Secondary market sales of fashion and luxury goods are booming, with the global market for secondhand luxury goods growing by 28 percent in 2022 to reach $45.21 billion, according to Bain & Company. That is 1.3 times higher than the growth rate for new luxury goods. “The secondhand market is already worth 3 percent to 5 percent of the overall apparel, footwear, and accessories sector,” according to Boston Consulting Group, which says that the segment “could grow to as much as 40 percent, depending on macroeconomic conditions.” Such growth is likely to be helped by changing consumer preferences and the macroeconomic climate, with consumers increasingly tapping into the online consignment segment to save money and to shop more “sustainably.”

All the while, new market entrants have rushed to meet burgeoning demand (bringing “an increased supply of goods” with them, per Bain) and existing players are looking to differentiate themselves and their value propositions. Against this background, funding keeps pouring into the secondary market – whether it be funneled into new resale platforms or already-established ones that are looking to expand their operations, including in an international capacity – and all the while, given the increasingly crowded nature of the market, consolidation is starting to come into effect, with existing entities joining forces to grab a bigger share of the market.

With so much activity underway on the resale and rental space, we have compiled a tracker of funding and M&A events to provide a broad overview of which players are fundraising, merging, and what the trajectory of this segment of the market – which only appears to be gaining in steam – looks like more generally.

Nov. 12, 2024 – Fleek Raises $20.4M in Seed, Series A

Fleek has raised $20.4 million in total funding, from a $14.8 million Series A round and a $5.6 million Seed round. HV Capital led the Series A, with additional participation from Y Combinator and Andreessen Horowitz (a16z), as well as Sean Plaice, chief technology of Postmates; Harvey Finkelstein, president of Shopify; and Maria Raga, who formerly served as CEO of Depop. The Uk-based second-hand fashion marketplace will use the new funds to bring on more suppliers and develop its platform’s interactive social features, such as chat and live video shopping.

Nov. 6, 2024 – Birl Raises £500K in Pre-Seed Round

Birl has raised £500,000 in a Pre-Seed funding round, adding to the £350,000 Innovate UK grant awarded to the company earlier this year. The Liverpool, UK-based fashion resale company says that it provides consumers with “an easy way to trade-in pre-owned clothing directly on brand websites,” offering a seamless alternative to platforms like eBay and Vinted. Birl plans to use the new funds to expand into the Nordics by the end of the year, with Cam McGimpsey, CEO and co-founder, saying that the company sees “significant opportunity in regions with strong interest in sustainability.”

Oct. 24, 2024 – Vinted Share Sale Values Co. at €5B

Vinted has closed a secondary share sale of €340 million led by TPG, a global alternative asset manager, alongside Hedosophia, Baillie Gifford, Invus Opportunities, FJ Labs, Manhattan Venture Partners, and Moore Strategic Ventures, nabbing it a valuation of €5 billion. Thomas Plantenga, CEO of the Lithuanian second-hand fashion marketplace, said, “TPG and our other new investors share our vision: to make second-hand the first choice, worldwide. We’re also delighted that this share sale rewards our employees for their dedication in making Vinted a success. We are incredibly proud to have built a product that our members love to use, and that has created a market for second-hand fashion. Vinted shows it’s possible to have a successful, profitable business that positively impacts people, communities, and the environment.”

Oct. 15, 2024 – Ghost Raises $40M in Series C

Ghost has raised $40 million in Series C funding led by L Catterton with participation from existing investors including USV, Cathay Innovation, Equal Ventures, and Eniac. The Los Angeles-based company touts itself as “powering the resale economy” connects brands and retailers “allowing them to enter into new channels and geographies by connecting them with a broad range of vetted buyers around the world who are seeking access to both surplus and wholesale inventory.”

“We are highly focused on advancing our mission to be the most trusted inventory solution for the world’s best brands,” said Josh Kaplan, Co-CEO of Ghost. “Ghost has continued to grow and expand our focus to be the true partner of choice for leading brands and retailers looking for efficient inventory management and channel opportunities.”

Aug. 13, 2024 – Trove Acquires Recurate

Trove has acquired Recurate, which it says is “a significant player in the branded resale market.” While the terms of the transaction have not been disclosed, San Francisco-based Trove, which is a leader in the branded resale and customer trade-in space, said in a statement that the deal “underscores its commitment to making branded resale more accessible and easier to launch and scale for brands.” Moreover, Trove confirmed that with this acquisition, it now commands over 75% of total U.S. branded resale traffic, “cementing its status as the market leader in resale technology.”

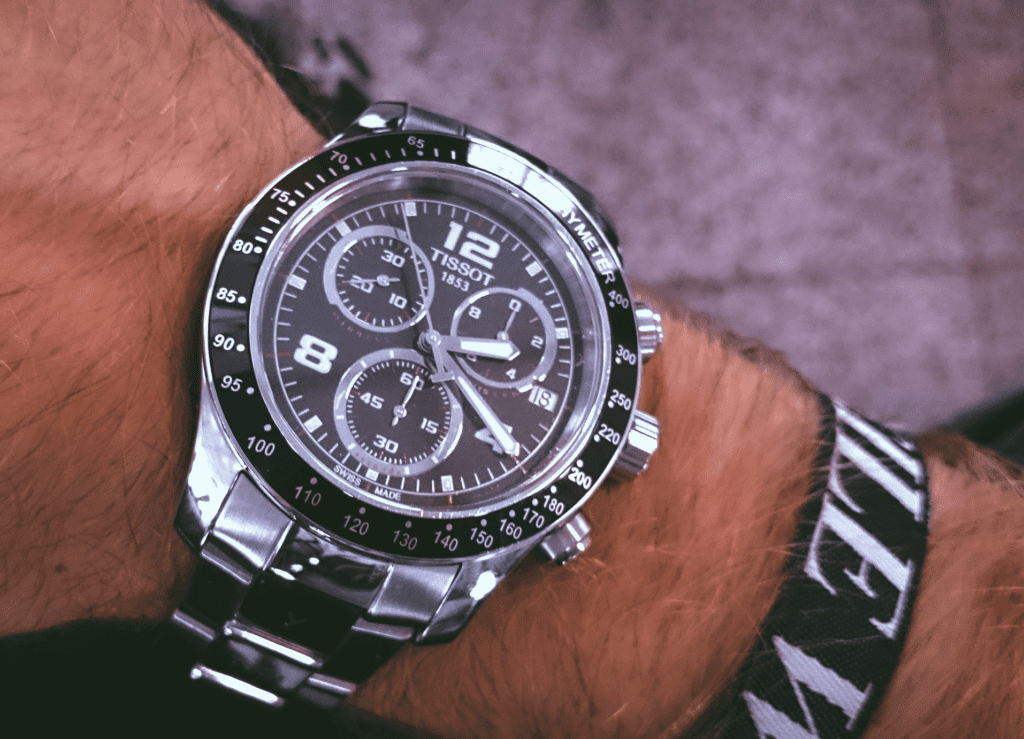

Jul. 3, 2024 – WristCheck Raises New Funds in Pre-Series A Round

WristCheck has raised new funds in a Pre-Series A round from JAY-Z, Alibaba Entrepreneurs Fund, Gobi Partners GBA, and K3 Ventures, bringing its total funding to date to $13.6 million. The Hong Kong-based secondary market platform, which was founded in 2021 by Austen Chu, says that it “provides watch enthusiasts with unparalleled access to thousands of guaranteed authentic timepieces, catering to a wide range of preferences and budgets from the rarest and most coveted models to watches at every price point.” The company further stated that in 2023, it experienced “a 300 percent-plus increase in total transaction volume,” and in the first four months of 2024, reported “a 588 percent year-over-year growth in online commerce, alone, with an average order value of USD $22,000.”

Jun. 4, 2024 – Charles Leclerc Invests in Chrono24

Formula One driver Charles Leclerc and his brother Lorenzo Leclerc have invested an undisclosed sum in Chrono24, joining the likes of Cristiano Ronaldo, Bernard Arnault’s family investment company, Aglae Ventures, as well as General Atlantic, Insight Partners and Sprints Capital, which have also invested in the online marketplace for luxury watches. In a statement, Leclerc said, “The watch world has long captivated me as one of my many passions. There’s a real unification between watch lovers around the world, and my brother and I are excited to be an even deeper part of that community through our investment involvement with Chrono24.”

May 23, 2024 – PopChill Raises $3.1M in Pre-A+ Round

PopChill has raised a $3.1 million Pre-A+ funding round from Top Taiwan Venture Capital, 500 Global, Acorn Pacific, ITIC, AVA Angels Fund, Acorn Pacific Ventures, and Darwin Ventures. The luxury resale marketplace, which operates in Taiwan and Hong Kong, says it will use the new funds to “reach break-even in Taiwan by the end of this year and expedite growth in the Hong Kong market,” while also expanding its team with a total of 18-20 new hires this year. Co-founder Andy Kuo said in a statement, “The potential for luxury resale in Asia is tremendous and largely untapped, with no clear leader outside of China. The key to success is security, and we are reacting to this by constantly improving our authentication processes.”

May 21, 2024 – Haz Raises $1.4M in Pre-Seed Funding

Haz has raised $1.4 million in a Pre-Seed round led by Speedinvest with participation from the scout programs of a16z, Atomico, and Concept Ventures. The London-based AI social commerce platform will use the new funds to develop its proprietary AI technology and launch the resale platform in the United Kingdom before expanding across Europe. Co-founded by Ronan Harvey-Kelly and Glenn Keller, Haz enables users to “automatically turn digital shopping receipts into items on the app, removing the manual element of listing something [items] for sale, creating a seamless resale experience.”

“82% of Gen Z now think about the resale value of an item before they even buy it, yet 47% of items fit for resale remain unsold” said Harvey-Kelly. “It takes a lot of time to resell something and consumers still lack the data they need to make informed resale decisions. That’s where Haz comes in.”

This is a short excerpt from a data set that is published exclusively for TFL Pro+ subscribers. For access to our up-to-date resale investment and M&A tracker, inquire today about how to sign up for a Professional subscription.