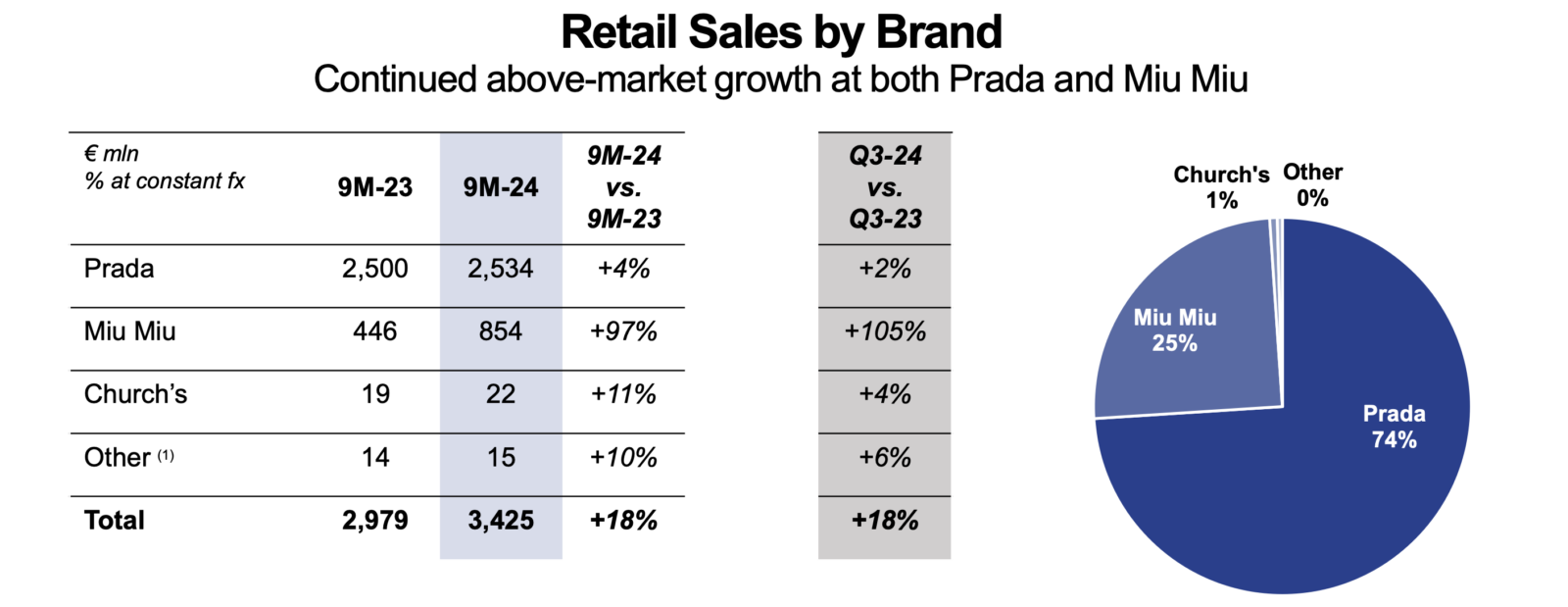

Milan-based brand Miu Miu is not just defying the current slowdown in luxury goods sales, it is growing significantly. Q3 sales for the Prada Group-owned brand “exceeded” the group’s expectations, Prada CEO Andrea Guerra told analysts this week. He noted that Miu Miu – which saw revenue grow by 105 percent in Q3 compared to the same 3-month period last year – is currently responsible for one quarter of the group’s total retail sales. (For reference, Prada reported a 1.7% increase in sales for the quarter.)

Founded in 1993 by Prada creative director Miuccia Prada, Miu Miu has stepped out of the shadow of its older (and bigger) sibling brand, Prada, by way of “it” products – namely, its Wander and Arcadie bags, 530 SL sneakers (the result of a collaboration with New Balance), and branded tops and mini-skirts.

In latest financial report, Prada Group touts the “sharp positioning” of Miu Miu, which it says is “built on strong and distinctive identity.” Against that background, it is worth noting that the company relies exclusively on its stylized MIU MIU wordmark and does not have a logo or monogram, evidence (at least anecdotally) that a company need not have a logo or repeating pattern a la Louis Vuitton to build a sizable business. (For a dive into what “it” branding looks like in 2024, you can find that here.)

A few standouts points regarding Miu Miu from Prada Group’s Q3 earnings call (courtesy of Bernstein’s Luca Solca) include …

> Management wants to sustain strong growth through 2027. Triple-digit growth will be hard to maintain, but Miu Miu remains quite small on an absolute level, and the U.S. is under-penetrated and a source of future growth.

> Manufacturing will not be a roadblock for growth. They have more capacity, but taking a measured approach, so they don’t flood the market with product.

> Miu Miu growth by category is balanced. Leather goods have been strong in the last 24-30 months. They cover the desires of 60-65% of consumers in leather goods.

> Wholesale is a very small percentage of Miu Miu’s business. It is used to cover regions where they have a weaker retail presence (e.g. U.S. department stores).

Not only are Miu Miu’s sales painting a clear picture of demand for the company’s offerings, Lyst’s Q3 ranking of the world’s “hottest” brands, which was released last month, put Miu Miu back in the number one spot. “As global demand for Miu Miu’s distinctive alt-girl aesthetic continues to accelerate, searches jumped a further 30% quarter on quarter,” per Lyst, which noted that “Miu Miu girls and boys are wishlisting the $3050 Arcadie bag, this quarter’s fourth hottest product.”

Lyst similarly sung Miu Miu’s praises in Q1 of this year, stating that “Miu Miu is outperforming the market, delivering brand heat plus cultural weight that sets it apart in the eyes of the fashion shopper; playful, unique styling and must-have viral products cement Miu Miu firmly on top of the table.”

Once a cottage industry of individuals that catered to Chinese consumers angling to avoid added taxes and growing price tags on luxury goods, the gray market – or daigou – is growing up. It “should be thought of less as an army of individuals,” as the practice has spawned “big organizations that are able to make money through razor-thin margins at scale,” Thomas Piachaud, head of strategy at China-focused consultancy Re-Hub, said reflecting on the current state of the parallel import market.

And sales in this market are growing: Daigou sales rose 23% in the first half of this year compared with the same period in 2023, per Re-Hub.

Given that “a Moncler puffer jacket can cost about a third less from a daigou,” according to the WSJ, and a Cartier Love Ring sells at a 37% discount to official prices on average, daigou trade presents significant challenges for luxury fashion brands.

This is causing concern among brands, which Denton’s addressed in a recent note, stating that, among other things, “Luxury brands can mitigate risks posed by daigou trade channels by tightening their supply chain controls and revising their wholesale relationships. For example, brands can incorporate buyback provisions into their contracts with retailers to prevent surplus goods from being resold through unauthorized channels. These provisions would give the brand the right to repurchase unsold goods, thereby controlling where and how the products are resold.”

In addition to supply chain controls, the firm’s Daniel Schnapp, MAry Kate Brennan, Aleksandra Sitnick, and Caen Dennis assert that “brands can utilize advanced monitoring tools to detect counterfeit products,” as well as the sale of authentic goods in “unauthorized channels.” This can include engaging in “active online monitoring by monitoring platforms such as Taobao, WeChat, DeWu, and YMatou to track gray market and counterfeiting activities,” alike. Monitoring may also take the form of “digital tracking mechanisms, such as RFID tags or blockchain-based systems, to … trace [products’] movement through the supply chain.”

Shopify released its “Luxury Retail Trends: The State of Luxury Retail in 2025” report this week, in which it shares “key trends in the luxury sector, so you can drive foot traffic to your physical stores and increase online sales.”

The e-commerce services provider set the stage in its report by stating that online sales in the luxury market are expected to reach $91 billion by 2025, which means that there is “plenty of opportunity for brands to sell superior goods at premium prices.” However, consumer preferences are “constantly evolving,” it says. This means that companies need to consistently consider how they can be better catering to buyers, including those in younger demographics, as “luxury brands are seeing a dramatic shift in their customer base, with consumers under 40 now representing 40% of the market, overtaking the historically dominant older demographic.”

*We recently dove into how companies – from Patagonia and Coach to Destree and Marc Jacobs – are appealing to younger generations of consumers by way of their branding.

Among some of the key trends cited by Shopify are …

> Recommerce and buyback programs – Consumers use resale schemes to buy luxury items at a discounted price. One in 10 global consumers actively buy second-hand luxury goods. It’s especially prominent in niches like luxury watches. Per BCG research, resale watches account for 30% of the luxury market’s total value—even outpacing new watch sales.

*For a look at how one luxury brand, Rolex, is taking ownership over the secondary market, you can find that right here.

> Sustainability at the core – As Federica Levato, partner at Bain, says, “Brands must purposefully rethink their value propositions by maintaining and expanding their audience reach as well as continuing to deliver exceptional experiences, while nurturing their value propositions across all price points, to build lasting consumer loyalty that goes beyond mere desirability.”

> Storytelling through founder-generated content – Founder-generated content is a relatively new term that puts store owners at the forefront of your marketing content. It’s a great way to cater to the 70% of consumers who feel more connected to a brand when its CEO is active on social media.

> Shoppable educational content – Global luxury brands like Chanel, Gucci, and Net-A-Porter are leaning into short and snappy video content to meet the new wave of high-end consumers buying luxury goods through TikTok.

> Immersive augmented reality experiences – Rebecca Minkoff found that shoppers are 44% more likely to add an item to their cart after interacting with it in 3D. They were also 27% more likely to place an order.