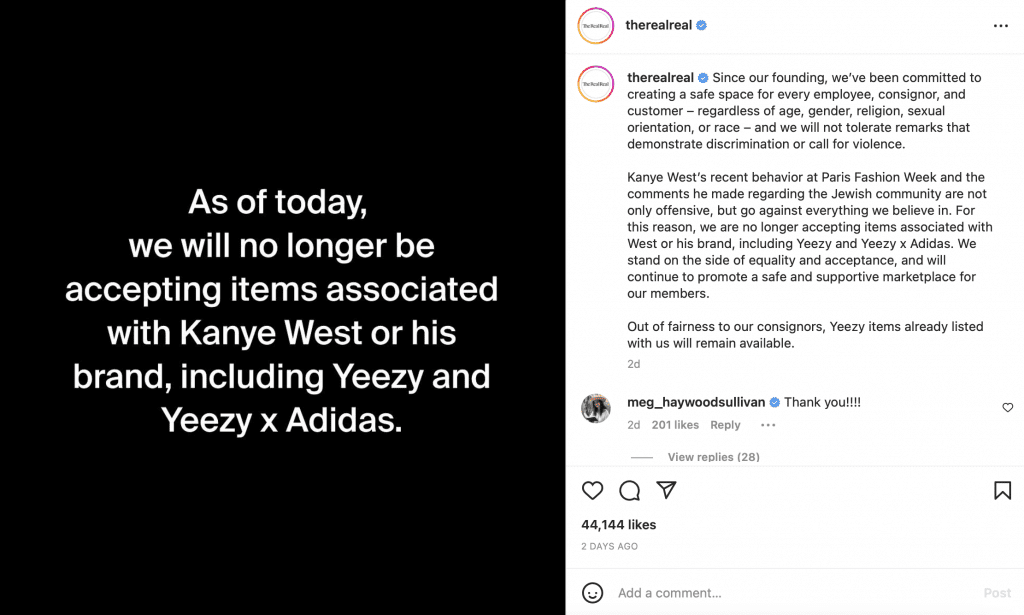

This week was, again, dominated by Kanye-related news, largely prompted by adidas’ announcement on Tuesday that it would cut ties with the rapper, with whom it has had a long-running partnership. Since the German sportswear giant revealed that it would “terminate the partnership with Ye immediately, end production of Yeezy branded products & stop all payments to Ye and his companies,” other companies have chimed in. Gap, which agreed to terminate its deal with West last month, said that it would remove all Yeezy Gap wares from stores and the web. T.J. Maxx and Marshalls owner TJX said it would not buy any Yeezy merch for its stores, which luxury reseller The RealReal echoed in a statement of its own this week.

Footlocker similarly distanced itself from West, saying that it was pulling any existing products from its stock. And finally, Brown Rudnick said that it will not represent West’s “business interests,” while a rep for Cadwalader said this week, “We are not presently providing any representation [to West] and have no intention of providing any future representation.” (Meanwhile, Balenciaga, CAA, and JP Morgan, among others, previously cut ties with West.) The fallout has prompted questions about the future of Yeezy wares at adidas (which I dive into below), and has led to a frenzy in the resale market, including on sites like StockX, where Yeezy sneakers have been spiking in price.

In non-Kanye news, consumers are concerned about climate, and at least some are looking to parlay that into their purchasing behavior. “About 15% of global fashion consumers are already highly concerned about sustainability and consistently make purchasing decisions to lower their impact,” Bain & Co. analysts stated in a recent report, noting that “that percentage could increase to more than 50%.” The analysts put forth 3 strategies to reaching these consumers, saying that brands must: (1) address the information gap; (2) engage consumers on product durability and impact; and (3) make sustainable purchases more convenient and appealing.

Moncler reported Q3 earnings this week, generating €638.3 million in the 3 months ending Sept. 30, and €1.5 billion ($1.51 billion) in the first 9 months of the year, helped by recovery in China and strong sales in Europe, potentially boosted by the strong dollar/traveling Americans. In a note, Jefferies analysts focused on price, stating, among other things, that “more than 50% of [Moncler’s] growth in Q3 at Retail was price driven.”

On the litigation front: Valentino and Mario Valentino are still in the thick of things in Italy, alerting C.D. Cal. Judge Kronstadt this week that the Italian proceedings in their clash over use of the VALENTINO trademark and over a 40-year-old co-existence agreement are underway, including appeals to the Court of Cassation (Italy’s highest Court), an arbitration-centric matter before the Court of Milan, and a trademark infringement and unfair competition action lodged by Mario Valentino before the Court of Naples.

Metaverse Marks: The initial wave of metaverse/NFT-related trademark filings seems to have died down, but brands ae still filing applications. LVMH-owned Givenchy and Kenzo, for instance, lodged WIPO applications for their names in the usual classes (9, 35, 41, and 42). And on the heels of one of the virtual dresses that it offered up on Roblox immediately after its S/S23 runway show selling for $5k last month, Carolina Herrera filed an EUIPO application for its name for use in classes 9, 35, and 41.

In recent deal-making news: Lisbon-based web3 startup Exclusible has closed a €5 million euro “strategic round” led by Holzmann & Tioga Capital with participation from former Cartier CEO Stanislas de Quercize, former Sotheby’s CEO Tad Smith, and Boston Consulting Group Managing Director & Partner Joel Hazan, among others. Exclusible will use the new funds to grow its team and build out its web3 customer relationship management product

– Gagosian denied rumors this week that it is being acquired by LVMH: “There is absolutely no truth to the rumor and the company is not for sale,” the Gagosian spokesperson said in an email.

– Zara-owner Inditex is selling off its Russian division, including its store lease contracts in the country, to UAE-based Daher Group.

– Frasers Group has increased its existing stakes in Hugo Boss and British fashion e-commerce company ASOS to 32.8% and 5.1%, respectively.

– A Tod’s buy-out is proving to be complicated, with the founding family of Italian luxury shoemaker saying this week they are “ditching a planned buyout of the group after failing to reach the 90% ownership threshold needed to take it private,” per Reuters.