Amid widespread pushes by fashion industry participants aimed at getting a handle on the seasonal runway schedule, and the incessant push to create and show new garments and accessories, independently-owned brands and big-name brands – like Gucci and Saint Laurent – alike, have said that they are looking to go back to the drawing board. Gucci creative director Alessandro Michele, for instance, asserted in a statement last month that the Milan-based powerhouse will opt out of “the worn-out ritual of seasonalities and shows.”

Routinely responsible for the bulk of Kering’s annual revenues (it generated $10.7 billion of parent company Kering’s $17.5 billion in annual sales for 2019), Gucci is by far the biggest name in the fashion industry thus far to throw its hat into the ring and agree to take part in the rewriting of the fashion system. The move by Gucci comes just weeks after fellow Kering-owned brand Yves Saint Laurent revealed that it will not present its collections “in any of the pre-set schedules of 2020.”

The Paris-based brand, under the control of creative director Anthony Vaccarello and chief executive Francesca Bellettini, said in a statement in late April that it will move away from the traditional fashion month calendar in furtherance of an attempt to “take ownership of its calendar and launch its collections following a plan conceived with an up-to-date perspective, driven by creativity.”

The announcements by Gucci and Saint Laurent were striking, as they lend major credence to efforts by many smaller brands and retailers to find ways for the multi-trillion dollar fashion industry to “become more responsible for our impact on our customers, on the planet and on the fashion community, and bring back the magic and creativity that has made fashion such an important part of our world,” as one group’s open letter asserted last month. This has largely included a call for alterations to the seasonal calendar, as well as emphasis on producing “less unnecessary product,” engaging in “less travel,” “making use of digital showrooms in addition to personal creative interactions, and reviewing and adapting fashion shows.”

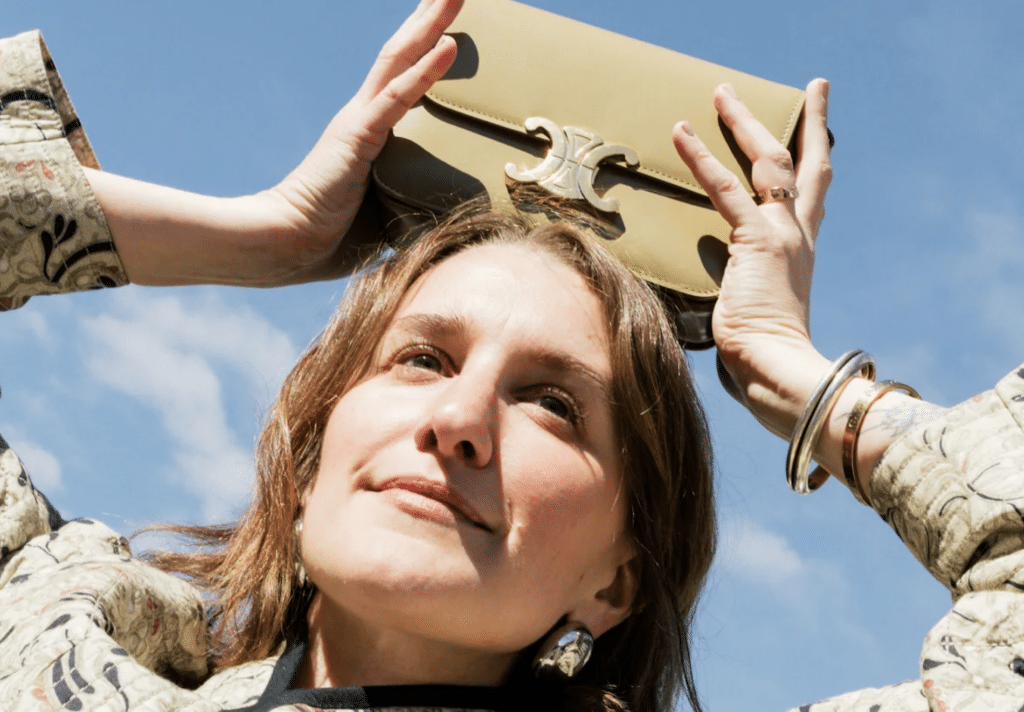

Noticeably absent from the list of brands that are looking to alter the current system are the many brands owned by rival conglomerate LVMH Moët Hennessy Louis Vuitton, such as Louis Vuitton, Dior, Celine, Loewe, and Givenchy, among others, which has not waded into the conversation. And as of this week, the industry’s second largest individual brand (by annual revenue) – Chanel – has plainly said that it will not be conforming to bid to adopt changes to its multi-annual runway show calendar.

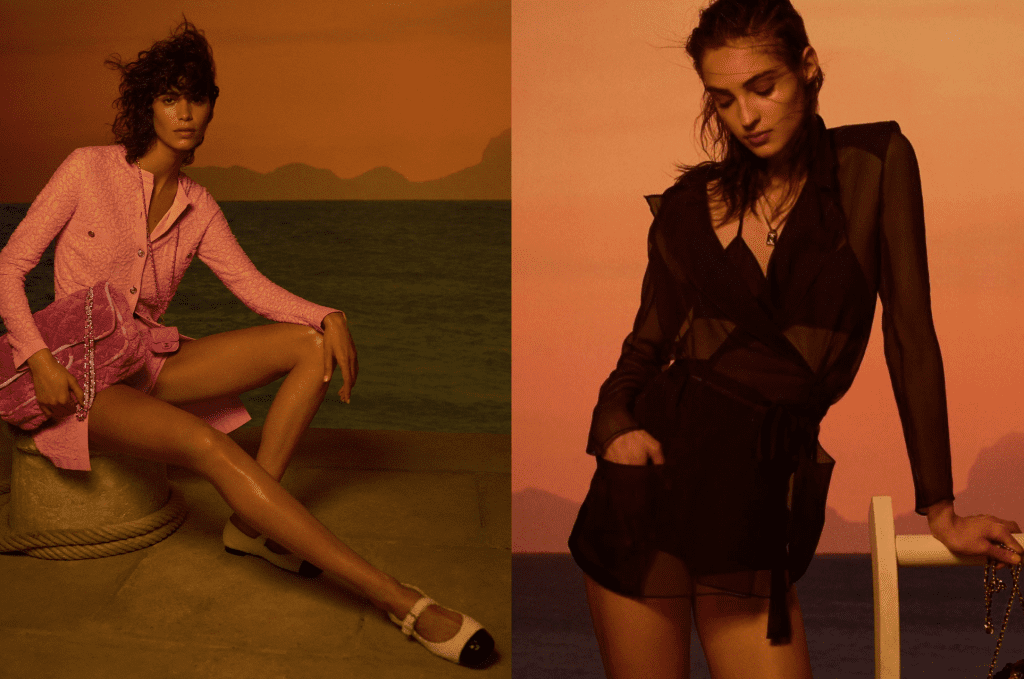

In an interview this week, Bruno Pavlovsky, president of fashion and president of Chanel, told WWD that Chanel’s system of creating six ready-to-wear collections a year – or better yet, “eight, if you count the Coco Neige and Coco Beach capsule ski and swimwear lines,” per WWD – works for the 111-year brand. “We prefer to have six more focused [main] collections rather than two endless collections,” Pavlovsky says. “We chose this rhythm and we like it, and we believe it’s what our customers want to see in our stores. So, we are sticking to this schedule.”

More than that, the Chanel executive says that the Paris-based brand will not be forgoing any of its traditional fashion shows, noting that “the fashion show remains the best way to express the brand’s creativity and know-how.” In fact, Pavlovsky says the brand hopes to resume its runway shows in October.

As for what changes are afoot, there is likely to be some scaling back. “We are entering into a slightly different period, probably more intimate, yet just as rich in terms of client relationships,” Pavlovsky notes, reflecting on Chanel’s notoriously over-the-top runway shows, which have seen the brand build a working rocket ship, a life-size grocery store, and even a makeshift beach (complete with sand … and water) inside of the sweeping Grand Palais in Paris. The brand’s annual runway schedule also regularly sees it traipse the globe – popping up in Havana, Dubai, Miami, Venice, Shanghai, and Singapore, and bringing hundreds of journalists, editors, influencers, celebrities, and top clients along with it, and raising questions about sustainability in the process.

The house’s creative director Virginie Viard says that going forward, Chanel’s runway presentations “will necessarily be on a smaller scale.” She says that the otherworldly sets that came with former creative Karl Lagerfeld’s tenure were “great … but now it no longer makes sense.” She says that she does, in fact, “want to go back to fashion shows,” and “will always travel if we can.”

One other way that Chanel is refusing to change course? E-commerce. While other, similarly-situated brands are readily focusing more on online shopping, as COVID-19 mandates have forced brick-and-mortar stores across the globe to temporarily shutter and as border closures have brought international travel (and the shopping associated with it) to an abrupt halt, Pavlovsky says that Chanel will stick to its current model, which sees it offering up only eyewear and cosmetics online.

“No, we are not going to launch e-commerce. It works very well this way,” he asserted. “Maybe we could sell a third more bags by doing it online, but we are taking a long-term view of the brand. We are not aiming for an immediate return on investment on this kind of thing.”