Hermès reported “very strong growth and exceptional results” for the first half of 2022, generating revenue of 5.48 billion euros ($5.59 billion) for the first 6 months of the year, up 29 percent compared to the first half of 2021 at current exchange rates and 23 percent at constant exchange rates. The Birkin bag-maker’s recurring operating income reached 2.3 billion euros (42 percent of sales), beating analyst expectations by almost 20 percent and topping its closest rival LVMH whose operating margin as a percentage of revenue for H1 was 41.4 percent, up by 0.6 points from the same period last year. As for the second quarter, Hermès’ sales amounted to 2.71 billion euros ($2.76 billion) – up 26 percent at current exchanges rates and 20 percent at constant exchange rates thanks to “a high level of activity in all the business lines.”

Looking at its results on a regional basis, Hermès stated that over the first half of 2022, “all the geographical areas posted strong growth,” with “strong resilience” from Asia, even in light of stringent COVID lockdowns in China. “Sales in the group’s stores (+23 percent) benefitted from the strengthening of the exclusive omni-channel network and online sales,” per Hermès, while “wholesale activities growth (+25 percent), resulted notably from the resumption of travel retail.” Sales in Asia (excluding Japan) – which accounted for 49 percent of H1 revenue – were up by 15 percent for the first half and “driven by a high level of activity” across the region and by sustained sales in Singapore, Australia and Korea.

As for the all-important Chinese market, which was effectively shut down for most of the second quarter, Hermès seems to have found its footing again more quickly than other rivals, revealing that its sales “strongly bounced back in June,” following store closures in April and May, especially in Shanghai and Beijing, and such demand carried into July. (For a point of comparison, LVMH’s chief financial officer Jean Jacques Guiony stated early this week that while LVMH saw improvement in terms of sales in China at the end of Q2, it was “not very significant” and store traffic is still “well below” this time last year. Meanwhile, Kering management said in a call this week that they were seeing “continuous improvement” in China in July but foot traffic has not resumed to normal levels yet.)

Hermès’ sales in the Americas, which made up 18 percent of total H1 revenue, were up by 34 percent year-over-year for the first half. Europe (excluding France) – which generated 12 percent of total revenue – was up by 34 percent, and France (+41 percent) “recorded sustained growth, thanks to the loyalty of local clients and the return of tourists, particularly in France, the United Kingdom and Italy.” And Japan posted “a remarkable performance,” which saw sales rise by 20 percent, “thanks to the loyalty of local clients.”

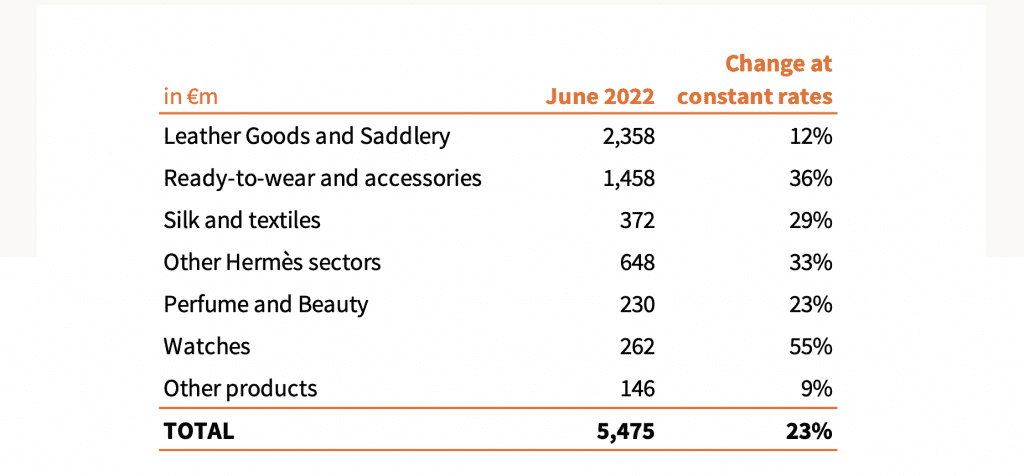

In terms of its business groups, Hermès pointed to a “remarkable increase” in Silk ( up 29 percent compared to the first half of 2021), Watches (+55 percent), and Other Hermès Business Lines, namely, Jewellery and Homeware (+33%). Its Leather Goods and Saddlery division – which is its biggest – generated 2.36 billion euros ($2.40 billion) in revenue (43 percent of total revenue for the group), an increase of 12 percent, which was driven by “sustained demand and the increase in production capacities [and which is] in line with the annual objective.” Perfume and Beauty, which was up 23 percent, gained from successful launches.

Looking beyond the first half of the year, Hermès management revealed that in June, sales were up by a double-digit percentage, and it expects a similarly successful performance for July. In terms of its recurring operating income for the second half of the year, management said in a call on Friday that they expect margins to sink as the company boosts spending on e-commerce and advertising, including in China. Still yet, production growth is on the horizon, with management pointing to five new leather goods workshops opening within the five coming years and noting that “capacity investments [are] strengthening in all business lines,” presumably a nod to the fact that the company is limiting production growth of its coveted leather goods to no more than 7 percent per year.

And in a final takeaway on the supply/demand front, Hermès CEO Axel Dumas said on the call on Friday that the company will not be wading into the secondary market any time soon. “It would be to the detriment of our regular client who comes to the store,” Dumassaid in response to an inquiry about the resale market. “We produce with one thing in mind, quality, if we don’t manage to have this in terms of know-how or beauty of materials, I prefer not to produce.” In a note on Friday, Bernstein stated that “demand for leather that is higher than supply” has placed limits on Hermès’ capacity, thereby, pushing “some customers to buy their products on the secondary market at higher prices and they sometimes end up with counterfeit products,” noting that “there is also a certain hypocrisy in the second-hand market today, in that many products sold are new and unused.”