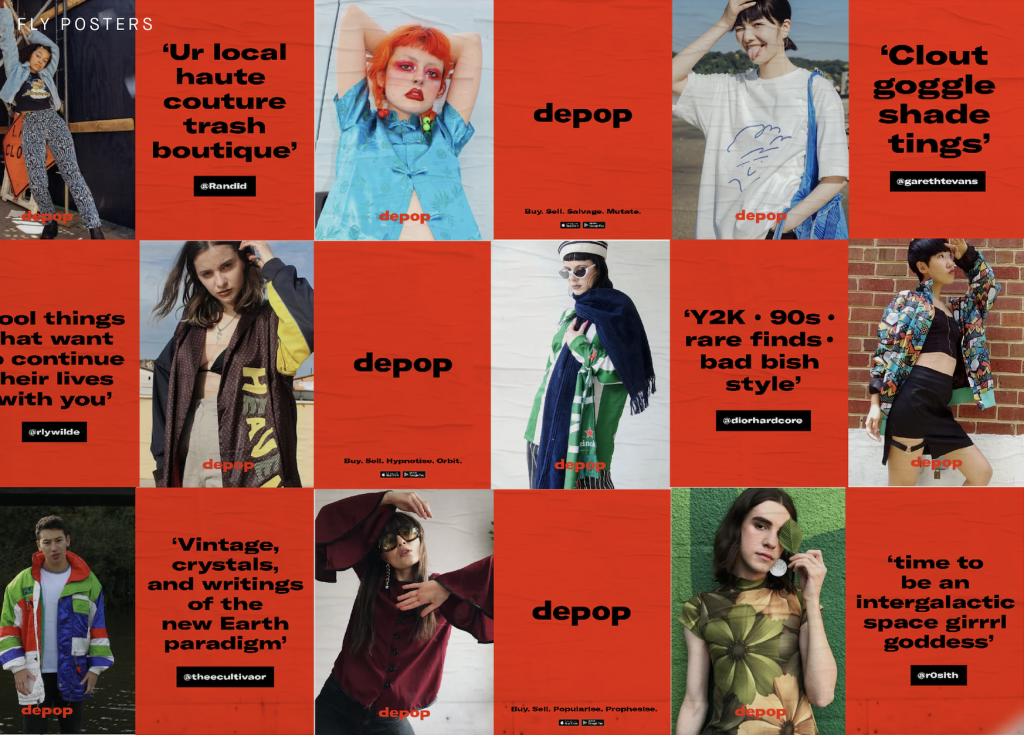

In a quest to target Gen-Z consumers (i.e., those born between the late 1990s and the early 2010s), who are driving both social shopping and largescale pushes in sustainability, Etsy announced that it will acquire burgeoning British shopping app Depop for $1.62 billion. Since its founding in 2011, London-based Depop has made its name in the pre-owned fashion space, garnering some 30 million registered users across 150 countries who can buy and sell apparel and accessories by way of its consumer-to-consumer e-commerce marketplace. In a statement on Wednesday, Depop CEO Maria Raga said that Depop is different from its many peers in that it is “where the next generation comes to explore unique fashion and be part of a community that’s changing the way we shop.

The newly-announced acquisition of Depop – which makes use of a social shopping element that positions it as a “mix of eBay and Instagram” – gives Etsy access to a sweeping pool of younger consumers, with the Brooklyn, New York-headquartered e-commerce marketplace asserting in a statement on Wednesday that more than 90 percent of Depop’s users are under age 26. (That is distinct from Etsy’s user base, which consists primarily of millennial consumers.) Calling it the “resale home for Gen-Z consumers,” Etsy further noted that Depop is the tenth most-visited shopping site for Gen Z consumer in the U.S., thanks, in large part to what Etsy CEO Josh Silverman said is “a vibrant, two-sided marketplace with a passionate community, [and] a highly-differentiated offering of unique items.”

Privately-held Depop recorded revenue of $70 million in 2020, up 50 percent on a year-over-year basis, according to the Wall Street Journal, while its gross merchandise value – the metric that reflects the total value of the pre-owned goods sold – has been growing at an annual rate of nearly 80 percent from 2017 to 2020.

THE BROAD VIEW: The Etsy-Depop deal comes as the pre-owned apparel market continues to grow at a compound annual growth rate of 39 percent, putting it at an estimated valuation of $64 billion by 2024, which is twice the size of fast fashion market. Resale platform ThredUp puts the size of the market at $80 billion by 2029, up from $28 billion in 2019 when sales of secondhand clothing were growing 21 times faster than conventional apparel retail. It also joins a recent flurry of investments in the resale space, which as Bloomberg’s Andrea Felsted recently noted, “underlines the current vogue for vintage and secondhand apparel – including anything from bootcut jeans to Gucci loafers,” a push that has been led in large part by demand from eco-conscious and budget-conscious millennial and Gen-Z consumers across the globe.

Expected to close in Q3 of this year, the $1.6 billion transaction follows from a number of headline-making fundraising rounds in the resale space. In recent months, consumer-to-consumer resale platform – and Lithuania’s first-ever unicorn – Vinted raised $303 million; second-hand fashion platform Reflaunt secured nearly $3 million in funding; and Thrilling – a startup that connects brick-and-mortar secondhand/vintage stores across the U.S. with eager consumers by way of its e-commerce platform – welcomed an $8.5 million investment. And not to be overlooked, Kering and American investment firm Tiger Global Management revealed in March that they were leading a new funding round that sees secondhand marketplace Vestiaire Collective bring in $216 million in new funding. On a public scale, resale platforms Poshmark and ThredUp both made initial public offerings this year.

Questions abound as to whether resale will maintain the momentum that it enjoyed during pandemic lockdowns. Poshmark founder and CEO Manish Chandra, for one, is optimistic, telling Fast Co. that “more Americans than ever are shopping secondhand” and that he “expects that as people have discovered buying and selling secondhand,” with many shopping in a resale capacity for the first time during the past year, “they are going to stick with this behavior.”