Adidas is reportedly still not sure what it will do with a whopping $1.3 billion in Yeezy products that it has in its stock after cutting ties with the rapper formerly known as Kanye West (now known as Ye) last year. Bjorn Gulden, who took over the chief executive role at adidas in January, said in March that the German sportswear giant was trying to decide what to do with its remaining stock of its trademark Yeezy wares, posing the “the idea of potentially selling the inventory and donating the profits ‘to do something good,’” according to the New York Times. Gulden revealed the Yeezy footwear and apparel at issue most likely would not be destroyed.

This is among the latest developments in the Yeezy saga, following from reports last fall that adidas might continue to offer up Yeezy style products after terminating its deal with Ye, as it maintains exclusive rights in the designs, themselves, as well as certain, non-Yeezy trademarks. Leaked images that reportedly depicted non-Yeezy-branded Boost sneakers began to circulate in December, prompting further speculation that Yeezy-less Yeezys may make it to the market via adidas’ shelves.

To date, no such sneakers have been released by the brand, and in fact, if recent comments from Gulden are any indication, the brand is focusing its attention elsewhere; the CEO told analysis in an FY 2022 call last month that the company “currently has maybe the hottest shoe in the market,” referring to its Samba sneaker.

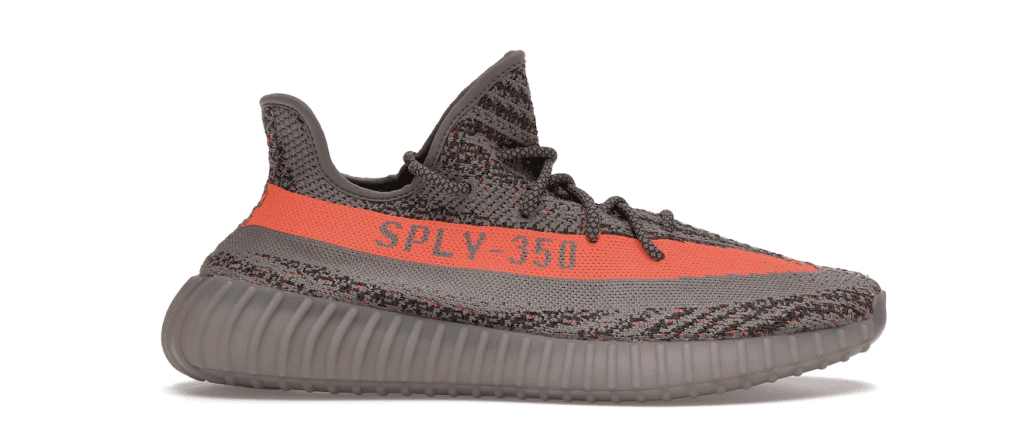

Interestingly enough, adidas does not appear to be giving up on at least one Yeezy-centric trademark if a currently pending opposition proceeding is any indication: The SPLY-350 word mark that appears on the side of an array of Yeezy Boost 350 models.

In late February, adidas filed an opposition with the U.S. Patent and Trademark Office’s Trademark Trial and Appeal Board to block the registration of a stylized word mark – “SPLYF” – for use on “Beanies; Hats; Pants; Shoes; Socks; Sweatpants; Sweatsuits; T-shirts; Tracksuits, [and] Hoodies,” pointing to its registration for SPLY-350 for use on footwear. In the February 21 notice of opposition, counsel for adidas asserts that “despite the prior rights of adidas in the SPLY-350 mark,” which is inherently distinctive, adidas argues, SPLYF Brand LLC filed an application seeking to register the SPLYF mark for use on goods that are “identical and otherwise closely related to the goods for which adidas has used and/or registered its SPLY-350 mark.”

Given that Chicago-based SPLYF Brand’s mark “so resembles adidas’s SPLY-350 mark, as to be likely, when used in connection with [its] goods, to cause confusion, to cause mistake, or to deceive as to the affiliation, connection, or association of [SPLYF Brand] with adidas, or as to the origin, sponsorship, or approval of [SPLYF Brand’s] goods by adidas,” adidas asserts that it will be damaged “by the likelihood of confusion, mistake, or deception, likely to be caused by the registration and/or use of [SPLYF Brand’s] mark.”

SPLYF Brand has not yet filed an answer in response to adidas’ opposition.

THE BIGGER PICTURE: In reality, the opposition may not be an indication of adidas’ future plans when it comes to offerings that previously fell under the Yeezy umbrella; after all, adidas is well known for its enduring efforts to ward off uses of – and applications for registrations for – marks that it deems to infringe its own indicators of source, including via routine opposition efforts. Chances are, the opposition might be more indicative of the fact that even in the midst of uncertainty – or maybe better yet, especially in the midst of uncertainty – companies will (and should) continue to police marks that they deem to be valuable.

As for enduring use of the SPLY-350 trademark by adidas, while the company, itself, has not been offering up SPLY-350-emblazoned Yeezy Boosts since it cut ties with Kanye last year, there is a chance that it in the event it seeks to use/enforce this mark at some point in the future, it could argue that the enduring – and frankly, robust – resale market has kept its mark alive. (For a bit of resale context, despite initial questions about how such sneakers would fare in the wake of various Ye-related controversies, in March, John Mocadlo, chief executive of sneaker reseller Impossible Kicks, told CNN that demand for Yeezy sneakers had jumped 30 percent on its platform since last October.)

Not an entirely novel claim, Ferrari successfully made something of a similar argument in connection with its Testarossa mark in a trademark fight in the European Union. In that case, the Italian automaker first argued in 2017 that it maintains rights in the Testarossa mark – even if it stopped making the model of care back in the 1990s – thanks, in part, to use of the mark in the secondary market. Siding with Ferrari in its bid to avoid cancellation of the mark, the Court of Justice of the European Union held that the resale of goods by a trademark owner can constitute “genuine use” even if those rights would have otherwise been exhausted as a result of the initial sale. (Meanwhile, in the U.S., courts, including the Seventh Circuit in Custom Vehicles, Inc. v. Forest River, Inc., have held that “unless … the product is unusually expensive, a single sale, followed by frenetic but futile efforts to make a second sale,” hardly constitutes genuine use.)

The fact that, as of now, all resale for Yeezy products occurs on platforms owned by other companies, however, would likely be an issue in the event that adidas sought to prove use via the secondary market for Yeezy goods. However, more broadly, the outcome in the Ferrari case, may serve as further impetus for brands that are wading into the secondary market. Not only would in-house efforts enable companies to regain control over the marketing and distribution of their offerings, as well as the condition – and certified authentic nature – of the products, themselves, by engaging in their own resale operations, or at least authentications services, perhaps, may insert a new – trademark-specific – benefit into the mix.

UPDATED (Apr. 13, 2023): In a notice of default, the USPTO examiner stated, “An answer to the notice of opposition was due in this proceeding on April 02, 2023. Inasmuch as it appears that no answer has been filed, nor has [SPLYF Brand LLC] filed a motion to further extend the time to file an answer, notice of default is hereby entered against [SPLYF Brand LLC] pursuant to Fed. R. Civ. P. 55(a).”