Analysts predicted that Tiffany & Co. would shoot own the initial, unsolicited $14.5 billion takeover bid that LVMH Moët Hennessy Louis Vuitton made last month, and according to Reuters, they were right. Citing sources close to the matter, Reuters reported on Wednesday that “Tiffany’s board decided that LVMH’s $120-per-share, all-cash bid was too low to become the basis for negotiations,” and instead, an offer closer to $16.9 billion or $140 per share, a price that the American jewelry stalwart’s shares reached last year, is “key to reaching a deal.”

LVMH “remains engaged and is considering a new offer,” per Reuters as it looks to bolster the smallest division under its sweeping ownership umbrella: jewelry. The Paris-based luxury goods conglomerate – which owns 75 different brands ranging from fashion houses like Louis Vuitton, Dior, Givenchy, and Fendi to spirits companies, such as Veuve Clicquot and Moet – is relatively light when it comes to “hard luxury.” Its Watches & Jewelry division consists of Bvlgari Chaumet, FRED, Hublot, TAG Heuer, Zenith, and 99-year old Italian jewelry brand Repossi, upping its stake latter this year from 42 percent to 69 percent.

Not only would a Tiffany & Co. acquisition enable LVMH to make greater inroads into the $20 billion global jewelry market, which was “one of the strongest performing areas of the luxury industry in 2018,” according to consultancy Bain & Co, and “increase LVMH’s exposure to the bridal and diamond category, as well as to U.S. luxury shoppers,” according to Reuters, it would serve as part of what the Guardian characterizes as “the latest in a wave of consolidations in the luxury goods industry that is tilting towards the ‘Fuerdai’ – a new generation of wealthy Chinese consumers.”

Last month, Tiffany & Co. CEO Alessandro Bogliolo spoke to the importance of the burgeoning Chinese market on its bottom line, noting that the company has seen a rise in Chinese spending as sales in the U.S. have taken a turn, due in part to increased spending by Chinese consumers at home. In an effort to increase domestic consumption, the Chinese government cut the average 15.7 percent tariffs on imported luxury goods to just 6.9 percent last year, thereby, incentivizing Chinese natives to curtail their pattern of seeking less expensive luxury goods beyond the borders of the mainland.

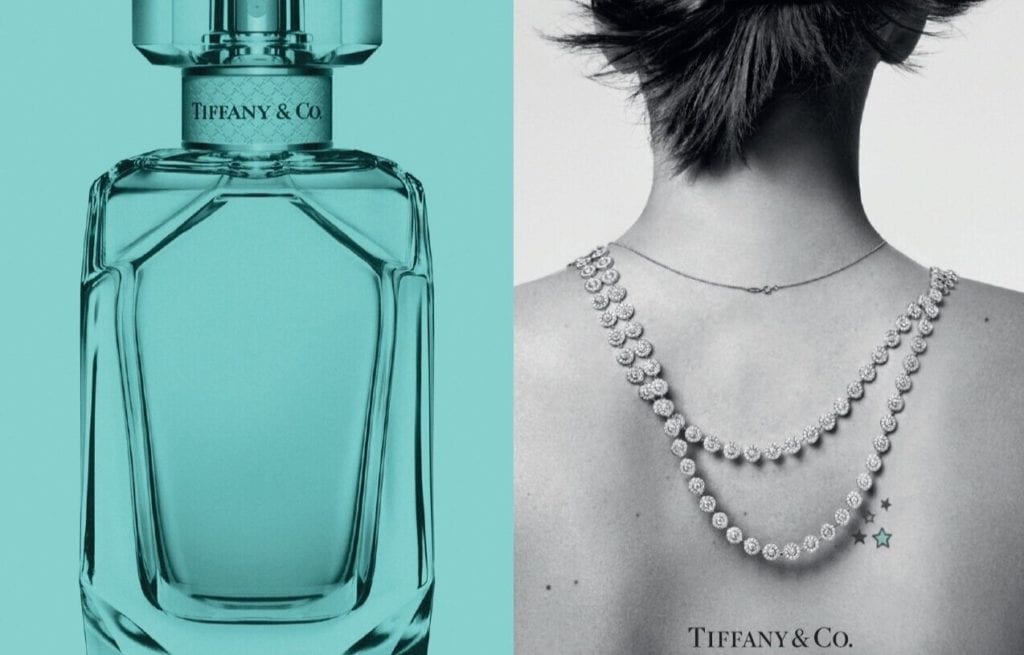

Bogliolo said that Tiffany & Co. – whose shares were trading close to $127 on Monday – has moved some of its most expensive pieces, including diamond necklaces valued at more than $1 million, to mainland China in furtherance of the company’s practice of “following our customers where they shop.”

As for whether other bidders are expected to come to the table, UK-based Money Week reported late last month that immediately after the news of LVMH’s bid went public, “Tiffany’s share price shot up by more than 30 percent to $130, well above the $120 LVMH is offering, in expectation that a rival will enter the fray to start a bidding war.” But a war might not be in the cards, according to Reuters, because to justify a price tag of $140 per share, the winning bidder “would have to boost Tiffany’s revenue growth to 9 percent a year over the next five years and expand its operating margin to 24 percent,” which would be no small feat.

All the while, Bloomberg notes that LVMH’s closest rivals might not be suited for the fight, at least not right now. Aside from the fact that Richemont CEO Johann Rupert “isn’t known to relish a fight with [LVMH Chairman] Arnault, or the idea of taking on debt to finance his acquisitions,” the Swiss parent to Cartier, Piaget and Van Cleef & Arpels “is still digesting the acquisition of Yoox Net-a-Porter last year, its biggest takeover to date.”

Still yet, for Kering, LVMH’s rival French conglomerate – which owns Gucci, Balenciaga, and Yves Saint Laurent, as well as jewelry and watch companies Ulysse Nardin, Pomellato, Girard-Perregaux, and Qeelin – “adding Tiffany could give it a critical mass to help grow houses it already owns.” However, a bid for Tiffany might not come to be, as it “would push the company’s debt to several times [its] annual earnings,” while “a counter-bid to muscle out LVMH would dilute the financial strength the company has built up during several years of rapid growth at Gucci.”