A growing number of lawsuits over non-fungible tokens (“NFTs”), including the case that Nike filed against StockX over its use of Nike trademarks on NFTs tied to hot-selling sneakers, are beginning to test the nature of these novel digital assets. In the Nike case, which was filed in a New York federal court in February, the distinction between virtual products and otherwise value-less digital receipts is the critical one when it comes to identifying what StockX’s Vault NFTs are. Nike has argued that the NFTs are “virtual products, i.e., digital collectibles, created and first offered for sale by StockX, and available direct to consumers for purchase and trade on the StockX website and StockX app.” Meanwhile, StockX has argued that its Vault NFTs “are absolutely not ‘virtual products’ or digital sneakers,” and rather, serve as a “claim ticket, or a ‘key’ to access ownership of the underlying stored item.”

While the lawsuit raises some novel questions that should shed light – and provide guidance – as an increasing number of brands look for ways to adapt their existing models for a Web3-focused world, Nike’s trademark infringement and dilution, and unfair competition lawsuit over StockX’s NFTs is also striking because it carries with it into the virtual world many of the same concerns that brands routinely argue in lawsuits over tangible goods in the “real” world, including issues of control, competition, and authentication, among others.

One of the most immediate qualms that Nike has with the Vault NFTs that are being offered by StockX – which has allegedly used Nike’s famous marks to “garner attention, drive sales, and confuse consumers into believing that Nike collaborated with [it]” for the NFT venture – appears to be one of control. Specifically, StockX is offering up the Nike trademark-bearing NFTs, while simultaneously robbing Nike of the ability to exert control over the sale and conditions of those NFTs.

An Exercise in Control

Nike’s problem is reflected in no shortage of language in its complaint, including its claim that “despite StockX’s prominent use of Nike’s trademarks and products in connection with the Vault NFTs, Nike has no control over the quality of the Vault NFTs whatsoever.” The Beaverton, Oregon-based titan also asserts that it “has no say in how many Vault NFTs bearing its trademarks are released, where the Vault NFTs are released and traded, when the Vault NFTs are released, how the Vault NFTs are released, traded, or redeemed, and at what price the Vault NFTs are sold and traded.” Clearly, these are pain points for Nike – and (maybe) rightfully so.

(While brands are generally forced to give up the right the control if/how their products are resold once they release them into the market (this is the tenet at the heart of the first sale doctrine), there are limits in instances where the products being resold – or the conditions in which the products are being resold – are “materially different” than they initially were. Nike has already suggested that is the case here given that StockX is bundling the sneakers (the original products that Nike released into the market) with NFTs, the latter of which “may take a variety of forms, and the holders of NFTs may be entitled to obtain certain products, benefits or engage in certain experiences, such as unlocking a prize or entry into an exclusive sale,” according to StockX’s terms.)

The idea that brands want to carefully control the conditions in which their products are sold is a well-established one. A brand’s ability to control where its products are sold and the terms/conditions of such sales is “critical to its ability to preserve brand equity, maximize profitable e-commerce channel growth, and prevent damaging e-commerce conflicts with its brick-and-mortar business,” among other things, according to Vorys partner Daren Garcia. As such, this is an issue that has come up in a variety of cases in recent years, in particular, as brands look to regain some of the control they that have ceded as a result of the rise of various sales/distribution channels, including the burgeoning resale market.

One need not look further than some of the lawsuits that Chanel has waged against resale entities for an indication that the ability to control how and where their products are sold is something that is important to luxury brands – and even more mass market brands like Nike, which is in the midst of prioritizing its direct-to-consumer distribution following decades of relying heavily on a robust wholesale network.

Chanel demonstrated the concerns of many similarly-situated brands on this front in a since-settled case that it waged against Crepslocker, in which it argued that the British reseller was running afoul of the law by offering up Chanel goods in conditions that were damaging to its wildly valuable brand image. This included shipping Chanel products in packaging that diverged from Chanel’s standards; offering up products in accordance with terms that differ from those observed by Chanel (Crepslocker’s no-return policy and its requirement that consumers pay via PayPal (and not credit card) were cited by Chanel as examples of this); and using Chanel’s trademarks alongside “sportswear and other brands, which do not have similar associations of luxury, prestige, exclusivity, and longevity to those enjoyed by [Chanel].”

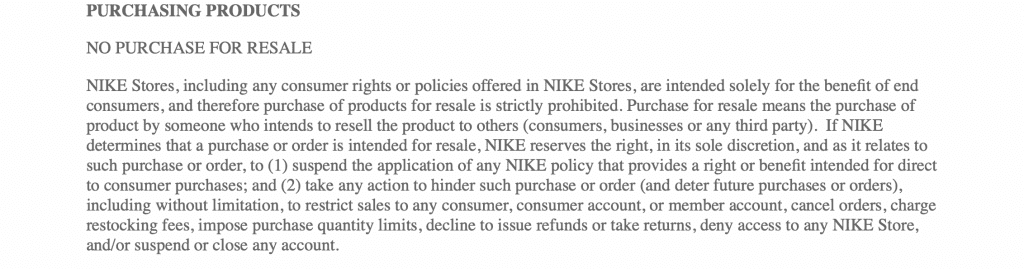

At the same time, brands are increasingly taking actions, including by placing quotas on certain products and/or adding resale-specific language to their terms to websites and receipts, in order to deter resale. Hermes, for example, includes language in its e-commerce terms stating, “The customer represents and warrants that they are purchasing Hermès product in our boutiques for their personal use. Therefore, you agree you will not, directly or indirectly, resell Hermès products purchased in our boutiques for commercial purposes.” More recently, Nike added resale-specific language of its own to its terms, stating, among other things, that “NIKE Stores, including any consumer rights or policies offered in NIKE Stores, are intended solely for the benefit of end consumers, and therefore purchase of products for resale is strictly prohibited.”

Such quests for control – and the arguments that come along with them – do not appear to be a million miles away from Nike’s claims in the StockX case, which seem to stem largely from its inability to control the nature of the Vault NFTs, including the “murky terms of purchase and ownership,” which have allegedly “already led to public criticism of StockX and allegations that [its] Vault NFTs are a scam.” (StockX has, of course, disputed this, pointing to the successful completion of 2,853 Vault NFT transactions since the launch of the NFT venture in mid-January.

Issue of Authentication

At the same time, the critical element of authentication – and the advertising of “authenticated” products – often comes hand-in-hand with brands’ pushes for control, and it has come up in Nike v. StockX, with the sportswear behemoth taking issue with the fact that that StockX “touts each Vault NFTs as ‘100% Authentic.’” According to Nike, StockX is making use of such declarations in order to “explicitly mislead consumers that Nike has authorized, approved, sponsored, and/or endorsed StockX’s Vault NFTs,” when no such affiliation or authorization is at play. (Nike amended its complaint to double down on this issue, adding a false advertising claim to the mix in May.)

Again, this is not new. In its case against The RealReal, for example, Chanel has pushed back against the reseller’s widespread promises of authenticity. Chanel has argued that The RealReal’s alleged authentication experts are “not properly qualified or trained in authentication of Chanel products to support [TRR’s] claims as to the genuineness of the products it resells.” And beyond that, Chanel has claimed that The RealReal has no business guaranteeing authenticity of Chanel goods, as “only products purchased directly from Chanel and its authorized retailers can be certain to be” – and thus, be advertised as – “genuine and authentic.”

In one more thing worth flagging, the recurring “real” world issue of marketplace operator liability is likely to come up as Nike’s lawsuit over the Vault NFTs proceeds (and potentially future cases against NFT marketplaces like OpenSea), with the Swoosh already contending that “unlike the eBay model, StockX is an active intermediary for each transaction – the seller ships the item to StockX, StockX receives and purportedly verifies the item’s authenticity, StockX then ships the item to the buyer with a StockX-branded verification badge, and StockX pays the seller (less its transaction fees).” As such, Nike may be setting the stage for an argument, should StockX seek to shield itself from liability on the basis that it is merely a marketplace operator and not a seller, which has been the go-to defense for the likes of Amazon.

THE BOTTOM LINE: The growing number of trademark lawsuits that center on NFTs is giving rise to an array of novel questions, including ones that might require courts to make precedent-setting determinations about the very nature and purpose of NFTs (digital receipts versus virtual products) and that could have a significant effect on things like the likelihood of confusion analysis. All the while, we should not overlook the fact that these cases still largely revolve around well-established “real” world, brand-centric issues, which these cases are bringing into the virtual realm.

This article was originally published in April 2022, and has been updated to include a mention of Nike’s new resale-centric rules.