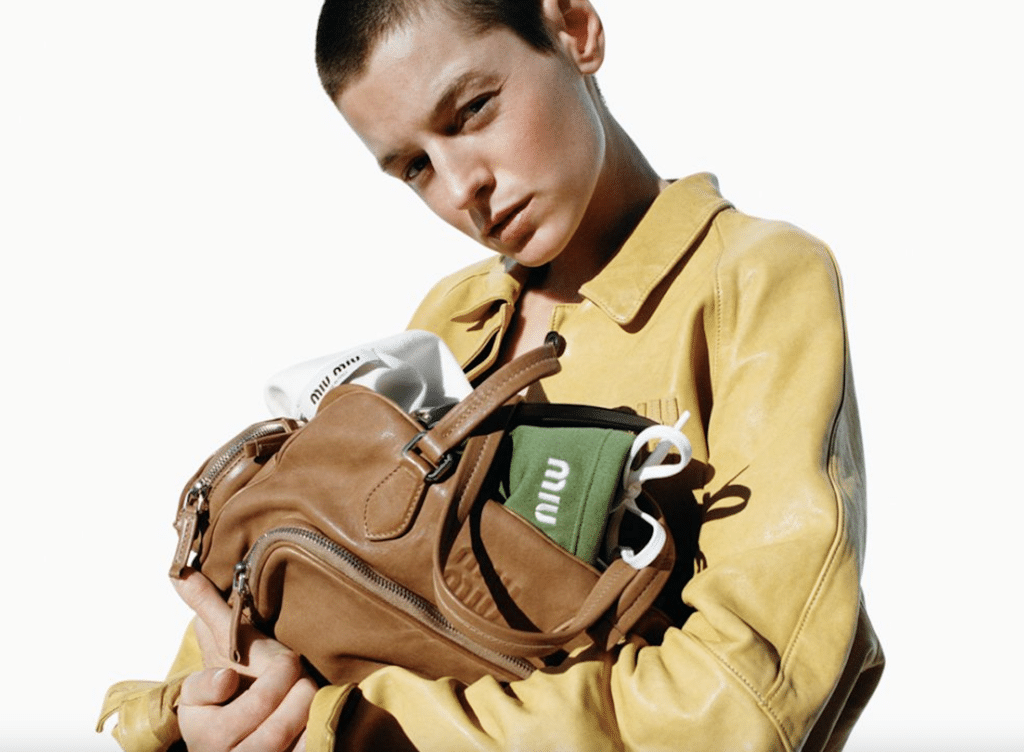

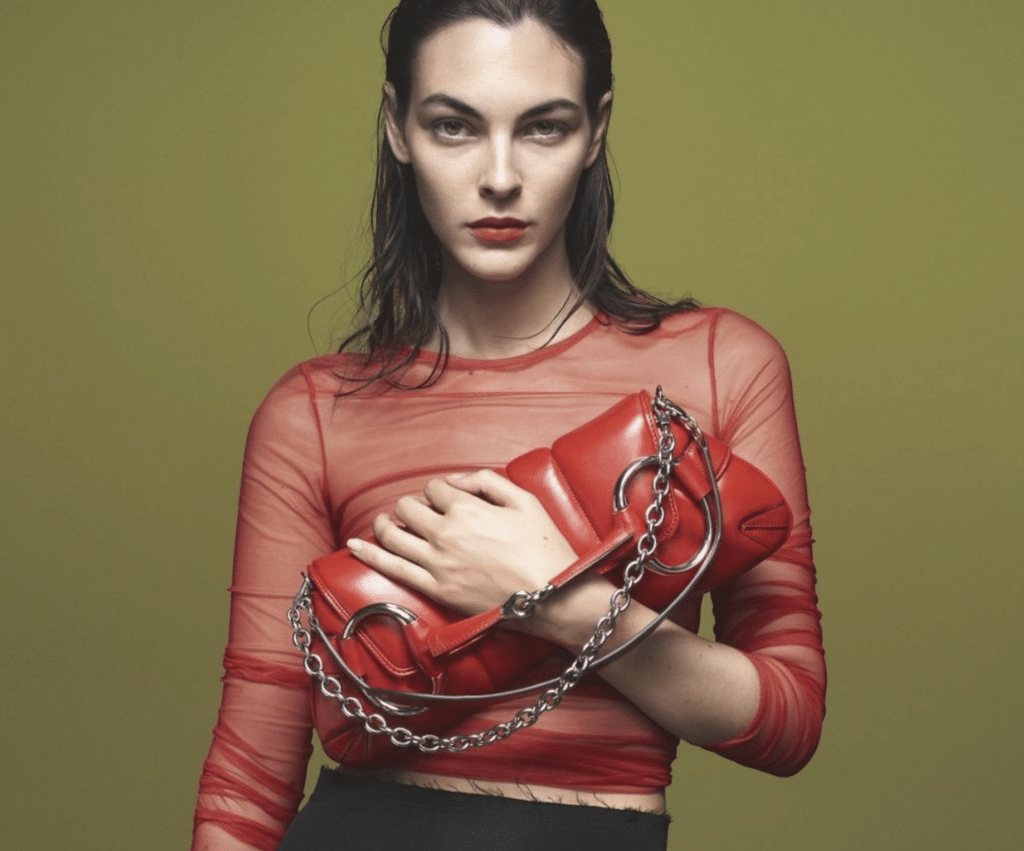

The Federal Trade Commission (“FTC”) made headlines in April when it issued an administrative complaint and authorized a lawsuit in a New York federal court in furtherance of an effort to block a proposed deal between Tapestry Inc. and Capri Holdings. According to the consumer protection-focused regulator, the $8.5 billion deal, which was first announced in August 2023, “seeks to combine three close competitors – Tapestry’s Coach and Kate Spade brands and Capri’s Michael Kors brand.” If allowed, the FTC alleges that the merger “would eliminate direct head-to-head competition between Tapestry’s and Capri’s brands” and “give Tapestry a dominant share of the ‘accessible luxury’ handbag market, a term coined by Tapestry to describe quality leather and craftsmanship handbags at an affordable price.”

At the heart of the case are questions of competition and consumer harm, but more specifically, the case centers largely on how the FTC defines the relevant market. According to the regulator, “Coach, Kate Spade, and Michael Kors brands compete to sell ‘accessible luxury’ handbags” in a “distinct market” that has “peculiar characteristics, as well as distinct prices and consumers and unique production facilities” that distinguishes it from the markets for other types of handbags.

In early responses, both Tapestry and Capri have pushed back against the FTC’s narrow framing of the market in which they operate, arguing, among other things, that the regulator is taking too constrained a view and in doing so, ignoring the “market realities” at play. While focused squarely on entities in fashion, the FTC’s case – one of the latest demonstrations of its quest to block “serial acquisitions” and roll-up strategies that it claims will lead to consolidation and chip away at competition – will likely have implications that reverberate beyond the immediate fashion market, namely for “serial acquirers” that are looking to merge.

As the closely-watched matter plays out in an adjudicative proceeding, as well as a case before Judge Jennifer Rochon of the U.S. District Court for the Southern District of New York (“SDNY”), we have put together a timeline of notable filings (that we will continue to update regularly) in order to help you to stay abreast of substantive developments …

Nov. 14, 2024

Tapestry announced that it has reached an agreement with Michael Kors’ parent company Capri Holdings to terminate the merger agreement between the parties. In a statement, Tapestry said that it and Capri “mutually agreed that terminating the merger agreement at this time is in the best interest of both companies, as the outcome of the legal process is uncertain and unlikely to be resolved by the February 10, 2025 outside date.” Joanne Crevoiserat, Chief Executive Officer of Tapestry, Inc., said, “We have always had multiple paths to growth and our decision today clarifies the forward strategy.”

Oct. 28, 2024

Tapestry and Capri lodged a Notice of Interlocutory Appeal with the U.S. District Court for the Southern District of New York, alerting the court that they “hereby appeal to the United States Court of Appeals for the Second Circuit from the Opinion and Order entered on October 24, 2024, granting Plaintiff Federal Trade Commission’s motion for a preliminary injunction … and all findings and rulings in connection therewith.”

Oct. 24, 2024

A U.S. District judge in New York has halted the merger between Tapestry and Capri Holdings, finding that a deal to combine the Coach, Michael Kors, and Kate Spade brands, among others, would reduce competition and hurt consumers. In an order issued on Thursday, SDNY District Judge Jennifer Rochon stated that a combination of “close competitors” Tapestry and Capri would result in “the loss of head-to-head competition.”

This ruling “gives the FTC time to complete its own internal trial over the merger,” per Milbank attorney James Weingarten.

Sept. 24, 2024

In the Proposed Findings of Fact and Conclusions of Law that they lodged with the U.S. District Court for the Southern District of New York on September 24, Tapestry and Capri state that the FTC – by way of its expert witness Dr. Loren Smith – inaccurately applied certain economic and legal tests to define the relevant market, namely, the “accessible luxury” handbag market. In doing so, Smith lent improper support to the agency’s underlying argument that the companies’ merger – which “seeks to combine three close competitors,” Tapestry-owned Coach and Kate Spade and Capri’s Michael Kors brand – “would eliminate direct head-to-head competition” between those brands and “give Tapestry a dominant share of the ‘accessible luxury’ handbag market” as a result.

Sept. 23, 2024

Counsel for the FTC lodged a pre-trial brief in the parties’ administrative proceeding, requesting that the administrative body permanently enjoin Tapestry from acquiring Capri on the basis that the proposed acquisition poses “a reasonable probability of substantially lessening competition both through a showing of increased market concentration as well as extensive evidence of head-to-head competition that will be eliminated if [the] merger proceeds.” Accordant o the FTC, Tapestry and ?Capri “are unable to meet their burden to show that [any entry by new firms, or expansion by existing firms] will be timely, likely, and sufficient in its magnitude, character, and scope to deter or counteract the competitive effects of their merger, or provide evidence of cognizable efficiencies.”

Sept. 17, 2024

In the final day of witness testimony, economic experts shed light on the state of competition in the market, with Yale University professor and former DOJ economist Dr. Fiona Scott Morton testifying on behalf of Tapestry and Dr. Loren Smith speaking in favor of the FTC. Scott Morton focused her criticism of the FTC’s case on its alleged failure to provide a solid base of evidence that the merger will, in fact, hinder competition in the market. Among other things, she argued that the FTC made use of outdated surveys (namely, customer surveys commissioned by Tapestry in 2021 and 2022 in furtherance of which consumers indicated which brands on a list of nearly 50 brands they had considered before making their most recent handbag purchase) and information from only select retailers. Moreover, the regulator focused too heavily on the performance of brands without considering the impact of the products, themselves, Scott Morton argued.

Meanwhile, Smith maintains that combining Tapestry’s Coach and Kate Space with Capri-owned Michael Kors raises “significant competitive concerns,” as it would give Tapestry control of 58 percent of the accessible luxury market and thus, enable Tapestry to raise prices by between 15 and 17 percent. This would ultimately cause consumer harm of up to $365 million per year thanks to a combination of price increases and a decline in product quality.

“Once they come together, if Michael Kors continues to decline, some of that decline is going to benefit the Coach brand,” Smith told the court, noting that the handbag industry has margins of 60 percent to 80 percent, which “makes the risk of diverting customers to another of their brands or losing customers to other brands less significant.”

Sept. 16, 2024

Michael Kors testified in court, telling Judge Rochon that his once-in-demand eponymous label is in need of a revamp after losing much of its appeal among consumers, a nod to the amount – and strength – of competitors in the market, as well as the changing nature of the market, itself. “I think we have reached the point of brand fatigue,” he said, saying that brands can fluctuate from being the “hottest thing on the block” to being “cold.” He also stated that new brands are capable of gaining significant traction among consumers thanks to social media and the influencing-power of stars like Taylor Swift. Specifically, he cited budding young handbag brand, Aupen, which he said he learned about when he saw a photo of Taylor Swift carrying one of its handbags. He noted that when he went to the company’s website, it was down due to a surge in traffic, presumably thanks to demand among Swift fans.

Still yet, Kors testified to the changing nature of the handbag market, saying that competition is coming from Lululemon, Zara, Louis Vuitton, and Gucci, as well as “direct-to-consumer brands that don’t have a fashion show.” He also highlighted competition from domestic counterpart Ralph Lauren, who “has got three different handbag collections plus what he’s producing for his outlets.”

Former Macy’s CEO Jeff Gennette similarly took the stand on September 16, testifying that competition in the handbag market includes “mass merchants like Target, Amazon, off-pricer retailers, social media players, pure-play handbag brands, and resellers.” Focusing on the Michael Kors brand in particular, he asserted that consistent markdowns for Michael Kors products contributed to “a bad spiral that Macy’s was living through when I was there,” and noted that the company unsuccessfully tried to raise prices in the past (a major concern of the FTC): “When they raised prices, they got spanked by the consumer.”

Sept. 10, 2024

The first couple of days of the parties’ bench trial have seen the two sides argue over the impact of the potential merger between Tapestry and Capri, with a focus on the definition – and workings – of the “accessible luxury” handbag market.

> Arguments from the FTC: The FTC focused on the potential damage that would be caused if Tapestry and Capri merger, namely, by raising handbag prices in the “accessible luxury” handbag market for “the working and middle class women of America.” The FTC defines the relevant market in the case as the “accessible luxury” handbags, namely, those with price tags that range from $100 to $999. The regulator’s legal team, which is being led by Nicole Lindquist, cited internal emails and research decks from the companies that showed their close attention – and efforts – to raising prices on the handbags coming from the likes of Coach and Michael Kors (including by cutting down on discounts for the latter), which they argue would only escalate following a merger.

Such a merger would be particularly problematic for the American market, Lindquist asserted, as the Coach, Kate Spade and Michael Kors brands account for “more than half of the [domestic] accessible luxury handbag market.” She argued that “when the biggest, closest competitors merge, that is bad for consumers.”

> Arguments from Tapestry and Capri: Tapestry and Capri’s lawyers reiterated the companies’ recurring argument that the FTC’s case does not reflect the nuanced reality of the handbag market. “The commercial reality is that customers have a Gucci bag lined up next to a Kors bag, lined up next to a Calvin Klein bag,” Latham & Watkins’ Lawrence Buterman, who is representing Tapestry, told the court.

Counsel for the two fashion groups also took issue with the government’s definition of the “accessible luxury” market, stating that the FTC’s characterization lacks precision and highlighting its use of words like “typically” to describe the materials used (“typically” leather), the quality of the bags (“typically” higher quality), and the customer base for the offerings “(typically” consumers with household incomes of up to $80,000).

Meanwhile, Capri CEO John Idol testified in court, saying that competition in this segment of the market is robust and in fact, it is the reason that the Michael Kors brand has struggled in recent year. “The pie started to get split between a lot of people,” Idol stated. “We’re getting squeezed from the top and from the bottom, as everybody wants a piece of the handbag market.” Against that background, Idol, who previously held the role of CEO of Michael Kors, said that the company “worked very hard to get the brand heat back for Michael Kors” and that they view Kors as competing in the “total handbag market” and not purely in the “accessible luxury” segment. (This reflects testimony from Mr. Kors, himself, who said in a deposition that his eponymous label competes with brands ranging from Tumi and Telfar to Louis Vuitton and Hermès at resale.)

After Idol, Tapestry CEO Joanne Crevoiserat took the stand to further chip away at the regulator’s definition of the relevant market, saying, “I don’t think anybody can agree on what [accessible luxury] even means.” She further shutdown the FTC’s biggest claim: that consumers will be forced to pay higher prices if the merger is allowed to proceed: “Customers have hundreds of choices. They can turn anywhere,” citing competition from brands like Ralph Lauren, Veronica Beard, Telfar, and even athleisure giant Lululemon, thanks to its uber-popular cross-body bag.

Sept. 9, 2024

The parties’ bench trial kicked off before Jennifer Rochon of the U.S. District Court for the Southern District of New York and is expected to last for a week and a half.

Aug. 30, 2024

Tapestry and Capri filed a proposed findings of fact and conclusions of law brief, arguing that the proposed deal will actually enhance competition and deliver significant consumer benefits, and that the FTC’s allegations are based on flawed assumptions and economic models that do not reflect reality.

The case is Federal Trade Commission v. Tapestry, Inc., 1:24-cv-03109 (SDNY).

This is a short excerpt from a Timeline/Tracker that was published exclusively for TFL Pro+ subscribers. Inquire today about how to sign up for a Professional subscription and gain access to all of our exclusive content.

Updated

September 10, 2024

This article was originally published on August 28 and has been updated to reflect new developments in the case.