Deep Dives

The pace of initial public offerings hit a “new low” in the second quarter of 2023, according to S&P Global, “as central banks around the world tightened monetary policies, pushing costs to unattractive levels for potential investors.” Despite efforts by the U.S. Federal Reserve and other central banks to fight “persistently high inflation with higher interest rates, after keeping them near zero during much of the pandemic,” companies are not rushing to go public due to the high cost of financing. Things may be turning around, though, with the number of stateside IPOs expected to increase as the Federal Reserve and other central banks move toward an end of rate hikes.

British chip-maker Arm Holdings’ highly anticipated Nasdaq listing – which saw it raise $4.87 billion in September – brought some initial optimism to the market. Later on in September, grocery delivery company Instacart started trading on the Nasdaq, and on the fashion/retail front, Birkenstock listed on the New York Stock Exchange on October 11 in an offering that has been touted as a “test [of] the new-issue market,” with the Wall Street Journal stating that how the German footwear maker’s stock trades “could help determine the tone of an IPO market that has shown signs of life after a long period of quiet.”

So far, the results have been less than stellar across the board, with Arm, Instacart, and L-Catterton-backed Birkenstock losing their initial gains and largely trading below their IPO prices of $51, $30, and $41, respectively. After dropping its price per share from an initial $46 to $41, Birkenstock finished its first day of trading down nearly 13 percent, nabbing it the title of the worst debut by a company worth more than $1 billion in nearly two years in the process, according to Bloomberg. Analysts have pointed to “an overvaluation of the company, a hesitation to buy into a market that is still trying to right itself, and a lack of confidence in the footwear sector” as contributing to Birkenstock’s “lackluster performance,” Modern Retail reported. “Together, these factors could make other brands cautious about pursuing an IPO in the coming months under similar economic conditions.”

Against the background of an evolving market and in light of reports about what companies are expected to list next (names like Shein, Italian footwear brand Golden Goose, Kim Kardashian’s SKIMS, sustainable fashion brand Reformation, e-commerce tech company Rokt, activewear-maker Vuori, and Spanish fashion retailer Tendam have been raised), one element worth considering is intangible assets. After all, it is well established that the value of intangible assets, including intellectual property, can make up a large portion of a company’s market value, and thus, make for a critical consideration in investment decisions.

“It is clear” that the focus on intangibles has become “more intense in the last two decades,” according to Aswath Damodaran, a corporate finance and valuation professor at NYU Stern School of Business. He points to two primary reasons for the increased focus: (1) the perception that intangibles now represent a greater percent of value at companies and are a significant factor in more of the companies that we invest in, than in the past; and (2) there has been “a sea change in the characteristics of companies entering public markets – while companies that were listed for much of the twentieth century waited until they had established business models to go public, the dot-com boom saw the listing of young companies with growth potential but unformed business models (translating into operating losses), and that trend has continued and accelerated in this century.”

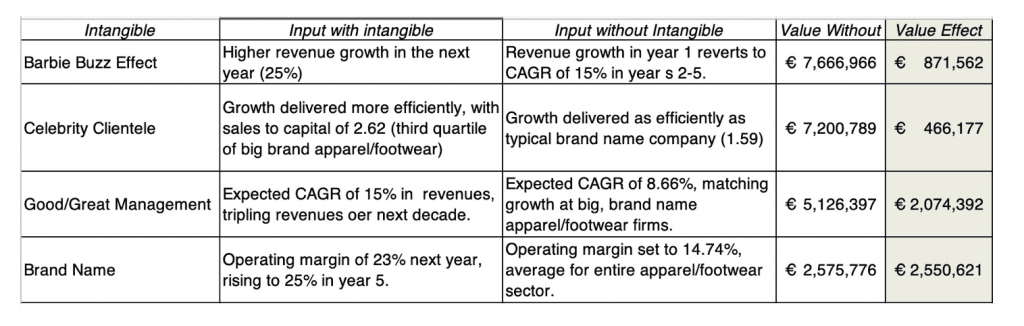

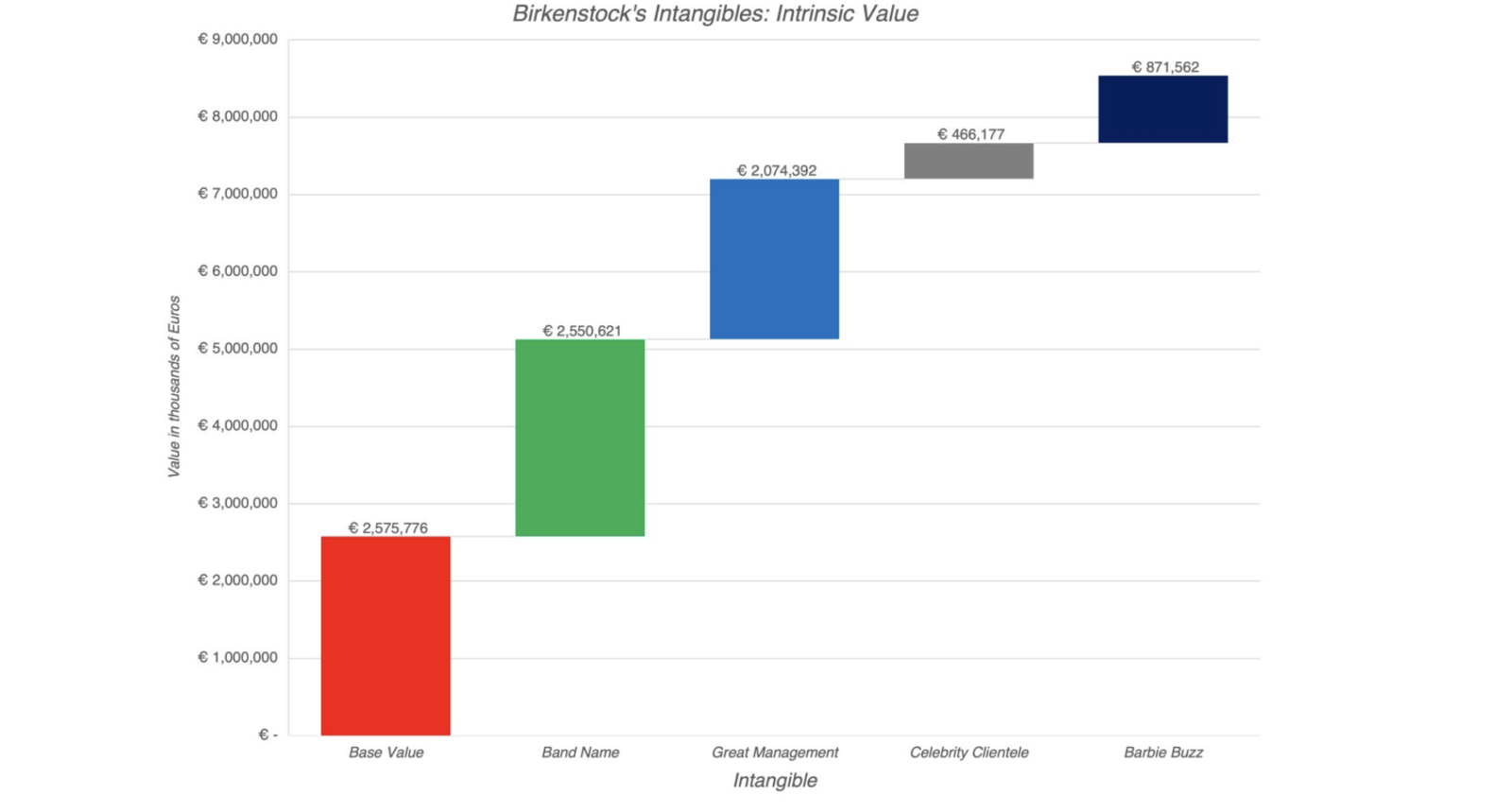

A recent IPO – Birkenstock’s – is a particularly interesting one from an intangible perspective since the German footwear-maker has many intangible assets in its arsenal, with “some more sustainable and more valuable than others,” per Damodaran. He highlights things – like its brand name, celebrity customers, good management, and even buzz from the recent Barbie movie – as falling in the realm of important intangibles for the company …

Brand name: “It is undeniable that Birkenstock not only has a brand name, in terms of recognition and visibility, but has the pricing power and operating margins to back up that brand name.” (I would add that this extends to the various other trademarks and product configuration trade dresses that it maintains, as well as the “Made in Germany” element of its brand. Its ability to boast that its products are made “under the best conditions for our brand in our own production facilities with an extensive amount of handwork” likely adds value from a reputational/goodwill standpoint.)

Celebrity customers: “Birkenstock attracts celebrities in different age groups … and more impressively, it does so without paying them sponsorship fees. If the best advertising is unsolicited, Birkenstock clearly has mastered the game.”

Good management: “Birkenstock seems to have struck gold with CEO Oliver Reichert. Not only has he steered the company towards high growth, but he has done so without upsetting the balance that lies behind its brand name.”

Barbie buzz: Birkenstock “has benefited from serendipitous events – from Margot Fraser’s introduction of its footwear to Americans in 1966 to Phoebe Philo’s sandals on the Paris catwalk in 2012.” (The “most recent craze for Birkenstocks started when Phoebe Philo put [mink-lined versions] on the [Céline] runway in October 2012,” fashion critic Caty Horyn wrote back in 2018.) However, the “most serendipitous event, at least in terms of its IPO, may have been the release of the Barbie movie, this summer” – in which a pink version of the company’s Arizona sandal gets spotlighted.” (True to form, the Barbie film makers reportedly expected Birkenstock to pay for play in the movie, but unlike some other companies that forked up cash to have their offerings in the biggest movie of the summer, the German footwear brand refused.)

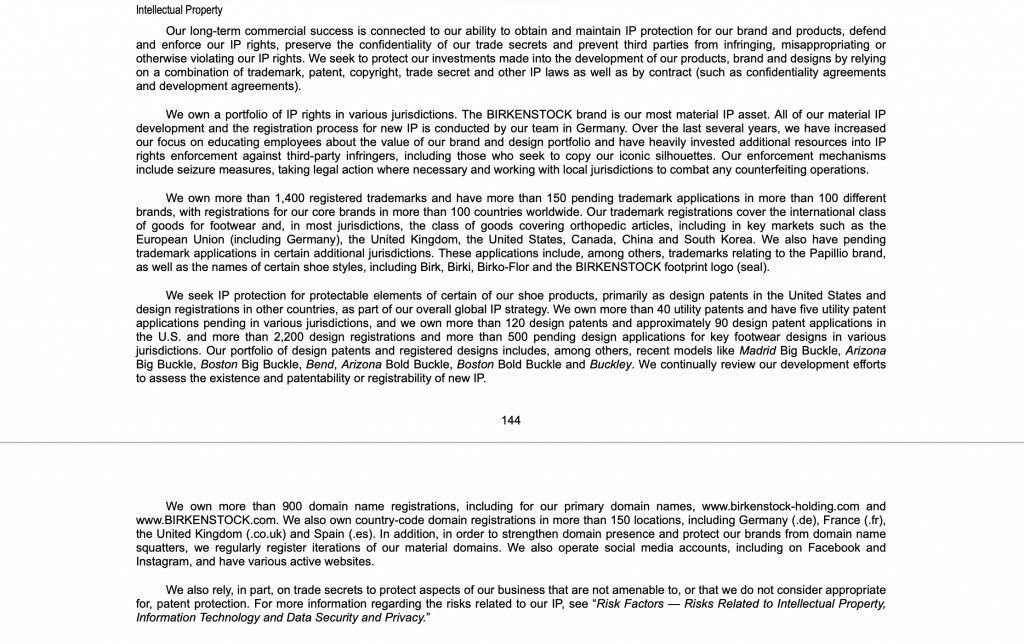

For a look at (some of) its intangible assets in its own words, Birkenstock included the following in its F-1 …

In a different take on intellectual property, Birkenstock stated in the same filing that one of the risks it faces comes by way of “counterfeit or ‘knock-off’ products, as well as products that are ‘inspired-by-BIRKENSTOCK,’ [which] may siphon off demand we have created for our brand, and may result in customer confusion, harm to our brand, a loss of our market share or a decrease in our results of operations.” The company asserted that it faces “competition from counterfeit or ‘knock-off’ products manufactured and sold by third parties in violation of our IP rights, as well as from products that are inspired by our footwear in terms of design and style, including private label offerings by retailers.”

Calling out Facebook directly and Amazon indirectly, Birkenstock continued, “In the past, third parties have established websites to target users on Facebook or other social media platforms with ‘look alike’ websites intended to trick users into believing that they were purchasing BIRKENSTOCK products at a steep discount … In addition, we have refrained, and we may in the future refrain, from using certain third-party websites to distribute our products due to the selling of counterfeit products on such platforms.”

The value of intangibles for companies and investors, alike, is not lost on the U.S. Securities and Exchange Commission (“SEC”), which modernized Regulation S-K Item 101, among others, in 2020 to require (in Item 101(c)(1)(iv)) the disclosure of “the duration and effect of all patents, trademarks, licenses, franchises, and concessions held to the extent material to an understanding of the registrant’s business taken as a whole.” Since the initial promulgation of this disclosure requirement, the SEC states that “intellectual property has become increasingly important to the business of a broad range of registrants.”

With the foregoing in mind, there may have been a disconnect between Birkenstock’s robust IP rights and analysts’ views that the company was overvalued ahead of its IPO. This may speak to the fact that while it is well established that intangible assets “contribute significantly to the value of a business,” experts assert that it is “heavily debated” whether investors actually “use the information about intangible assets disclosed by companies as metrics for higher company valuations.” Researchers in the departments of Banking and Investment, and Finance at the Technical University of Košice, for instance, stated in a study last year that investors “still assess companies based on their profitability rather than considering the information on intangible assets the enterprises disclose in their financial disclose in their financial statements.”

It is still early days for Birkenstock’s stock. So, stay tuned. In the meantime, we have a new data set that tracks the fashion/retail related IPOs, which can be found here.