In much the same way as trends on the runway are constantly evolving, the legal strategies of the fashion industry’s leading brands and conglomerates are consistently in-flux. According to a new report by TrademarkNow, the industry has experienced a peak in luxury goods-related intellectual property (“IP”) protection (the report’s Top 5 Clothing, Apparel & Luxury Goods companies applied for more than 6400 marks around the world during 2016), and a more globally diversified playing field – both in terms of competition and in companies’ vies for IP protection.

Fashion and Luxury

As set forth in the report, entitled, Trademarks, Now: Trademark Industry Review Q1 2017, LVMH Moët Hennessy Louis Vuitton SE; Victoria’s Secret’s parent company L Brand Inc.; VF Corporation (which owns Wrangler and Lee, Timberland footwear, Nautica sportswear, and The North Face); Gucci, Balenciaga, and YSL’s parent Kering; and Richemont, which owns Cartier, Chloe, and Alaia, top the list of most active trademark-filers – in that order – in terms of luxury goods and apparel brands.

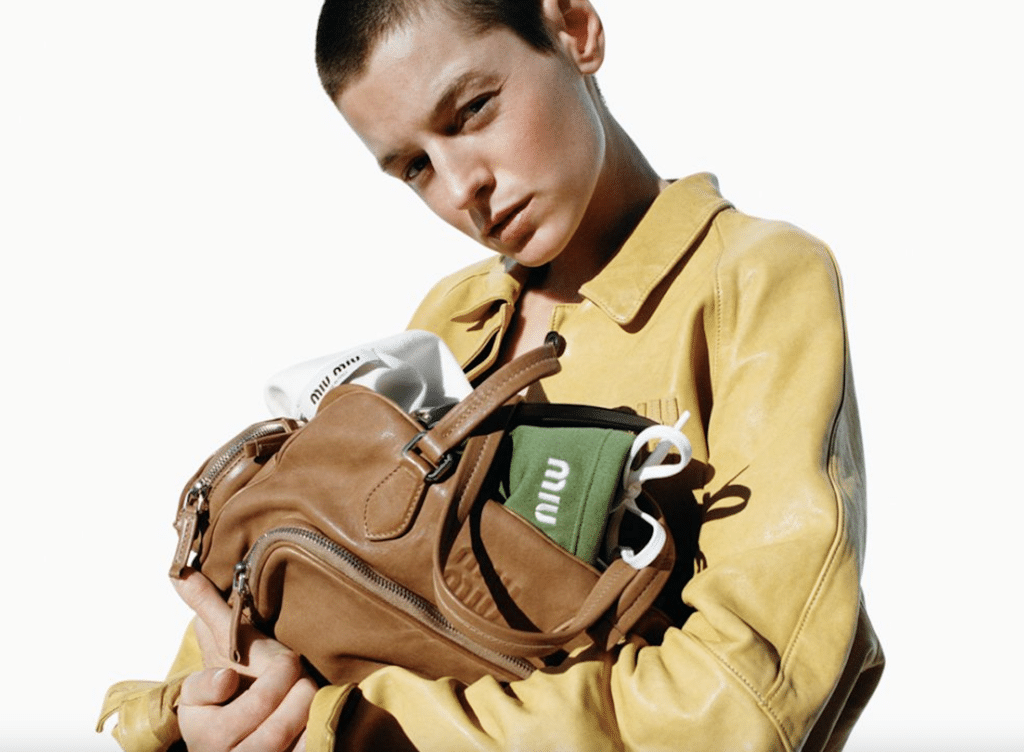

Of those companies, cosmetics-related trademarks continued to dominate in 2016. Accordingly, “While the top 5 companies in the Clothing, Apparel & Luxury Goods space obviously have varied areas of focus in terms of products, Leather Goods (trademark Class 18) has shown consistent growth in trademark applications over the past five years among these companies. Cosmetics (Class 3) and Jewelry, while still a larger fraction of the total product mix, have had a flatter growth in trademark filings.”

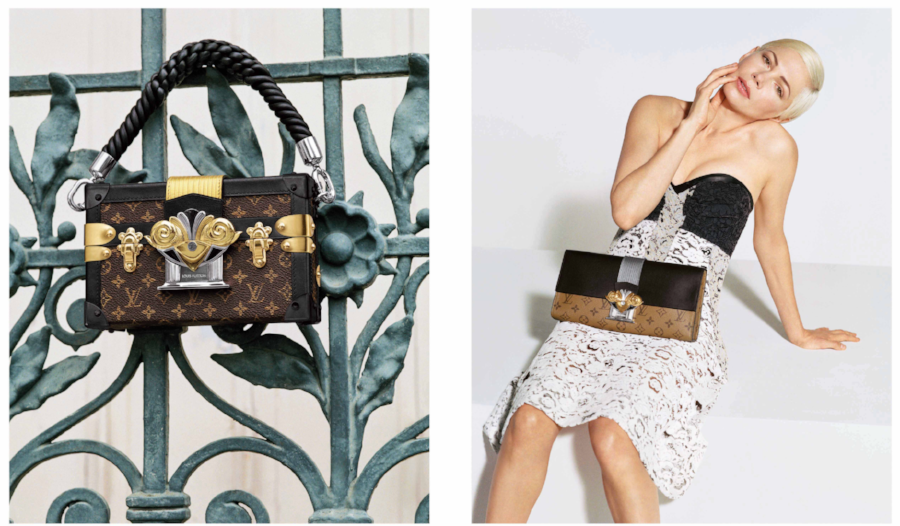

LVMH, which recently welcomed Dior under its umbrella of brands that range from Louis Vuitton, Givenchy, Celine, and Marc Jacobs to an array of wine and spirits brands, among others, took the top spot on TrademarkNow’s list of luxury brands. The Bernard Arnault-owned firm took the still-noteworthy no. 12 spot on the overall list, as the “Paris-based diversified luxury goods group is a perennial powerhouse in trademarks, having applied for more than 2100 marks around the world in each of the past three years. In terms of regions, its greatest number of applications in 2016 were led in China, the United States, France, and Mexico.”

While LVMH has reported significant growth within its cosmetics divisions, thanks to the introduction of a range of Louis Vuitton fragrances last year and the sustained consumer interest in Givenchy cosmetics, as well as the group’s ownership of Sephora and other industry-specific companies, cosmetics decreased as a fraction of its overall mark applications during 2016. The number of trademark applications citing Leather Goods and Jewelry, on the other hand, increased.

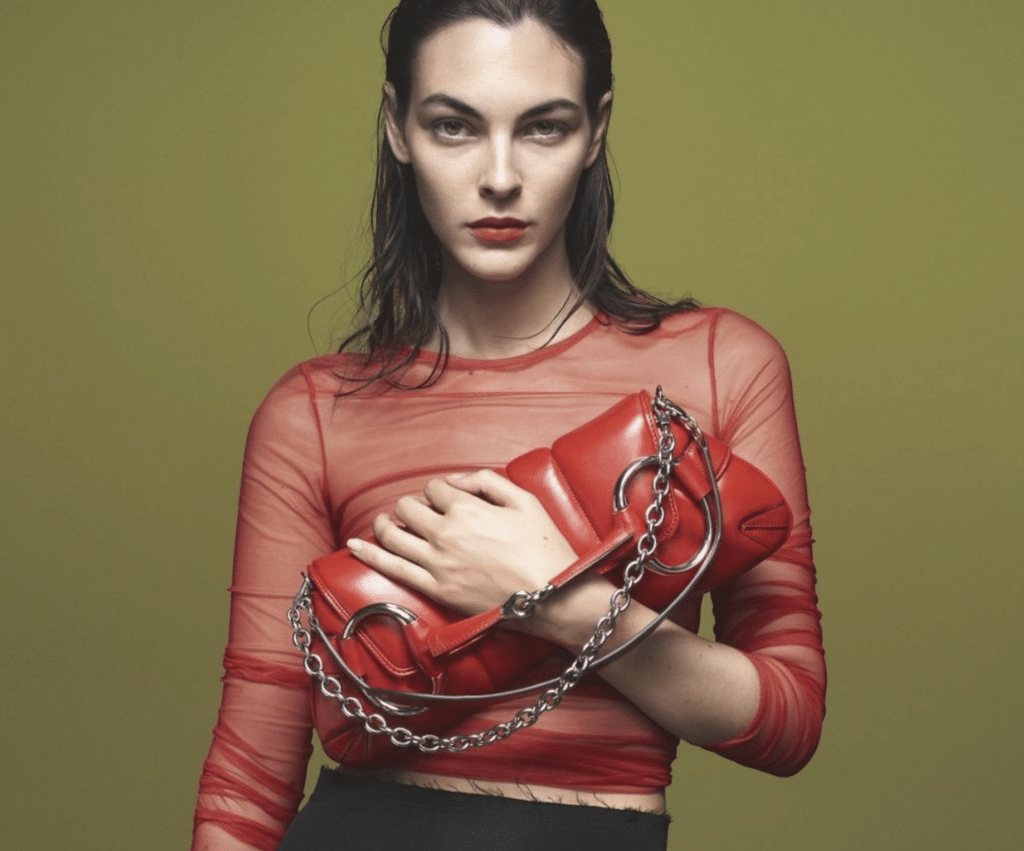

Meanwhile, LVMH’s most direct competitor, Kering, which took a luxury goods ranking of no. 4 and an overall ranking of no. 54, applied for over 800 new trademarks around the world in 2016 – “somewhat less than it did in 2015 (when it filed more than 1200).” Leather goods and jewelry were Kering’s top product classes in 2016, with fragrances taking a backseat.

Regionally, the Kering’s top focus continued to be on China, which is right on trend, as “China was by far the highest-activity trademark office among the Top 5 companies in the Clothing, Apparel & Luxury Goods sector in 2016, continuing (and expanding on) a trend that is several years in the making. Hong Kong filing activity has also dramatically increased among these companies over the past couple of years.”

Still yet, Cartier’s parent Richemont “slowed its overall filing activity significantly in 2016 versus the prior year.” Jewelry marks – namely, watches – remained the company’s top focus, but represented a proportionally smaller share of its total trademark filings in 2016 versus past years.

Not surprisingly, “China, Hong Kong, the U.S., and South Korea were Richemont’s top regions for trademark filings for the year.”

Global Trends

In a broader sense, of all the companies survey by TrademarkNow, the largest-volume trademark classes in 2016 were those within the “always-busy broad business-oriented categories” (e.g., Advertising & Business; Research & Development), and the prominent Technology/ Media/Telecom categories (Electrical & Scientific Devices; Education & Entertainment). “Clothing and Pharmaceuticals & Medical Supplies also placed near the top,” according to the report.

China took the top spot on terms of trademark filing activity. “The State Administration for Industry and Commerce (SAIC) in Beijing accepted 3.7 million trademark applications during the year, a 29% increase over 2015 and more than seven times(!) the filing volume of the second-busiest trademark office, the U.S. Patent and Trademark Office.” Following behind China and the U.S. was India, Japan, South Korea, Brazil, Mexico, European Union, Turkey, France, and Australia – in that order.

As for the “50 Fastest-Growing Trademark Portfolios,” Chinese social media and internet technology giant Tencent, which recently became the world’s tenth-most valuable public company, took the top spot in the world during 2016, with more than 4000 applications filed.

Per TrademarkNow, “Korean technology manufacturer LG Electronics was second in portfolio growth, with over 3600 filings; media titan Time Warner was third, with over 3500. Pharmaceuticals and medical devices conglomerate Johnson & Johnson and global cosmetics company L’Oreal rounded out the top five.” As previous noted, LVMH took the no. 12 spot (filing 2,100 application, an increase of 4% compared to 2015), Victoria’s Secret’s parent company L Brand Inc. took the no. 45 placement (filing 922 applications, an increase of 60%), and VF Corporation came in at no. 49 (filing 840 applications, down by 91%).

A few other notable place-holders: Apple at no. 15 (filing 1,800 applications, down by 62%), Chinese e-commerce giant Alibaba at no. 18 (filing 1,700 applications, down by 95%), Japanese cosmetics giant Shiseido at no. 31 (filing 1,300 applications, down by 94%), Abercrombie & Fitch Co at no. 42 (filing 973 applications, a 5% increase, and Amazon at no. 50 (filing 837 applications, an increase of 15%).

As for some of TrademarkNow’s key takeaways from the 2016 report is that not much has changed in terms of what companies are topping its list and filing the most applications: very big, multi-national, largely western companies, which are “seeking to protect their brands in both large economies and the newly-industrialized economies. More specifically: we see lots of huge American, European, Korean, and Japanese firms protecting themselves both in their traditional ‘G20’ markets and in the trademark boomtowns of China, India, Brazil, Mexico, and Turkey – among others.”

At the same time, however, “we are also witnessing the exponential growth of trademarked brands (and, thus according to recent studies, an explosion of innovation) within the newly-industrialized economies themselves.”