemars Piguet is getting ready to use its branding – including the source-indicating elements of its Royal Oak bezel – on “non-fungible token (‘NFT’)-based goods, namely, downloadable image files containing timepieces and chronometric instruments authenticated by NFTs,” “downloadable virtual goods,” such as watches “for use online and in online virtual worlds,” and corresponding “retail store services.” That is what the Swiss watchmaker revealed in a recently-filed response to push back from an examining attorney for the U.S. Patent and Trademark Office (“USPTO”).

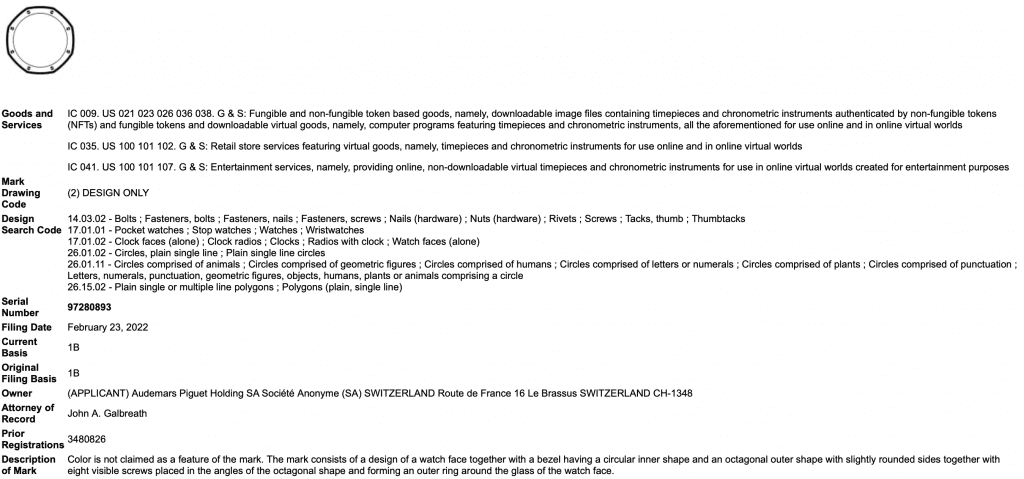

The Background: Audemars Piguet filed an application for registration for the configuration of its Royal Oak watch face for use in Classes 9, 35, and 41 in February 2022. In a non-final Office action in November, USPTO examiner Amanda Galbo took issue with the mark – which AP describes as consisting of “a configuration of a watch face together with a bezel having a circular inner shape and an octagonal outer shape with slightly rounded sides together with eight visible screws placed in the angles of the octagonal shape and forming an outer ring around the glass of the watch face.” The issue, according to the USPTO: The watch face does not “indicate the source of [Audemars’] goods and services, to identify and distinguish them from others.”

In particular, Galbo pointed to third-party evidence – including media coverage of a Sotheby’s auction for an NFT-tied watercolor depiction of the original Royal Oak prototype painted by Gerald Genta – featuring what “appears to be the applied-for mark used in connection with [Audemars’] recited NFT goods and related services.” She also highlighted the “Rare Watches Collection” of NFTs, which consists of digital trading cards featuring images of and information about 100 “digitized watches,” including the Audemars Piguet Royal Oak, that are linked to – and sold via – NFTs.

“Given that the [aforementioned] evidence establishes that the applied-for mark will likely be perceived by consumers as a feature or element of artwork authenticated by an NFT,” Galbo stated that the Royal Oak bezel mark “will not function to indicate the source of applicant’s goods and services,” and refused registration under Trademark Act sections 1, 2, and 45.

AP’s Response

Counsel for Audemars Piguet lodged its response to the Office action this week, stating that “the applied-for octagonal bezel mark will indeed function as a trademark to indicate the source of [its] goods and services and to identify and distinguish them from others.” Delving into some of the evidence produced by Galbo, Audemars claims that the Genta artwork example “concerns a single NFT that authenticates an original drawing of the first Royal Oak watch.” While the drawing and the NFT were recently sold by Mr. Genta’s widow Evelyne via an auction at Sotheby’s, Audemars Piguet asserts that it “purchased the drawing, as well as the NFT, and does not intend to resell them.” Instead, it will “display the drawing and NFT at its company museum, where they will certainly serve to indicate the source of [its] goods and services.”

(A copyright/contract sidenote: AP states that the drawing was done by Gerald Genta, who the company “paid [in 1970] for the Royal Oak watch design and the assignment of the copyright related to [the original watch sketch]. It was a work for hire” – the status that presumably also applies to an array of Genta’s other famous works, including the Patek Philippe Nautilus.)

In terms of its plans for use of the mark (the application was filed on an intent-to-use basis), AP tells the USPTO that it is “preparing to use the applied-for mark in commerce for the goods and services listed in the application – and when it does so, it will use the mark as a trademark, so that the consumer will perceive the bezel as a source-identifier and not as an artistic feature of the goods.” The watch co. also notes that it “already owns a registered trademark (Reg. No. 3480826) for the octagonal bezel … [which it] is already using the bezel to indicate the source of its watch- related goods and services.”

As for what those plans actually look like, there is a chance that AP’s use of the watch face mark – and other trademarks like the Audemar Piguet word mark and AP logo – in connection with “downloadable image files containing timepieces … authenticated by NFTs” will come hand-in-hand with its impending pre-owned watch endeavor. After all, AP made headlines early this year after CEO François-Henry Bennahmias announced the company’s plans to launch a certified pre-owned initiative, and stated that he anticipates that the secondary market business will be bigger than retail sales of new models. This seems like it could be an opportunity for the luxury watch company to make use of NFT technology for both provenance-proving and story-telling aims.

AP may opt to use blockchain technology to help verify the authenticity of and/or provide traceability for – and warranty information for – any new watches that it produces in the not-too-distant future, and it would not be the first to do so. Blockchain technology enables brands to tokenize assets, which ensures that transactions involving those goods – including purchasing, exchanging, and trading – are recorded accordingly, which is particularly meaningful with regards to the burgeoning secondary market and efforts by brands to offer repair/refurbishment services.

It is also potentially significant from an authentication/anti-counterfeiting perspective, as “NFTs can act as a digital record of authenticity and provenance on the blockchain,” Taylor Wessing’s Clare Reynolds stated in a note. “Each sale, trade and owner is built into the NFT’s ledger, and the NFT’s metadata might contain a digital certificate of authenticity,”

The bigger picture here is an increasingly robust secondary market for luxury goods – timepieces, included – and companies’ efforts to wield a stronger hand in how such pre-owned assets are offered up and sold. Analysts project that the market for second-hand luxury watches will overtake new models within the next ten years, driven in no small part by demand for watches from the likes of AP. LuxeConsult, a Swiss-based industry analyst and consulting firm, puts the market for vintage and pre-owned watches at 79 billion euros ($85 billion) as of 2033, more than triple the 25 billion euros sold in 2022.